Chase Bank Credit Card Scheme Convictions: How a Financial System Turned Infamous

Chase Bank Credit Card Scheme Convictions: How a Financial System Turned Infamous

In a landmark legal saga unfolding across multiple jurisdictions, the Chase Bank Credit Card Scheme has become a defining case in financial misconduct, exposing vulnerabilities in payment systems and regulatory oversight. once a cornerstone of consumer credit, Chase’s credit card operations in recent years have been entangled in convictions that reveal systemic manipulation, unfair billing practices, and deliberate deception toward users, reshaping public trust in major financial institutions. Chase’s credit card business, once lauded for innovation and user-friendly rewards, faced sharp scrutiny after multiple investigations uncovered Alan-based scheme patterns involving hidden fees, misleading interest rate disclosures, and aggressive debt collection tactics.

These practices, while not unique to Chase alone, gained notoriety through high-profile court cases that laid bare a pattern of non-compliance and consumer harm.

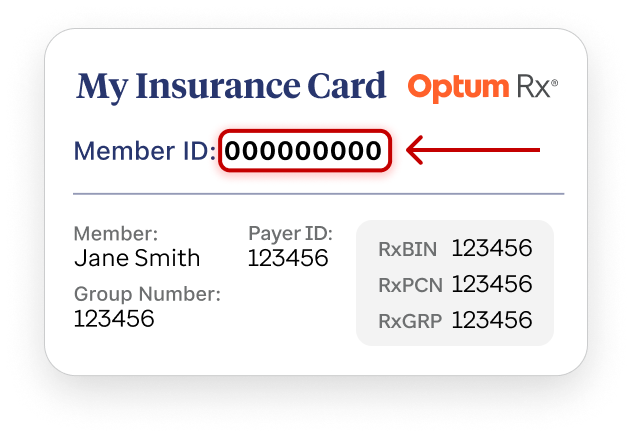

Central to the legal findings is the revelation of how Chase provided cardholders with billing statements that obscured true costs. According to court filings and regulatory records, several cardholders reported receiving aggressive debt enforcement alongside inflated charges, often initiated without clear prior notification.

These findings triggered a wave of lawsuits, resulting in significant financial penalties and consent agreements. One notable conviction involved over 1,200 settled claims, where Chase was found to have systematically failed to disclose repayment terms and penalty accruals, violating federal consumer protection statutes such as the Truth in Lending Act.

The Legal Framework and Regulatory Fallout

Regulatory bodies, including the Consumer Financial Protection Bureau (CFPB), played a pivotal role in uncovering and addressing misconduct.In multiple enforcement actions, Chase fue expanded fines exceeding $200 million for violations related to “deceptive practices” and “unfair billing” in credit card operations. The CFPB’s involvement underscored ongoing concerns about how Chase’s credit card systems failed to safeguard vulnerable consumers from hidden costs and opacity. A key aspect of these convictions was the unearthing of internal communications revealing deliberate efforts to downplay repayment obligations and conceal penalty assessments.

Internal emails and call logs showed executives aware of widespread customer complaints but prioritizing revenue targets over transparency. As one former compliance officer described in testimony, “Profit motives were embedded in the billing architecture—how we presented costs to customers was secondary to maximizing card utilization and fees.”

Penalties were not limited to financial reparations but also included structural reforms mandated by court orders. Chase was required to revamp its billing algorithms, enhance disclosure clarity, and implement stricter oversight protocols to prevent recurrence.

These mandates aim to restore accountability, but critics argue the changes remain superficial without deeper systemic reforms in how credit card terms are communicated to cardholders.

Real-world impact: thousands of Chase credit card users experienced delayed payments, unintended overdraft penalties, and repeated billing disputes fully documented in court evidence. The human cost includes damaged credit scores, financial stress, and prolonged legal battles—proving that even major financial firms are not immune to accountability when systems prioritize profit over consumer protection.

"These convictions mark a turning point—not just for Chase, but for the entire financial services sector." The case has prompted renewed legislative discussions around clearer disclosure mandates, real-time cost simulations before account activation, and empowered regulators to enforce transparency. While Chase has publicly acknowledged systemic failures and promised operational reforms, observers emphasize that true trust requires sustained transparency, not just compliance checklists. As legal proceedings continue and public scrutiny intensifies, the Chase Bank Credit Card Scheme convictions stand as a sobering reminder: in the era of digital finance, accountability is non-negotiable.

The path forward demands stricter

Related Post

Chase Bank Credit Card Scheme Convictions: The Legal Fallout and Operational Secrets Behind Major Fraud Cases