Boost Savings and Loyalty with Kohl’s Credit Card: How Paying with Kohl’s Boosts Your Superhero Spending Power

Boost Savings and Loyalty with Kohl’s Credit Card: How Paying with Kohl’s Boosts Your Superhero Spending Power

Every day, shoppers navigate a labyrinth of discounts, points, and exclusive perks—but few offer the seamless blend of retail rewards and financial flexibility like the Kohl’s Credit Card. Designed to turn everyday purchases into measurable savings, this card leverages Kohl’s massive retail network to reward frequent shoppers with cash back, NOW rewards, and unmatched department-agnostic benefits. Whether repaying balance or financing weekly shopping trips, Kohl’s Credit Card transforms routine spending into a strategic financial advantage.

At the core of Kohl’s credit card value lies its exceptional cash back structure, meticulously calibrated to reward the modern shopper.

Users earn up to 3% cash back on a broad spectrum of eligible Kohl’s purchases—groceries, seasonal apparel, home essentials, and more—automatically applied at checkout. Beyond standard cash back, qualifying transactions contribute to the transformative NOW rewards program, meaning every dollar spent gains immediate redemption potential. “Our cash back tiers are engineered to reward volume—about 5% back on essentials and consistent shoppers who maintain a minimum weekly spend,” says a Kohl’s consumer finance spokesperson.

What sets the Kohl’s Credit Card apart is its intelligent layering of rewards beyond ordinary spending.

For registered users, NOW rewards turn routine card use into a dynamic savings engine. On eligible purchases—especially during high-traffic sales like Black Friday or end-of-season markdowns—stickers or digital tags trigger instant NOW points, stacking up with cash back for cumulative gains exceeding 10% during peak events. “We’ve structured NOW to kickstart engagement, encouraging users to explore full-line shopping rather than isolated checkouts,” explains a marketing lead.

Unlike niche cards tied to specific retailers, Kohl’s Credit Card thrives on cross-category appeal.

Whether stocking up on kitchenware, apparel, or holiday decorations, more than 1,600 Kohl’s stores nationwide, plus Kohl’s.com and degree (the online subsidiary), count toward eligible purchases. This includes seasonal must-haves like Halloween costumes, summer patio furniture, or holiday lighting—categories often underrepresented in other cash-back programs. “Our aim is to make the card indispensable for year-round shopping, not just a seasonal tool,” said a Kohl’s executive.

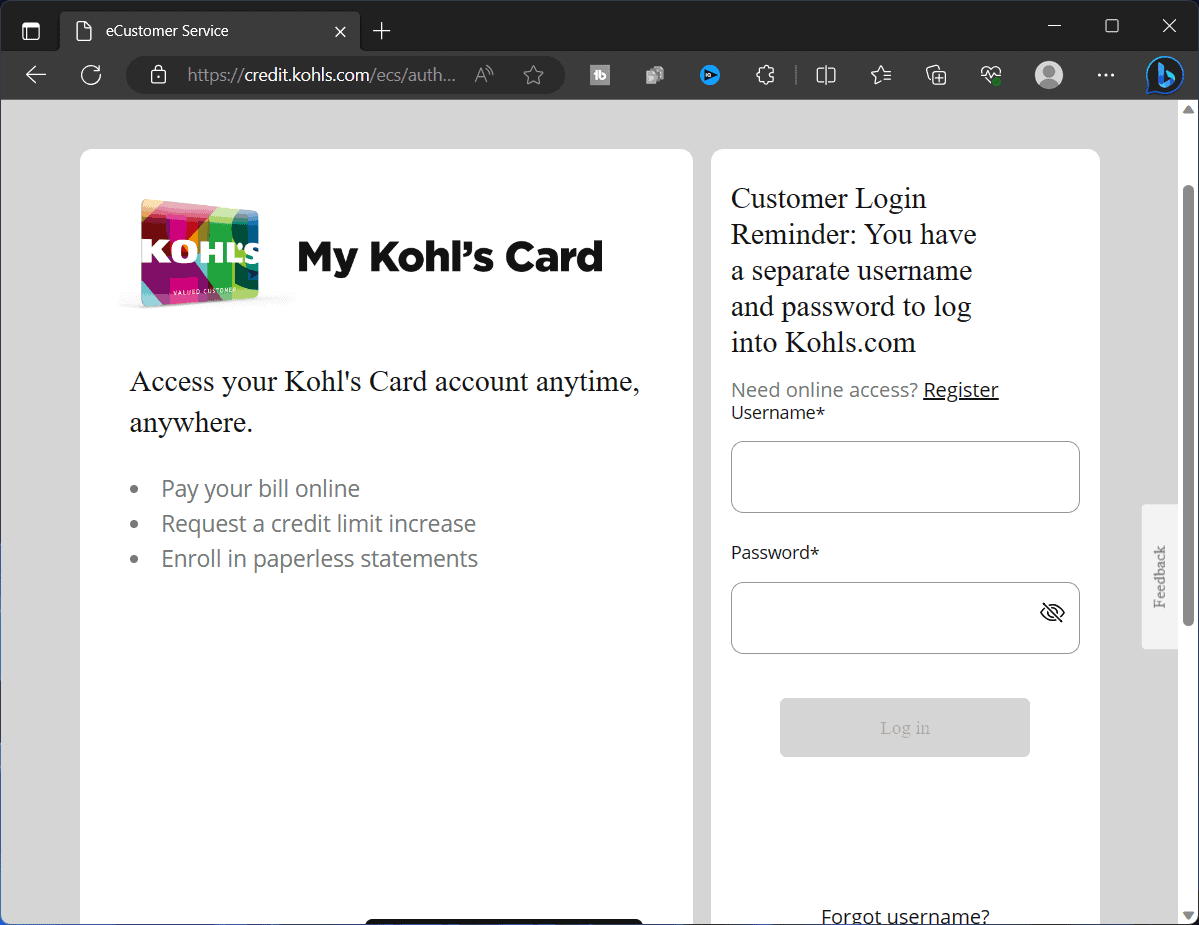

While rewards fuel the card’s appeal, Kohl’s Credit Card delivers robust financial infrastructure to protect users.

Features include flexible payment plans with no late fees if paying the full statement balance, inspiring confidence in budget-friendly repayment. Importantly, purchases made with the card are seamlessly linked to a transition to Kohl’s Consumer Direct Bank (formerly Kohl’s Bank), enabling zero-fee checking, exclusive savings accounts, and early access to private gear exclusives. This integration ensures that financial empowerment isn’t just about earning—it’s about trust in earnings.

“We see the card not just as a spending tool, but as a gateway to a broader financial ecosystem,” notes a fintech analyst specializing in retail credit.

Representing a strategic alliance between Kohl’s retail powerhouse and financial services innovation, the credit card exemplifies how modern payment solutions merge loyalty, convenience, and tangible value. With no foreign transaction fees, 24/7 customer support, and educational tools through Kohl’s app—detailing reward milestones and personalized savings tips—every cardholder gains insight alongside incentive. “It’s about maximizing every transaction,” says one long-term user, “turning a $200 grocery bill into $15 in savings, plus accumulating points across multiple store visits.”

Beyond the numbers, the Kohl’s Credit Card reshapes shopping into a calculated, rewards-maximizing experience.

By aligning cash back, NOW points, flexible finance, and seamless accumulation across 1,600+ locations, it delivers a value proposition few rivals match. For consumers seeking deeper engagement beyond transactional utility, Kohl’s card delivers measurable returns—both financial and experiential—proving that in today’s retail landscape, well-structured credit isn’t just a benefit, it’s a competitive edge.

What makes this card truly exceptional is not merely the percentages or points, but the holistic ecosystem it builds: one where spending fuels savings, loyalty is rewarded in real time, and every purchase contributes to a richer, more informed financial journey. For the savvy shopper, the Kohl’s Credit Card is no longer just a payment tool—it’s a strategic partner in smarter, smarter spending.

Related Post

Know About Lori Huang: The Ultimate Guide to Her Life and Achievements

Is Shipments Free Legit? Uncovering the Truth Behind Free Shipping Promises in E-Commerce

Anna Paul TikTok Bio Wiki Age Boyfriend Brother and Net Worth