Applying For The SASSA R350 Grant: A Simple Guide That Gets Results

Applying For The SASSA R350 Grant: A Simple Guide That Gets Results

The SASSA R350 grant remains one of South Africa’s most accessible financial lifelines for low-income households, offering approximately R350 per quarter to those meeting strict eligibility criteria. Despite its simplicity in purpose, many applicants miss key steps in the application process—missing opportunities, currency loss, and avoidable frustration. This detailed guide breaks down every phase of applying for the SASSA R350 grant with clarity and practical insight, turning a complex process into a manageable path toward financial stability.

Who is Eligible for the SASSA R350 Grant?

Understanding eligibility is the first and most critical step. The R350 grant is designed primarily for individuals living on the monthly threshold of R350 or below. The process hinges on two core thresholds: - Income: Total monthly income across all contributors must not exceed R350.- Asset and Debt Assessment: A household’s total weighted assets must be under R12,500, and principal debt obligations—such as rent, loans, or mortgage installments—should not exceed R1,350 per month. These combined figures determine access, but eligibility also requires full residency in South Africa and a valid SASSA registration. “Don’t assume you qualify—verify every figure,” warns financial aid officer Thandi Mbele.

“Accurate income records and up-to-date asset declarations are non-negotiable.”

Step-by-Step Application Process Uncovered

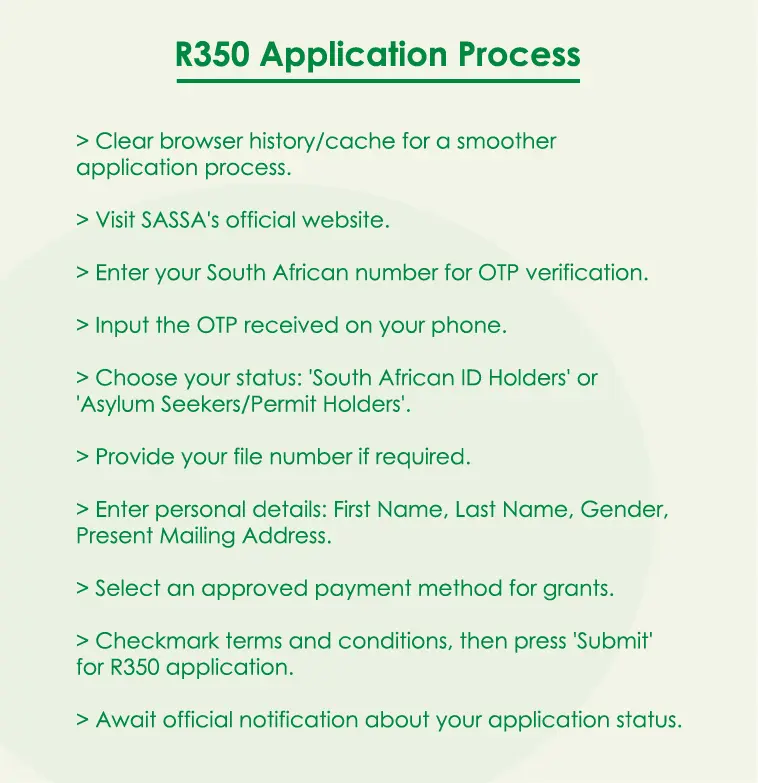

Applying for the R350 grant is streamlined but requires careful attention to detail at each stage. The process unfolds in five essential steps: First, **check eligibility using the SASSA Threshold Calculator** available online. This tool allows applicants to input household income, asset value, and debt in monthly terms, instantly flagging whether they meet the R350 income cap and R12,500 asset threshold.“Technology has simplified eligibility checks,” notes creator of the calculator, Juan Pierre. “It eliminates uncertainty before even opening an application form.” Second, **collect required documentation**. Key documents include: - A valid ID (e.g., ID card, drivers license) - SASSA registration details - Income statements from all household contributors (pay stubs, tax returns, or employer attestations) - Bank statements proving asset holdings and debt obligations (rent receipts, loan agreements, utility bills) - Proof of residence (e.g., lease agreement or utility invoice) Third, **translate information into a clear, organized application**.

Applicants complete SASSA’s online form or download the prescription register, filling in all income, asset, and debt data with precision. Transparency here strengthens credibility. Fourth, **submit the application** either electronically through the SASSA website or via authorized Social Welfare officers.

Late submissions due to technical glitches or missed deadlines are discouraged—SASSA grants priority to timely filings. Fifth, **track submission status** using the intra-degree, email, or SMS system. Approval typically arrives within 7 to 14 business days.

“Patience is vital,” advises Mbele. “But delays rarely mean rejection—just follow up if silence stretches beyond two weeks.”

Common Mistakes That Sabotage Applications

Even small oversights can derail otherwise eligible applications. The most frequent errors include: - Underreporting income: Informal earnings or side jobs often go unreported.“Don’t leave out gig work,” cautioned administrative expert Sipho Ndlovu. “Income must reflect real cash flow, not estimates.” - Outdated asset valuations: Properties, vehicles, and bank accounts change value monthly. Apply with current, accurate figures—SASSA conducts real-time cross-checks.

- Omitting joint contributors: Households with multiple active earners must list every contributor. Failing to include all income streams clips approval chances. - Missing supporting receipts: Without dated rent receipts or loan agreements, assessors cannot verify claims.

Keep digital backups handy. Each mistake compounds administrative scrutiny, increasing the risk of rejection. “Accuracy and completeness are not just best practice—they are your strongest advocacy,” concludes Ndlovu.

Maximizing Impact: What You Gain When You Apply

Securing the R350 grant delivers more than short-term support—it provides a foundation for long-term financial resilience. The monthly income shield helps affiliate families cover food, rent, medical costs, or emergency expenses without debt. This stability eases chronic stress and enables better budgeting, education investment, and household planning.“Every approved application is a step toward dignity and control,” says Thandi Nkosi, a former recipient turned advocate. “The R350 grant isn’t charity—it’s a lifeline that restores agency.” For those eligible, the process is straightforward, transparent, and purposeful. With accurate data, timely submission, and adherence to guidelines, applying for the SASSA R350 grant transforms bureaucracy into benefit—proving that even in complexity, clarity is within reach.

The SASSA R350 grant stands as a vital tool in South Africa’s social safety net, and mastering its application ensures that support arrives when needed most. By following this guide, applicants empower themselves to access timely, reliable aid—turning eligibility into advantage with tangible, life-changing impact.

Related Post

Weather Vatican City: A Microcosm of Stability in a Volatile World

Kill Tony Hedi: The Rise, Impact, and Controversy Behind a Computing Icon Whose Legacy Endures

Unlocking the Vocal Wonders of African Grey Parrots: The Unrivaled Speech and Sound Repertoire

Waukegan Family Mourns Loss as Death Notice Sparks Community Reflection on Mortality