Doing Due Diligence: The Indispensable Practice Behind Smart Decision-Making

Doing Due Diligence: The Indispensable Practice Behind Smart Decision-Making

In an era defined by rapid transactions, complex deals, and global uncertainty, doing due diligence is no longer optional—it’s foundational. More than a box to check, it is a rigorous process that uncovers risks, validates information, and ensures that choices are grounded in verified facts. Academic studies confirm that organizations embedding deep due diligence frameworks reduce financial losses by up to 40% and significantly increase deal success rates.

From mergers and acquisitions to investment ventures and regulatory compliance, the act of conducting thorough due diligence shapes outcomes with precision and foresight. Understanding its meaning, methods, and implications is essential for anyone operating at the nexus of commerce, governance, or innovation. Doing due diligence means systematically investigating and verifying critical aspects of a person, business, asset, or project before committing resources.

Rooted in rigorous assessment, it involves collecting and analyzing financial records, legal documentation, operational practices, and reputational indicators. The term shares synonims such as “performing due diligence,” “conducting due diligence,” “due diligence process,” and “intensive due diligence”—each capturing the essence of meticulous scrutiny. What unites them is a shared demand for evidence-based inquiry.

As Boston Consulting Group notes, “Due diligence is not just about confirming what’s claimed—it’s about anticipating what might go wrong.” The core meaning lies in its role as a safeguard against hidden liabilities and misinformation. Due diligence serves as a protective shield, enabling decision-makers to identify red flags, assess viability, and evaluate long-term sustainability beneath surface-level data. Whether evaluating a potential acquisition target or onboarding a new business partner, the practice transforms ambiguity into clarity.

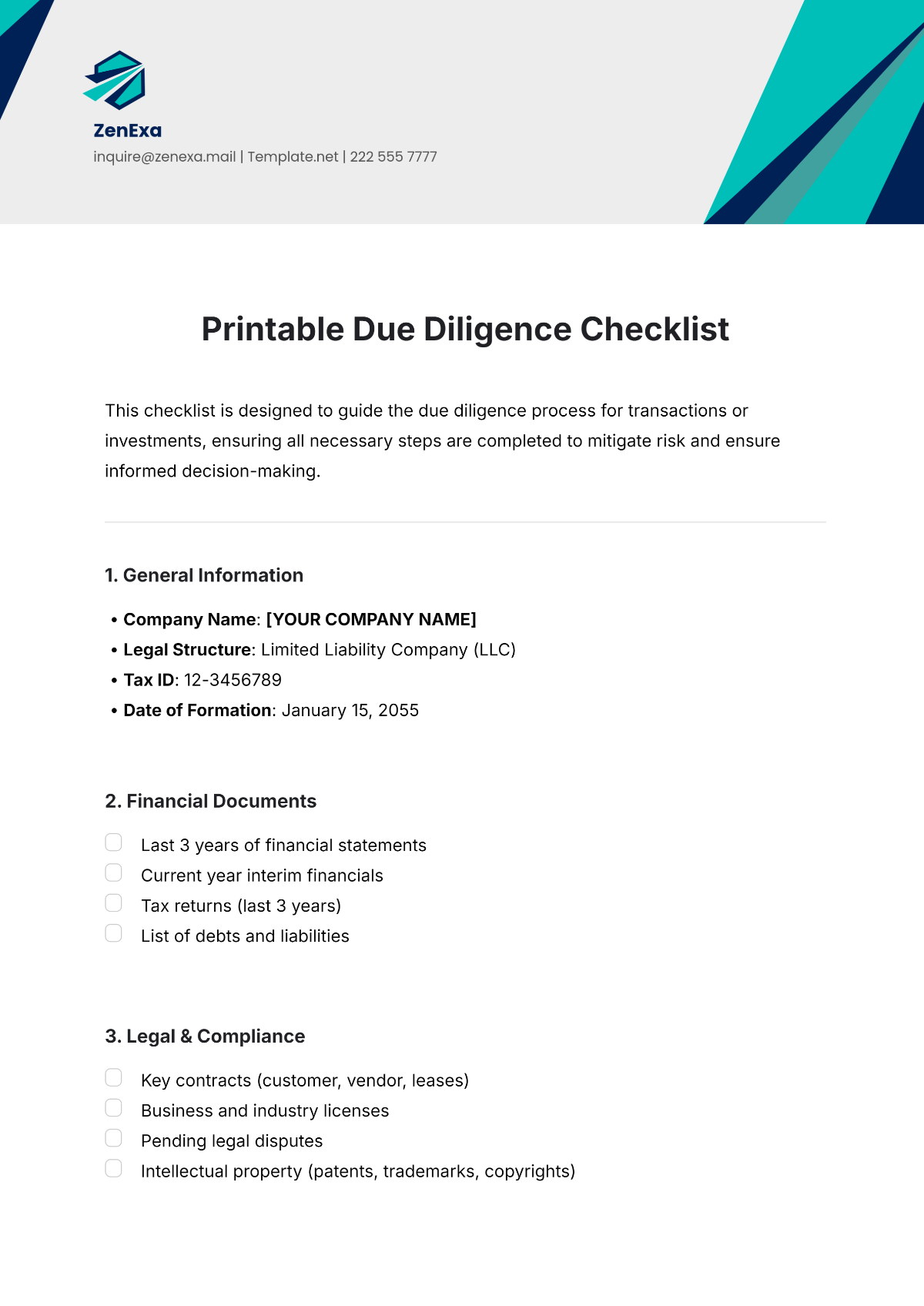

According to legal expert and deal strategist Laura Thompson, “Without due diligence, even seemingly sound investments become high-risk gambles with unpredictable consequences.” At the heart of due diligence is a structured yet adaptable framework. Common components include: - **Financial Due Diligence**: Scrutinizing historical and projected financials, auditing revenue streams, and validating balance sheets to uncover discrepancies or inflation. This step detects hidden debts, revenue recognition fraud, or unsustainable business models.

- **Legal Due Diligence**: Reviewing contracts, intellectual property registrations, regulatory compliance, litigation history, and litigation risks. It ensures no unnoticed legal obligations or contractual pitfalls undermine the deal. - **Operational Due Diligence**: Evaluating supply chains, infrastructure, workforce competence, and technological systems.

This step identifies operational inefficiencies or capability gaps that could erode value post-acquisition. - **Reputational Due Diligence**: Analyzing media coverage, customer feedback, and industry standing. Poor public perception or exposed ethical breaches can devastate brand equity, even if financials appear sound.

These elements converge to form a comprehensive risk profile. Industry leaders emphasize that due diligence should not conclude when the transaction closes—ongoing monitoring remains critical to detect emerging issues. As one CFO described, “Due diligence isn’t a one-time event; it’s a continuous discipline that manages uncertainty long after signing the contract.” Tools and techniques vary by context but generally integrate data analytics, third-party audits, and expert consultations.

Digital platforms now enable real-time access to financial disclosures, regulatory databases, and AI-powered anomaly detection—transforming due diligence from a time-intensive chore into a strategic, scalable process. Yet technology amplifies, rather than replaces, human judgment. “The best due diligence teams combine advanced analytics with seasoned oversight,” states Dr.

Elena Martinez, a professor of business ethics. “Data reveals what happened; experience interprets why it matters.” Common challenges include information asymmetry, cultural differences, and deliberate obfuscation by sellers. Overcoming these demands patience, skepticism, and professional expertise.

A delayed but thorough investigation often prevents catastrophic losses—cases like failed mergers due to hidden liabilities confirm that skipped diligence steps can carry enormous, irreversible costs. Conversely, companies that excel in due diligence consistently report higher post-deal performance, stronger stakeholder trust, and greater resilience against market volatility. Ultimately, doing due diligence is a disciplined commitment to truth in uncertain environments.

It bridges information gaps, validates assumptions, and empowers decisions rooted in clarity. In a world where speed often overshadows scrutiny, choosing rigorous due diligence remains the benchmark of prudence. Organizations that embed it into their culture don’t just protect assets—they build sustainable value, resilience, and credibility from day one.

Effective due diligence is less about perfection and more about diligence. It transforms guesswork into strategy, optimism into confidence, and risk into readiness. For any actor in business, finance, or public policy, understanding and applying its principles isn’t just responsible—it’s essential.

What Is Due Diligence, Truly?

Decoding the Term and Its Core Purpose The phrase “due diligence” carries wide-ranging synonyms—phase, process, investigation, verification—but converges on a singular mission: to confirm and evaluate before committing resources. In practice, it is the disciplined process of examining all relevant variables, from financials and legal standing to operational capacity and market position, ensuring informed decision-making. According to the Institute of Internal Auditors

Related Post

Ulysses S. Grant: Unpacking The Complex Legacy of The 18th President Of The US

Where Is Ecuador? Unlocking the Geography of a Crossroads of Cultures and Landscapes

Matthew Grey Gubler Wife: The Private Life of a Hollywood Star Beyondand Public Limelight

Yailin Erome: A Closer Look At Her Life, Influence, and the Phenomenon Surrounding L'Ms Virl