Master Financial Strategy in Real Time: How the Investopedia Simulator Transforms Investing Education

Master Financial Strategy in Real Time: How the Investopedia Simulator Transforms Investing Education

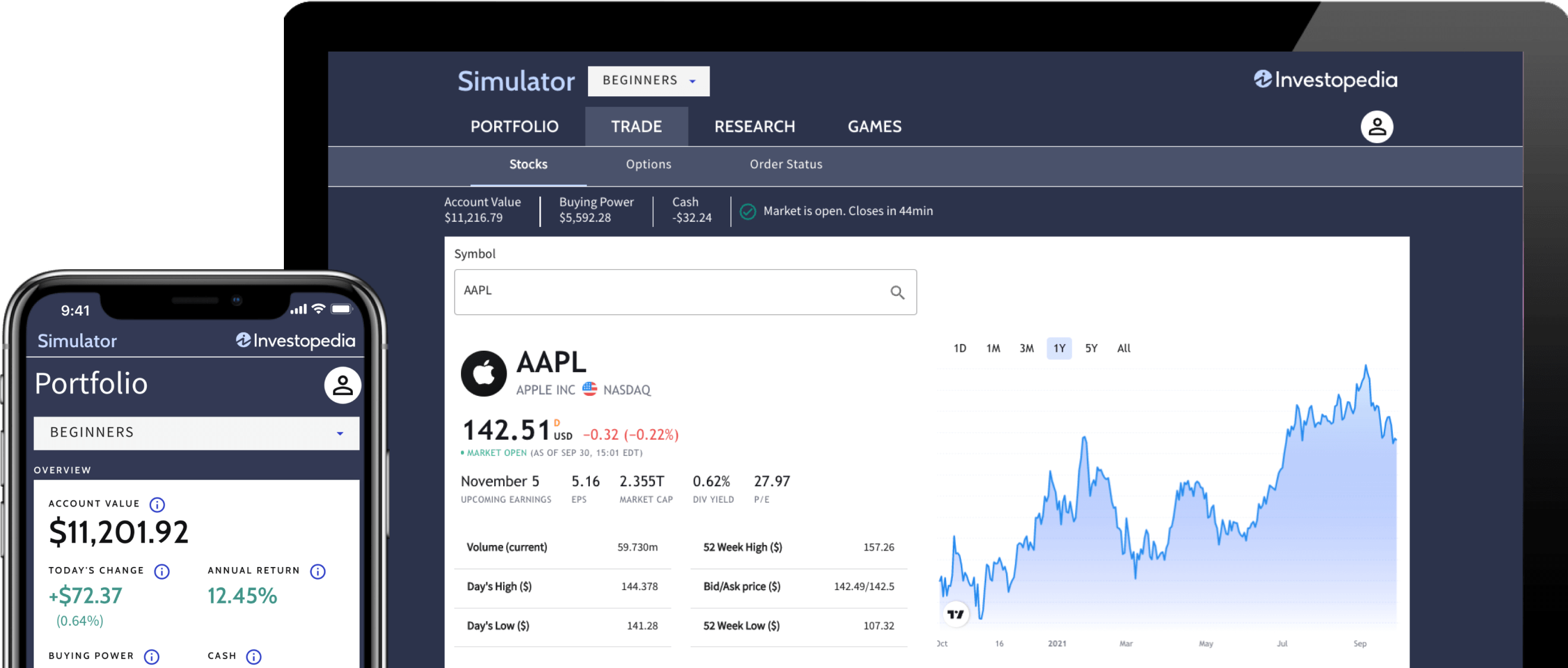

In an era defined by rapid market shifts and digital-only trading platforms, the Investopedia Simulator offers investors—from novices to seasoned traders—a powerful sandbox to test capital allocation, refine decision-making, and experience real market dynamics without financial risk. By replicating live trading conditions with full transparency into positions, outcomes, and performance metrics, this innovative tool bridges theoretical knowledge and practical application in ways previously limited to live markets. Investors who embrace the simulator are not just practicing—they’re building disciplined, data-driven habits essential for long-term success in volatile economies.

At its core, the Investopedia Simulator functions as a virtual stock exchange where users manage portfolios across equities, commodities, bonds, cryptocurrencies, and forex in real time.

The platform’s real-world precision begins with live price feeds, order execution mechanics, and transaction cost simulations—mirroring actual brokerage environments. This level of fidelity means every trade, dividend, or market shock delivers immediate feedback, allowing users to observe cause and effect within seconds. As this non-stop feedback loop accelerates learning, even complex concepts like portfolio diversification or risk-adjusted returns become tangible through repeated, consequence-driven practice.

The Anatomy of the Simulator’s Educational Infrastructure

The Investopedia Simulator’s value lies not just in its mechanics but in the structured learning environment it creates.

Core features include:

- Live Market Data Integration: Position values fluctuate in real time, reflecting actual exchange conditions, news impacts, and liquidity shifts, eliminating the lag or artificiality of pre-recorded scenarios.

- Portfolio Analytics: Detailed dashboards track key metrics—return on investment, Sharpe ratio, maximum drawdown, and turnover—offering immediate insight into performance beneath surface-level gains.

- Risk Management Tools: From position sizing calculators to stop-loss enforcement, the platform guides users in applying disciplined risk protocols, reinforcing strategies like dollar-cost averaging and portfolio rebalancing.

- Historical Data Playground: Users can simulate playing through pivotal market events—such as 2008 financial crisis crashes or 2021 meme stock surges—to analyze how their choices would have fared under actual stress conditions.

These features collectively form a comprehensive laboratory for financial literacy, where decisions carry weight but carry no real capital loss—cracking the paradox of “failing forward” in investment education.

How Experienced Traders Use the Simulator to Sharpen Tactics

Seasoned investors leverage the Investopedia Simulator not as a novice playground, but as a high-stakes refinement zone. Many use it to stress-test complex strategies before deploying them in live markets. For example:

Top traders employ the simulator to:

- Backtest algorithmic models using historical data to validate efficacy without risking real funds.

- Evaluate emotional responses—patience during downturns, discipline avoiding FOMO—to build psychological resilience crucial for consistent returns.

- Experiment with leverage, short selling, and options—accounts often restricted in demo environments—without financial consequence.

“The simulator strips away external variables, forcing you to rely solely on your edge,” says one professional trader who trains regularly on the platform.

“It’s not about winning games—it’s about seeing yourself think like a proven market participant.”

Quantifying Progress and Refining Mental Models

A key advantage of the Investopedia Simulator is its built-in performance tracking, enabling users to map emotional tendencies against objective outcomes. By continuously analyzing:

- Return over time and volatility patterns reveals whether luck or skill drives results.

- Transaction history exposes overtrading or hesitation—two primary drains on long-term returns.

- Risk-adjusted returns expose whether strategies are genuinely profitable or merely benefiting from market direction.

This data-driven transparency fosters rapid iteration: successful patterns are reinforced, biases corrected. Over weeks and months, users don’t just accumulate trades—they evolve toward consistent, repeatable decision frameworks.

As one user notes, “The simulator teaches you not just *what* to trade, but *how* to think about every trade.”

Real-World Transfer: From Simulated Gains to Actual Market Confidence

The gap between simulated success and live market performance narrows dramatically with consistent use. By practicing under conditions that mimic real volatility, users develop the situational awareness needed to react appropriately when true markets shift. For instance:

- Students who simulate managing $100,000 portfolios often transition to paper trading within weeks, moving to live accounts after developing credible risk controls and analysis habits.

-pract blockchains and cryptocurrencies increasingly offer integrations with educational simulators, enabling new traders to build hoards of verified experience before exposure to volatile digital markets.

“I started in the simulator with $0,” recalls an early adopter. “Each winning move built muscle memory; each loss taught me humility.

Now I don’t panic during corrections—just analyze and act.”

The Simulator’s Role in Shaping the Future of Financial Literacy

The Investopedia Simulator is more than a tool—it’s a cultural shift in how people learn to invest. By democratizing access to real-time trading conditions, it dissolves the barriers that once limited market participation to insiders or wealthy elites. Every user, regardless of background, gains a chance to experiment, fail forward, and grow with a feedback loop as precise as it is forgiving.

In doing so, it doesn’t just train better investors—it cultivates a global community of reflective, resilient market participants ready to thrive in complexity. As financial landscapes evolve, the simulator stands not as a gimmick, but as a cornerstone of modern investment education.

Related Post

Jane Lynch: Star, Separate Life, and the Quiet Strength Behind Her Iconic Voice

Moscow Under Attack? Drone Strikes Raise Questions About Russia's Air Defenses

Navigate with Precision: Mastering the Memorial City Mall Map