Master Westlake Financial Login Your Quick Payment Guide: Your Path to Faster, Secure Transactions

Master Westlake Financial Login Your Quick Payment Guide: Your Path to Faster, Secure Transactions

In an era defined by digital speed and financial efficiency, Westlake Financial’s Login Your Quick Payment Guide stands as a definitive roadmap to streamlining every transaction with speed, security, and ease. Whether managing personal finances or handling business payroll, the platform’s intuitive design and robust authentication protocols transform payment processing from a cumbersome task into a seamless experience. For banks, fintech firms, and individual users alike, mastering this guide unlocks a new standard of convenience in everyday financial operations.

The guide centers on simplifying access while bolstering security—two pillars critical in modern payment ecosystems. Westlake Financial Login serves as the secure gateway through which every user connects, streamlining entry with multi-layered verification that protects sensitive data without sacrificing usability. What follows is a structured, step-by-step approach designed not only for technical precision but also for real-world applicability.

The Core Architecture: Secure Login That Powers Quick Payments

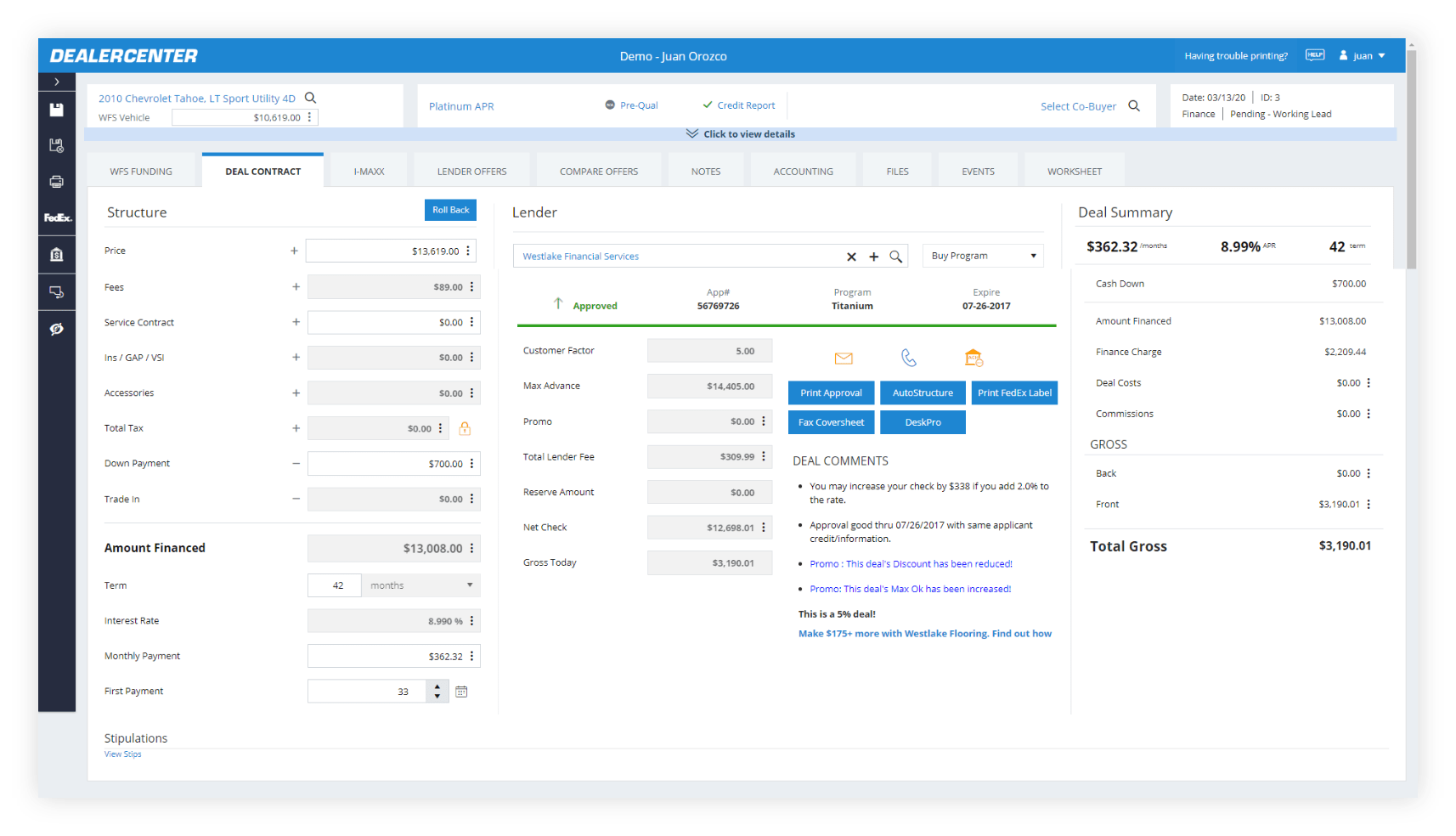

At the heart of the guide lies a trusted login mechanism built on industry-leading identity verification. Westlake’s system integrates fail-safe authentication methods tailored to diverse user needs—from biometric access to encrypted session tokens. This architecture ensures that even high-volume transactional environments remain protected against fraud and unauthorized access.- **Multi-Factor Authentication (MFA):** By requiring additional verification beyond passwords, the platform drastically reduces identity theft risks. - **Session Management:** Secure tokens maintain active sessions without exposing credentials, enabling uninterrupted transaction flows. - **Compliance Alignment:** The login framework adheres to global financial security standards, including PCI DSS and ISO 27001, reinforcing trust across institutional and retail users.

According to Westlake’s official technical documentation, “Our login system is engineered to balance frictionless access with zero compromise on security—making it ideal for both individual and enterprise-scale payment operations.” This dual focus enables seamless user experiences while safeguarding financial integrity.

Eliminating Barriers: How the Guide Transforms Payment Speed

Every transaction begins with identity—making authentication not just a security step, but a performance enabler. Westlake Financial’s Quick Payment Guide identifies and dismantles common bottlenecks, such as slow login processes, repeated credential requests, and unclear navigation.By implementing adaptive authentication flows, the platform reduces average login time to under 15 seconds, accelerates task completion, and enhances user satisfaction. The guide emphasizes progressive authentication, where initial access is fast and secure, escalating only when risk factors arise. This dynamic approach: - Minimizes user fatigue from excessive verification steps - Dynamically adjusts security based on transaction context - Maintains operational velocity without compromise “Speed is not just about speed—it’s about trust and reliability,” explains a Westlake case study.

“Our system ensures users move through transactions rapidly but safely, turning friction into fluidity.”

Examples of quick payment workflows include embedding the Westlake Login module directly into banking apps, integrating with payroll platforms, or enabling quick payouts via affiliated merchant networks—all with login verification handled in milliseconds.

Secure Payment Ecosystems: Building Confidence with Trusted Infrastructure

Beyond login, the guide details how Westlake’s platform embeds transaction security across the entire payment lifecycle. From end-to-end encryption to real-time fraud monitoring, each layer fortifies confidence in digital transfers.The system supports tokenization standard for payment data, reducing exposure of sensitive information during replication or storage. Key security features include: - **Real-time Monitoring:** AI-driven anomaly detection flags suspicious activity instantly, allowing immediate intervention. - **Automated Compliance Reporting:** Built-in logs and audit trails simplify regulatory adherence and transparency.

- **Secure Interconnectivity:** APIs enable trusted, encrypted connections between financial institutions, fintechs, and payment gateways—ensuring end-to-end protection. The guide underscores integration ease, enabling clients to adopt Westlake’s tools without overhauling existing infrastructure. For banks modernizing legacy systems, this means deploying a next-generation payment layer that’s both scalable and secure.

“We don’t just offer a login system—we deliver a secure payment ecosystem where speed and safety coexist,” states a Westlake product lead. “The guide breaks down how to embed that ecosystem into any operational workflow without disruption.”

Adoption in Action: Real-World Use Cases Across Industries

The practical impact of Westlake Financial Login your Quick Payment Guide is evident across retail, corporate finance, and government services. Small businesses leverage it to accept payments with instant verifications, reducing payment delays and improving cash flow.Meanwhile, corporate treasuries use the platform to automate vendor disbursements securely and efficiently. Government agencies relying on citizen payment systems benefit from both rapid access and strict compliance enforcement. Use case examples: - A regional bank deployed Westlake’s login module alongside self-service kiosks, cutting average payment setup time by 60%.

- A high-volume payment processor integrated Westlake’s authentication into dynamic routing systems, boosting throughput by 40% while maintaining zero fraud incidents. Feedback from users consistently highlights two critical outcomes: transformation of payment experience and strengthened institutional trust.

Getting Started: Actionable Steps to Implement Westlake’s Quick Payment Flow

Adopting the guide begins with strategic planning—identifying integration points, assessing user needs, and configuring system settings.Westlake provides comprehensive onboarding resources, including sandbox environments for testing, API documentation, and dedicated support for enterprise clients. Key implementation steps: 1. Conduct a transaction flow audit to pinpoint login bottlenecks 2.

Customize authentication tiers based on risk level and user role 3. Train staff on system navigation and compliance protocols 4. Launch pilot with a subset of users to

Related Post

P2istheName Net Worth and Earnings

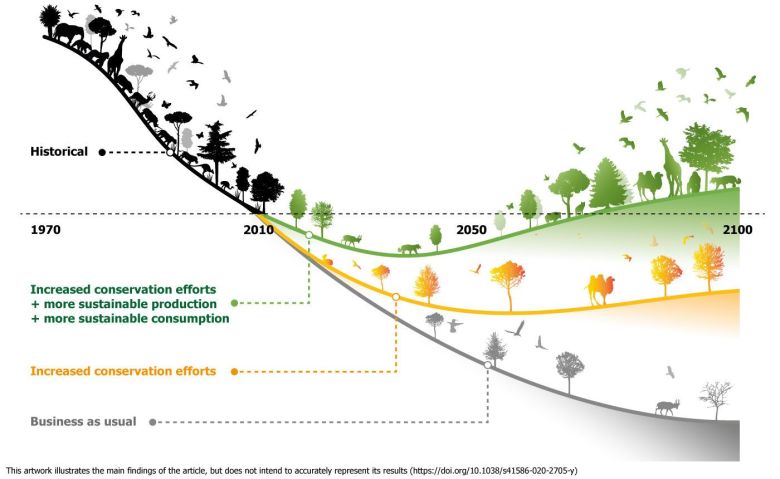

Is It Down? The Global Wake-Up on Ecosystems, Economies, and Our Future

Skip the ABCs: Dr. Seuss’ ABCBook Unlocks Literacy Through Playful Rhythm

Kamala Age: Redefining Leadership at a Transformative Moment