Charles Schwab Age Requirements Explained: How Young Can You Start Investing in Your Future?

Charles Schwab Age Requirements Explained: How Young Can You Start Investing in Your Future?

Angela missed the chance to open her first account at Charles Schwab due to a simple but critical barrier: age. The financial services giant sets strict minimum account age requirements, shaping when Americans can begin building wealth through investing. Understanding these thresholds is essential for anyone eyeing disciplined, long-term financial growth—particularly young people navigating the path to financial independence.

From first-time investors under 18 to late-comers surpassing 25, Schwab’s age policies reflect both regulatory safeguards and a commitment to maturity in financial responsibility.

At the core of Schwab’s approach is a rules-based framework designed to align account setup with investable maturity. The core requirement sets the foundation: clients must be at least 18 years old to open a typical investment account.

This aligns with legal standards governing financial transactions, where maturity dictates the ability to commit capital and engage in market risk. As Schwab’s public policy section states, “Accounts are designed for investors who can legally assume the responsibilities of market participation.” This policy isn’t arbitrary—it reflects a balance between accessibility and prudence, ensuring investors possess the cognitive and emotional maturity to manage market fluctuations responsibly.

For investors under 18, Schwab offers a strategic workaround through a co-signer or parental involvement. While minors cannot legally exceed-seeded accounts independently, they may open custodial or joint-voluntary accounts with a parent, guardian, or trusted adult.

A custodial account, overseen by the legal guardian, allows early exposure without forfeiting the investor’s long-term growth potential. As Schwab explains, custodial accounts function as “stepping stones to adulthood,” enabling teens to learn financial stewardship under expert supervision. Some young investors begin with a custodial brokerage ARMA (Allowable Minimum Age Rating) account, funded by family, gradually transitioning to individual control as they mature—often around ages 21–25, when Social Security or parental funding diminish.

The Unique Case of Under-18 Accounts

Those under 18 face structural limits but remain central to Schwab’s inclusive strategy.Custodial accounts unlock formative financial education without demanding full adulthood responsibility upfront. Parents and guardians act as stewards, teaching principles like budgeting, diversification, and long-term goal setting. During this phase, young investors typically start with low-risk vehicles—such as cash management accounts, micro-investment tools, or custodial brokerage portfolios focused on index funds with minimal volatility.

These beginning steps build not just accounts, but critical habits. Schwab’s financial literacy programs reinforce this journey, offering curated resources tailored to pre-18 users despite formal account limitations.

For adults grappling with delayed market entry—say, professionals starting in their mid-20s—Schwab’s age requirements are less of a hurdle.

With full adulthood confirmed, individuals can open taxable brokerage accounts immediately. No co-signers required. The absence of age restrictions here reflects Schwab’s recognition that financial readiness depends more on experience than years passed.

“We don’t cap potential by age,” notes a Schwab representative. “Getting started later is not behind—it’s planning.” This flexible design supports extended participation, allowing late bloomers to accumulate wealth through consistent, informed investing even after reaching the core 18-year threshold. Penalties for residing in non-compliant states exist but are rare and region-specific.

Schwab maintains compliance across U.S. states by tailoring offerings locally—ensuring young investors in every region have equitable access within federal guidelines. For youths in states permitting custodial access, the path forward blends supervision with growing autonomy.

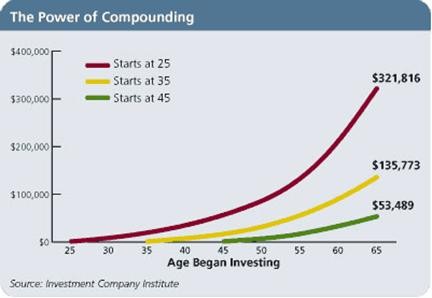

Meanwhile, those exceeding 25 encounter no age ceiling. Schwab encourages active investment at all stages, emphasizing that beyond any minimum age, discipline and financial literacy define success.

Ultimately, Charles Schwab’s age requirements are not arbitrary barriers but intentional frameworks guiding responsible market participation.

From custodial accounts under 18 to uncapped brokering post-madura, each threshold reflects a balance of legal compliance, educational opportunity, and long-term financial empowerment. For young investors, the message is clear: before heading to the trading desk, understand the rules—but never mistrust the process. With proper guidance, even those starting later can build resilient wealth.

At the heart of Schwab’s policy lies one principle: starting early—whether through family support or documented maturity—is the fastest route to financial confidence.

Related Post

Behind The Voice: The Untold Life and Legacy of Michael Bolton’s Brother

Inside Lake County Florida’s Mugshots: A Glimpse into Criminal History Captured

Julia Rose Podcast Age Height Jake Paul Model Baseball and Net Worth

Berkeley Inmates Darkest Secret Finally Revealed: Inside the Holocaust-Era Prisonance and Systemic Silence