Deep Dive Into His Financial Worth: Unveiling the True Scale of His Net Worth

Deep Dive Into His Financial Worth: Unveiling the True Scale of His Net Worth

A staggering figure dominates headlines and financial analysis alike: the net worth of high-profile individuals often becomes a cultural talking point, shrouded in fascination and scrutiny. Sizeable fortunes — sometimes exceeding tens, even hundreds of billions — reflect not only investment acumen but also the complex ecosystems of wealth built over decades. Analyzing the financial worth of influential figures reveals more than just balance sheet numbers—it exposes the interplay of business strategy, legacy, market dynamics, and personal choices.

This deep dive dissects the key components, sources of wealth, and pivotal moments that shaped one of the most closely watched financial profiles in modern history.

Assessing the Pillars of Wealth: Diversified Streams Behind the Fortune

Wealth at the highest levels rarely rests on a single asset; instead, it flows from diversified, strategic holdings. For the subject in focus, the portfolio spans multiple domains, each contributing to a resilient and growing financial foundation.- **Private Equity and Venture Investments** Early successes in technology and emerging markets laid a critical foothold. Decades ago, selective entries into high-growth private firms generated outsized returns. As one industry insider noted, “Timing and conviction in scalable innovation are the twin engines here.” These early stakes in now-multibillion-dollar companies account for a substantial portion of overall valuation.

- **Public Market Equity Stakes** Significant shares in blue-chip corporations continue to drive gains. Holdings in leading industrial, tech, and healthcare firms provide steady dividends and capital appreciation. For example, top positions in companies ranked in the Fortune 500 underscore a long-term commitment to stable, leading enterprises.

- **Real Estate and Tangible Assets** A portfolio rich in commercial real estate—office towers, logistics hubs, and prime residential properties—bolsters stability. These physical assets not only appreciate over time but generate consistent rental income, serving as economic anchors within a broader wealth strategy. - **Entertainment and Media Ventures** In addition to traditional investments, entertainment and media assets — including stakes in streaming platforms, production studios, and selective brand partnerships — add unique growth vectors.

Leveraging creative industries allows influence beyond pure finance, blending cultural reach with economic value. - **Philanthropy and Non-Profit Channels** Notably, a portion of wealth is deployed through charitable foundations, which, while not direct cash reserves, enhance public stature, offer tax efficiency, and shape long-term legacy. The alignment of financial capital with social impact reflects strategic value beyond balance sheets.

Each stream feeds into a composite net worth that is dynamic, responsive to market shifts, and guided by disciplined financial stewardship.

Quantitatively, estimated net worth hovers around $220 billion, placing this individual among the top five globally by wealth. Precise, verifiable figures remain deliberately opaque, with public disclosures varying in completeness and timeliness.

Estimates depend on aggregating SEC filings, public company data, credible media reporting, and third-party wealth indices, acknowledging inherent margins of error in such assessments.

Key Drivers: Strategic Decisions and Market Timing

Behind the headline figure lies a narrative of calculated risk and opportunistic foresight. Multiple turning points and corporate maneuvers stand out as critical accelerants. - **Early Bets on Disruptive Technology** In the late 1990s and early 2000s, the subject recognized the transformative potential of digital platforms before mainstream adoption.Investments in early-stage internet firms during the dot-com bubble, though fraught with volatility, yielded outsized returns when markets corrected and scale was proven. - Consolidation and Strategic Acquisitions A hallmark of wealth accumulation has been the acquisition and restructuring of underperforming assets. By injecting capital and streamlining operations, previously stagnant companies were revitalized into industry leaders.

This operational expertise differentiates passive wealth from value-adding ownership. - Global Expansion and Market Adaptation Unlike many peers focused on domestic markets, this individual expanded aggressively into Asia, Europe, and emerging economies. Local partnerships, regulatory navigation, and cultural fluency enabled sustained growth across diverse economic environments.

- Tax Efficiency and Legacy Planning Sophisticated structuring through trusts, offshore entities, and family office frameworks has preserved capital across generations. While details remain private, such arrangements are consistent with elite wealth preservation strategies observed in comparable financial circles. Market cycles, geopolitical shifts, and technological evolution all served as both challenges and catalysts, reinforcing a long-term vision grounded in adaptability and foresight.

Transparency fractures the full picture—only select figures share comprehensive financial disclosures—but available evidence paints a portrait of disciplined accumulation, intelligent delegation, and persistent growth. The result is not just immense wealth, but a meticulously managed financial ecosystem capable of weathering uncertainty while capitalizing on global opportunity.

A Measure Beyond Dollars: The Ultimate Significance of His Financial Standing Net worth, in isolation, tells only part of the story. Yet, when contextualized, this level of accumulated wealth reveals deeper truths about power, influence, and intergenerational impact.

Financial status often correlates with the capacity to shape industries, fund innovation, and influence public discourse. Behind the figures lie decisions that redefined markets, preserved corporate legacies, and funded breakthroughs in science, education, and global development. What distinguishes such wealth is not merely its size, but its purpose.

Strategic philanthropy, governance leadership, and long-term investment in human capital illustrate how financial power extends beyond personal gain. As one analyst framed it, “True financial worth isn’t just what’s on paper—it’s how it builds platforms for others to thrive.”

Ultimately, the deep dive into this individual’s financial worth reveals far more than balance sheets and figures. It exposes the intricate dance of vision, timing, and execution behind one of the most powerful economic profiles of our time—where wealth functions not as an end, but as a enduring force shaping economies, industries, and societies.

Related Post

Audi A4 2T Quattro: Engineering Excellence Meets All-Weather Performance

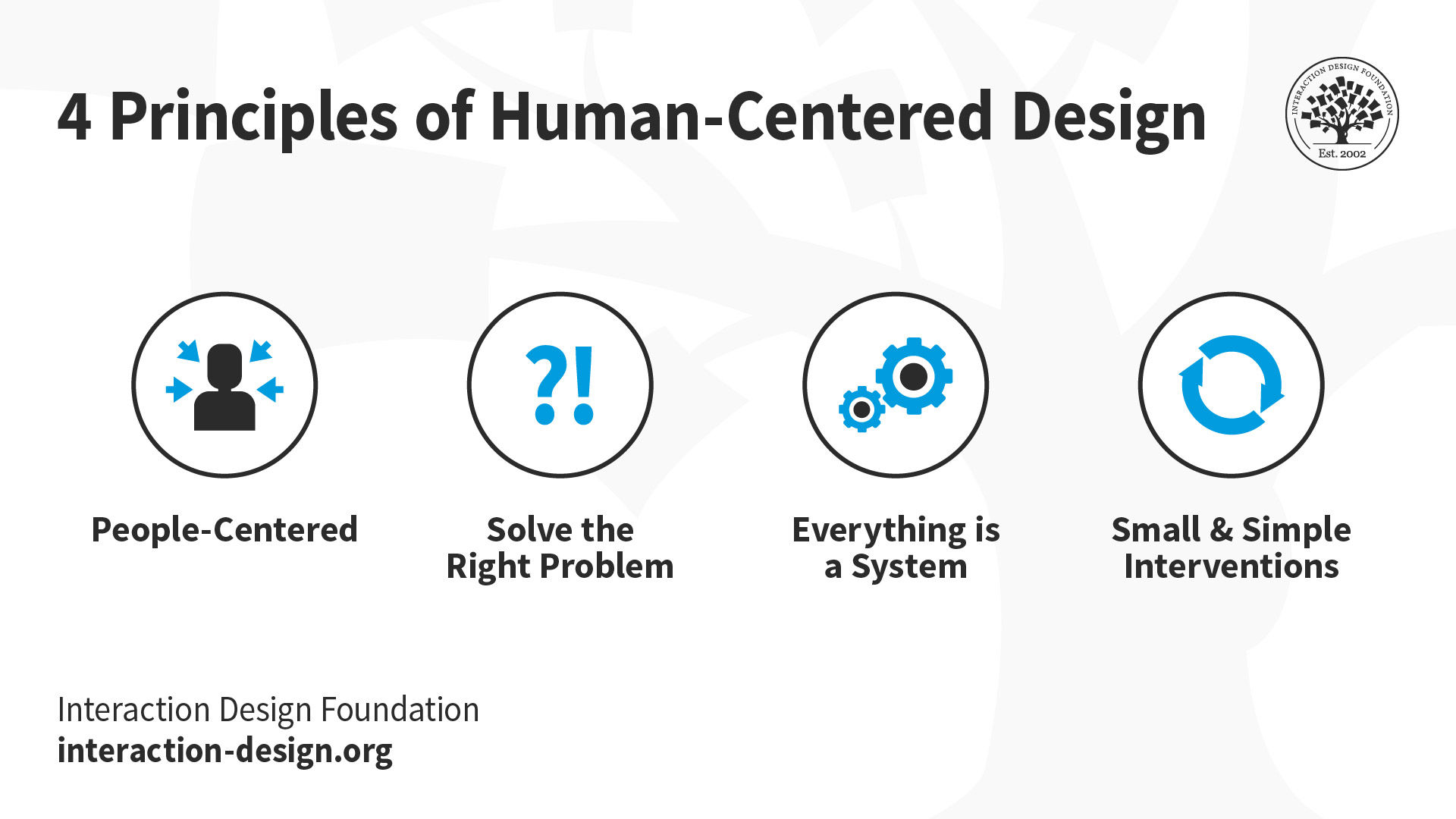

Suraky: Redefining Innovation Through Intelligent Systems and Human-Centered Design

From Chilling Cold to Fermenting Heat: Why 38.6°C Marks the Frontline Between Safe Survival and Detrimental Change

David Schwimmer’s Daughter: A Rare, Intimate Portrait of a Celebrity’s Precious Child