Financeiro English Translation And Usage: Mastering the Precision of Financial Language

Financeiro English Translation And Usage: Mastering the Precision of Financial Language

In an increasingly globalized economy, the seamless translation and accurate usage of financial English are indispensable assets for professionals, investors, and businesses navigating cross-border operations. Financial terminology carries precise meaning—alterations or ambiguities can reshape strategies, distort data, or lead to costly misinterpretations. This article explores the critical dimensions of financeiro (financial) English translation and usage, shedding light on key challenges, essential best practices, and real-world applications that ensure clarity, credibility, and compliance in financial communications.

Why Financeiro English Translation Requires Expertise Beyond Direct Word Swapping

Translating financial English is far more than a literal exchange of words—it demands deep domain knowledge. Terms like “amortization,” “capitalization,” or “hedge ratio” carry distinct, often subtle meanings that vary by regulatory environment and market practice. A direct translation may preserve syntax but fail to convey the exact financial implication.According to financial linguist Maria constructs, “A translation without understanding context risks turning ‘goodwill impairment’ into a simple bookkeeping footnote—when in reality, it signals a fundamental loss in asset value that affects balance sheets globally.” Professional financial translators must grasp not only vocabulary but also cultural and regulatory nuances. For example, while “depreciation” is standard in English, in Portuguese-speaking markets “depreciação” is widely accepted but often paired with local accounting standards that specify allowance methods. The choice of terminology directly influences how reports are interpreted by auditors, investors, and compliance officers.

Translating complex financial instruments—such as derivatives, SPVs (Special Purpose Vehicles), or complex securities—requires specialized proficiency. A mistranslation of “credit default swap” could mislead counterparties about risk exposure, with real-world consequences in trading and regulatory reporting. Precision constructs trust.

Core Principles Of Effective Financeiro English Usage

Effective use of financeiro English in financial contexts hinges on clarity, consistency, and compliance.These principles form the backbone of accurate, persuasive, and legally sound financial communication.

- Clarity: Avoid ambiguity in numbers and concepts. Specify “$50 million in acquisition debt” rather than “substantial financing,” ensuring stakeholders instantly recognize the scale and nature of the obligation.

- Consistency: Use standardized terminology across reports, presentations, and filings.

For instance, whether writing “earnings before interest, taxes, depreciation, and amortization (EBITDA)” or translating it as “Lucro Antes de Juros, Impostos, Depreciação e Amortização,” cross-referencing definitions prevents confusion.

- Compliance: Align translations and phrasing with regional regulations, such as IFRS (International Financial Reporting Standards) or local GAAP frameworks. A phrase accepted in U.S. GAAP may require adjustment under European accounting principles to maintain legal integrity.

For example, calling a “provision for loan losses” “reserva para inadimplência” in Brazilian Portuguese is accurate—but only if consistently defined throughout documentation to maintain transparency with IBBA (Brasil’s financial watchdog) and international auditors.

Professional financeiro English usage turns abstract concepts into actionable insights. When done right, it strengthens collaboration, supports audit readiness, and enhances global credibility.

Real-World Applications: From Investor Reports To Cross-Border Transactions

In investor relations, the power of precise translation shapes market perception.A poorly translated balance sheet footnote detailing “retained earnings” as “lucros retidos” without context may mislead shareholders unfamiliar with accounting conventions. Conversely, a clear “Fundos Retidos em Exercício” supported by explaining notes builds investor confidence in governance. Cross-border mergers and acquisitions depend heavily on accurate financial communication.

Consider a Latin American firm acquiring a European counterpart: translating “Goodwill” consistently and precisely avoids overstatement or underestimation, protecting valuation accuracy. Discrepancies here can trigger renegotiations or regulatory scrutiny. In banking and fintech, financeiro English underpins smart contracts, automated risk models, and compliance AI systems.

Misinterpretation of terms like “collateralized debt obligation” (CDO) or “quantitative easing” in core platform software can compromise algorithmic accuracy and systemic stability.

Every financial exchange—whether in earnings calls, loan agreements, or regulatory filings—is a critical interaction where language becomes a bridge. Mastery of financeiro English ensures these bridges remain strong, accurate, and trustworthy.

Key Financial Terms That Demand Careful Translation

Understanding high-impact terms is essential.Below are critical financeiro English terms and their precise Portuguese translations: -

Amortization

Typically translated as “amortização,” this refers not just to spreading costs over time but specifically to reducing intangible assets’ book value. In financial contracts, ambiguity here risks misrepresenting asset longevity and impairment. -Capital Expenditure (CAPEX)

‘Investimento em capital fixo’ is standard, but in Brazilian Portuguese business discourse, “Capex” (acrophon adopted internationally) is widely recognized in annual reports and equity analyses.-

Credit Default Swap (CDS)

“Contrato de swap de crédito” must retain its acronym in global markets, but explanatory phrasing like “proteção contra inadimplência” ensures clarity for local stakeholders. -Hedge Ratio

“Razão de cobertura” remains accurate, but context must clarify its role in risk management frameworks to prevent misuse in momentum-driven trading strategies. Precise term selection reflects a deeper grasp of financial mechanics—translations become tools of transparency.Technology And Tools Enhancing Financeiro English Accuracy

Modern financial translation leverages advanced tools designed for precision. Machine translation augmented by domain-specific AI enhances fluency—but always requires human oversight. Financial translation platforms integrated with regulatory databases verify terminology against IFRS, SEC, and local standards in real time.Translation memory systems allow firms to build standardized glossaries for recurring content—say, loan covenants or revenue recognition clauses—ensuring uniformity across multilingual teams. These tools reduce errors, improve turnaround, and maintain compliance at scale.

The Human Element: Why Expertise Remains Irreplaceable

Despite AI progress, financeiro English mastery demands human insight.Translators and financial writers must understand not only language but market intent, investor psychology, and regulatory intent. A finance professional fluent in both Portuguese and English, for example, recognizes when “volatility” in a report signals actual risk—so much more than a mere fluctuation. “Technology accelerates,” notes translation specialist Carlos Mendes, “but human judgment interprets nuance—critical when structuring complex derivatives pricing or ESG reporting disclosures that shape investor confidence.” Translation is ultimately the art of transmitting meaning, context, and trust—capabilities uniquely human.

In an era where milliseconds and clarity determine market movement, fluency in Financeiro English is not optional. It’s a strategic imperative.

Final Thoughts: Building Bridges Through Precision Financeiro English

Mastering the translation and usage of financeiro English is about more than correct grammar—it’s about precision, consistency, and deep contextual understanding. From investor confidence to regulatory compliance, every phrase shapes decisions in global finance.As cross-border transactions grow and standards evolve, the ability to communicate financial truths clearly separates excellence from error. In finance, language is not just a tool—it’s a cornerstone of credibility.

Related Post

Portugal’s Football Identity: From Tim Antão to the World Stage

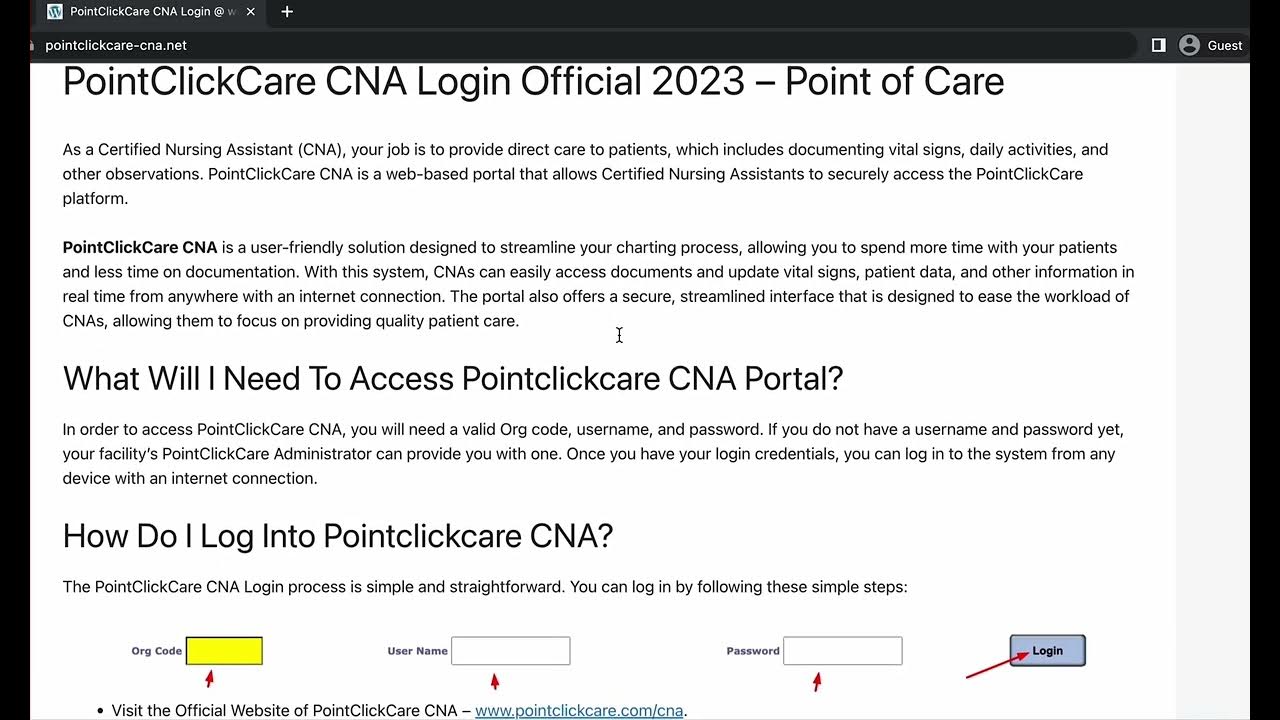

Navigating Cna Point Care Login: Your Essential Gateway to Quality Home Healthcare

Decoding Time Zones: What Time Is It Now In Nederland?

Jeremy Strong Bio Wiki Age Height Wife Succession Pitch Perfect and Net Worth