Find Your Klarna IBAN: The Easy Guide to Globally Easy Bank Identifiers

Find Your Klarna IBAN: The Easy Guide to Globally Easy Bank Identifiers

Managing international payments can feel like navigating a maze—especially when each country uses unique IBAN formats that vary by region. For users of Klarna, one of the world’s fastest-growing buy-now-pay-later platforms, understanding how to locate and verify your Klarna IBAN is key to seamless, error-free transactions. This comprehensive guide demystifies the process of finding your Klarna IBAN, explains what makes it function, and offers practical tips to avoid costly mistakes.

Whether you’re a global customer reliant on quick payments or a business partner integrating Klarna best practices, this user-friendly manual delivers clarity on a technically complex topic with precision and accessibility.

The IBAN—International Bank Account Number—is more than just a series of digits; it’s a standardized code ensuring international transfers reach the correct financial institution without delay or misdirection. For Klarna users, having the right IBAN means faster approvals, reduced administrative friction, and greater financial confidence when engaging across borders. But how do you actually find your Klarna IBAN?

More importantly, how can you verify it’s the right code to use? This guide answers both questions with actionable steps tailored to clarity and reliability.

What Is a Klarna IBAN and Why Does It Matter?

Klarna, like many global fintech platforms, operates across multiple jurisdictions with diverse banking systems. Its IBAN—typically following Europe’s standardized format—serves as a universally recognized identifier linking payment requests, invoices, and account verifications.

Unlike conventional IBANs that span 25–34 alphanumeric characters, Klarna-specific IBANs may vary slightly in structure to align with internal reconciliation protocols while still conforming to international standards.

An accurate Klarna IBAN directly impacts user experience: it ensures: - Fast, automated payment processing without manual intervention - Accurate linking of subscriptions, installment plans, and purchase transactions - Reduced risk of rejected payments due to invalid or mismatched IBAN entries - Simplified reconciliation for businesses integrating Klarna’s payment gateway

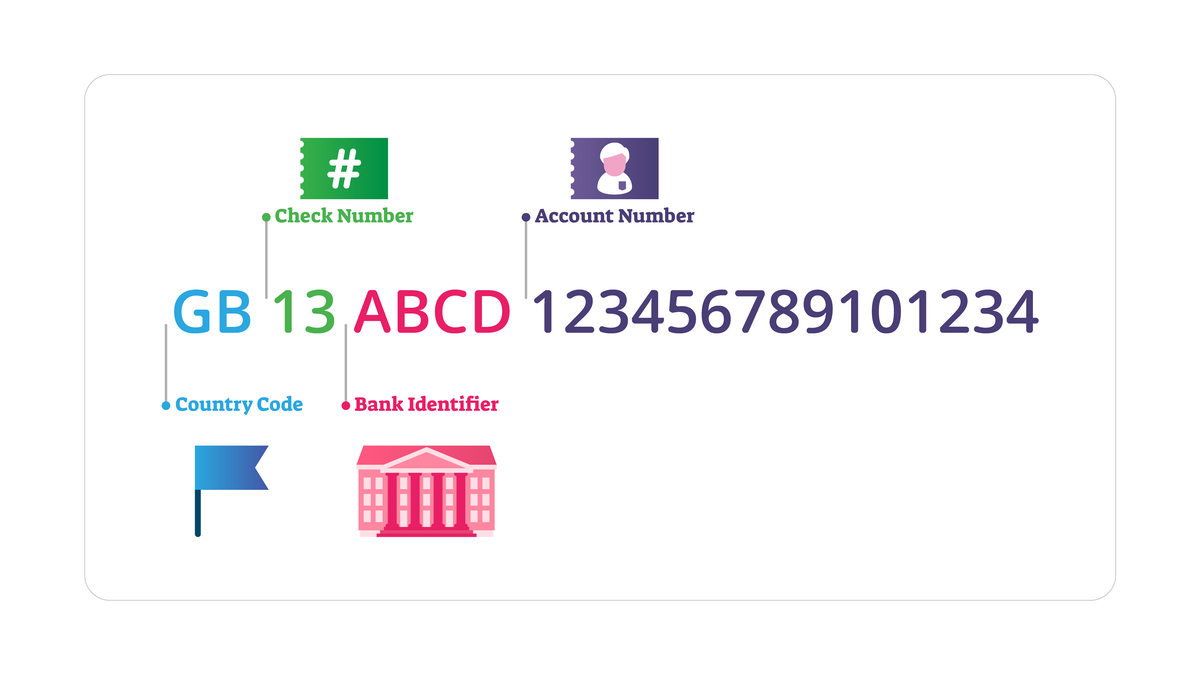

Key Components of a Klarna IBAN

A Klarna IBAN remains composed of three core components, each serving a distinct function:

- li>**Tracking Country Code (DF):** A two-letter regional identifier (e.g., DE for Germany, AT for Austria) indicating where the account originated.

- **Check Digit (FD):** A single numeric digit at the end, used algorithmically to validate the IBAN’s integrity—like a digital fingerprint.

- **Can Goods and Services Number (CGSN):** The alphanumeric core, typically 15–34 characters, linking the account to Klarna’s internal systems via a unique reference.

How to Find Your Klarna IBAN: Step-by-Step Guidance

Locating your Klarna IBAN is straightforward when guided by clear, direct steps. Whether you access your information through Klarna’s app, a web portal, or a printed invoice, the process hinges on familiarity with platform navigation and documentation.

Here’s how to do it right:

- Incomplete or truncated entries. Truncating an IBAN by omitting trailing zeros or the last two digits can render it invalid.

Klarna’s systems are strict—too short or extra characters trigger payment rejections.

- Region code confusion. Misidentifying or manually changing the DF (country code) alters the entire IBAN structure, leading to routing errors across borders.

- Outdated IBANs. While rare, accounts may migrate to new IBANs; using a stale number results in failed transactions and delayed settlements.

- Never share your IBAN via unencrypted email, SMS, or social media. Use Klarna’s official app or secure customer support instead.

- Regularly cross-check your IBAN against recent payment statements or invoices to confirm accuracy.

- Enable two-step authentication and monitor account activity for unauthorized transactions.

- Keep digital backups (screenshots or PDFs) in a secure vault but avoid storing them in easily exploitable cloud folders.

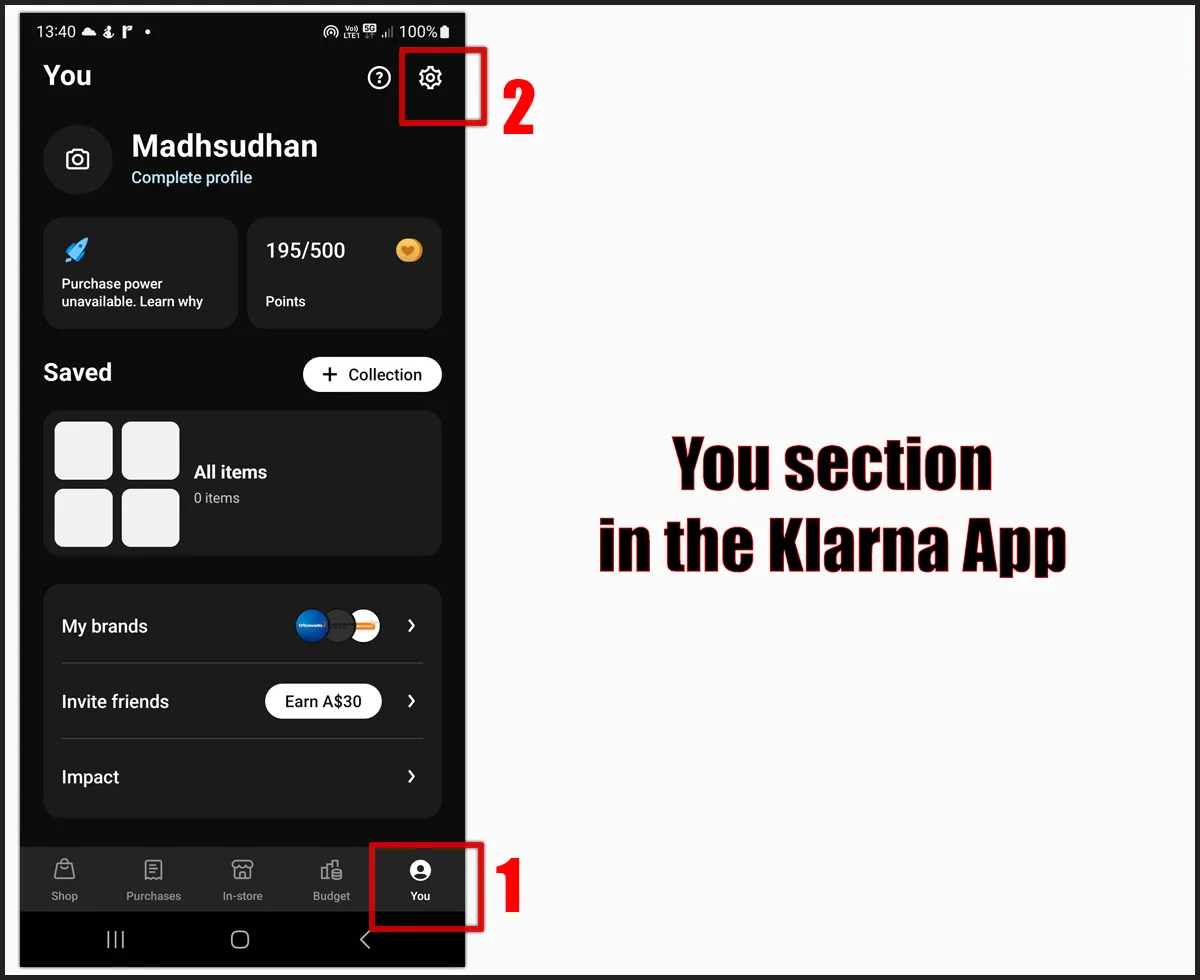

1.

Log into Klarna’s Secure Portal. Access the Klarna app or website and verify your identity using multi-factor authentication (MFA), ensuring only authorized users retrieve sensitive data.

2. Navigate to Account Settings or Payment Information. Within your profile, identify sections labeled “Account Details,” “Payment Methods,” or “IBAN & Details”—locations commonly reserved for core financial identifiers.

3. Locate the IBAN Display Field. The IBAN is typically presented in a standardized format, often bolded or highlighted, with the full 22- or 27-character code displayed beneath your current payment account.

Some platforms embed metadata beneath the IBAN—such as the account type, currency, or currency code—helpful for confirming correct identification.

If direct access proves difficult, Klarna provides a downloadable IBAN via the “Export Account Details” feature, usually found under “Customer Support” or “Help Center.” This paper-friendly option ensures compliance with data privacy standards while offering a backup proof of your IBAN.

Never rely on third-party sources for your Klarna IBAN—only official Klarna channels validate authenticity, protecting against fraud and unauthorized access.

Common Pitfalls When Using Klarna IBANs & How to Avoid Them

Despite progress in digital finance, errors in handling IBANs remain frequent, directly impacting transaction outcomes. Klarna users encounter several recurring issues, from transcription mistakes to outdated or mismatched codes.

Key pitfalls include:

To safeguard against missteps, verify every IBAN against official Klarna channels, confirm country codes align with your bank’s records, and refresh documentation after any account migration or account merge.

Practical Tips for Managing Your Klarna IBAN Securely

Beyond retrieval and verification, responsible management of your Klarna IBAN strengthens transaction security and long-term reliability. Best practices include:

For businesses integrating Klarna, automating IBAN validation and reconciliation reduces human error and streamlines financial operations.

Many platforms now offer API tools that cross-verify IBANs in real time, ensuring only valid codes process.

Alternative Nachums and Regional Variants for Global Users

Although Klarna’s primary IBAN format follows European standards, users in select non-EU countries may encounter modified or alternative identifiers.

For example, while most European users see IBANs starting with DF codes (e.g., DE, FR), Klarna may append country-specific prefixes or reformat internal identifiers for certain regional integrations. Always verify new formats with Klarna’s support to avoid confusion.

Additionally, Norway uses NIB (National Identification Number), and Sweden follows SVERIGEIBAN, though Klarna adapts seamlessly across these variants—treating each as its own valid code when authorized by the user’s bank and platform.

Understanding and correctly using your Klarna IBAN transforms erratic payment flows into predictable, efficient exchanges. By mastering the mechanics of retrieval, recognizing common errors, and applying proactive security habits, users unlock the full potential of Klarna’s global payment ecosystem. In an era where frictionless finance defines competitive advantage, knowing your IBAN isn’t just a technical detail—it’s a cornerstone of digital financial fluency.

Keeping your Klarna IBAN accurate and accessible empowers faster transactions, smarter budgeting, and greater confidence in international commerce.

This guide equips both individuals and businesses to handle their financial identifiers with clarity, precision, and peace of mind—making global payments not just easier, but infinitely more reliable.

Related Post

Rachel Syme New Yorker Bio Wiki Age Husband Book Salary and Net Worth

How K-Pop Redefined Global Culture: A Deep Dive into Its Influence on Modern Societies

Erin Myers KTLA Bio Wiki Age Height Husband Salary and Net Worth

Blue Archive Anime Meet The Amazing Characters That Define Combat, Culture, and Community