Money Easily: Master Proof of Payment & Profitable Earning Strategies in Today’s Fast-Paced Economy

Money Easily: Master Proof of Payment & Profitable Earning Strategies in Today’s Fast-Paced Economy

In an era where financial transparency and efficient income generation are non-negotiable, understanding how to authenticate payments and deploy smart earning strategies has become essential for both individuals and businesses. “Money Easily: Proof of Payment and Earning Strategies” reveals actionable pathways to validate transactions securely while unlocking sustainable revenue streams—without sacrificing time, trust, or integrity. From digital verification methods to proven income models, this guide delivers a fact-based roadmap for turning financial interactions into tangible value.

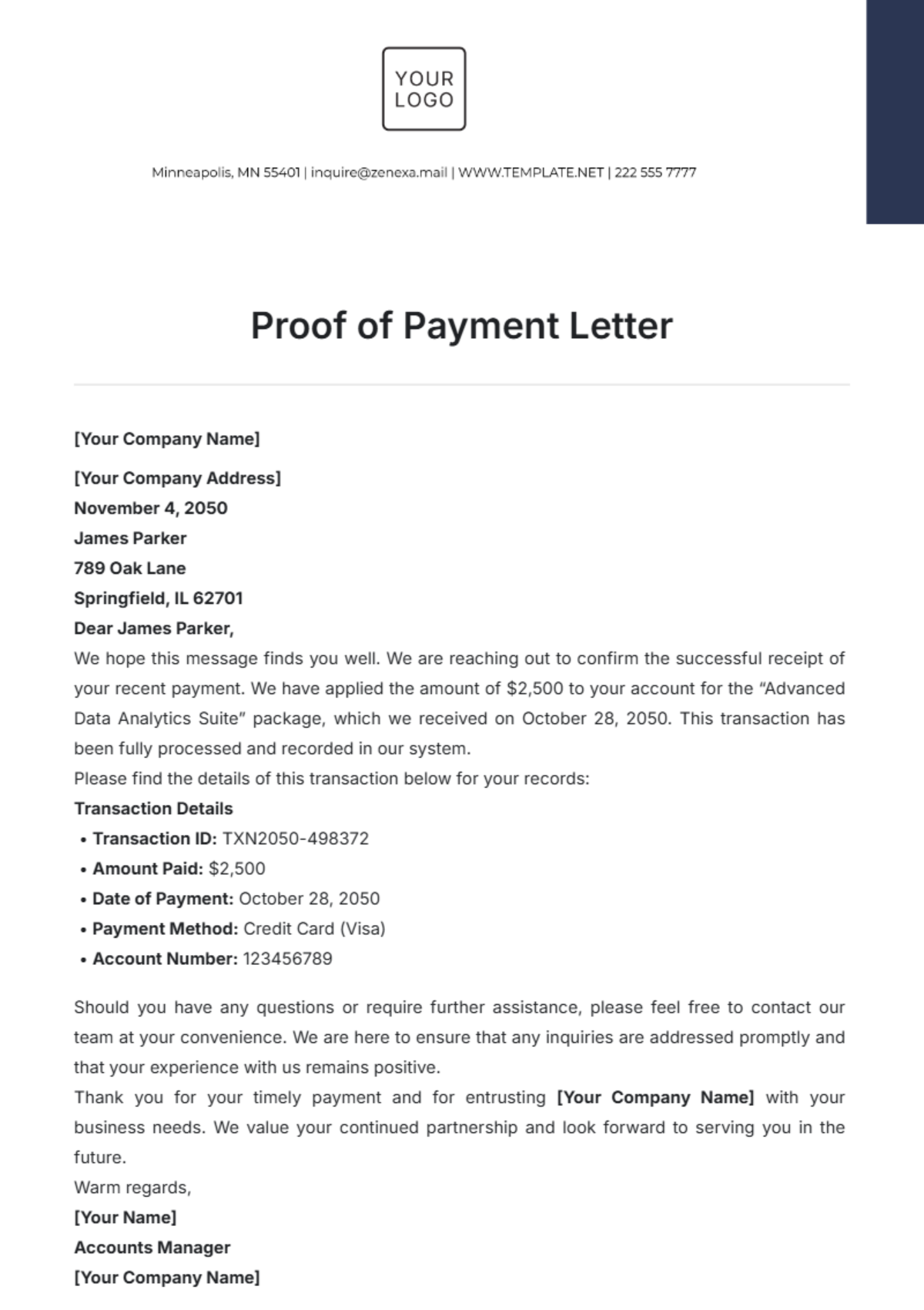

At the core of modern economic exchange lies the critical need to prove payment—ensuring transactions are not only recorded but also verifiable, secure, and compliant. Proof of payment serves as the cornerstone of financial accountability, protecting buyers and sellers alike. Whether through digital signatures, encrypted receipts, or blockchain-based transaction logs, the systems available today make validating payments faster, more transparent, and more enforceable than ever before.

One of the most reliable methods is the integration of digital payment platforms certified with Secure Sockets Layer (SSL) encryption and two-factor authentication.

Services like Stripe, PayPal, and Square not only process millions of transactions securely but also generate timestamped, tamper-resistant proof of payment. These digital records reduce disputes and streamline audits—essential for small businesses managing cash flow or freelancers documenting income. Furthermore, adopting blockchain technology for select transactions offers immutable ledgers that enhance trust, particularly in cross-border dealings where traditional banking delays and risks often apply.

How Proof of Payment Protects All Stakeholders

- **For Sellers:** Hashes, receipts, and transaction IDs create defensible proof, reducing fraud and enabling faster dispute resolution.- **For Buyers:** Encrypted confirmations and instant digital receipts eliminate uncertainty and support better financial reconciliation. - **Regulatory Compliance:** Automated logging aligns with anti-money laundering (AML) and know-your-customer (KYC) requirements globally.

Beyond verification, the article explores proven earning strategies that transform income generation into a repeatable, scalable process.

While high-risk schemes promise quick returns, sustainable wealth builds on consistency, skill-building, and strategic reinvestment. Top earners prioritize methods that balance risk, accessibility, and long-term return—principles evident in both freelance platforms and micro-investment vehicles.

Proven Earning Strategies: Scale with Smart, Low-Effort Income Streams

- **Freelancing & Digital Services:** Platforms like Upwork, Fiverr, and Toptal allow experts in writing, design, coding, and marketing to monetize niche skills globally. Focus on building a strong profile, delivering exceptional client value, and reinvesting early income into advanced tools or training.- **Micro-Investing and Dollar-Cost Averaging:** Automated investing via apps like Acorns or Robinhood allows users to grow capital steadily by investing small, regular amounts—turning everyday spending into compound growth. This passive approach minimizes timing risk while fostering financial discipline. - **Affiliate Marketing & Referral Programs:** Leveraging content platforms (blogs, YouTube, newsletters) to promote high-quality products generates income through earned commissions.

Success hinges on audience trust, targeted content, and authentic recommendations rather than misleading hype. - **Content Monetization:** Creators earn via YouTube ads, sponsorships, and fan subscriptions—models proven when paired with consistent, niche-focused engagement. Monetizing expertise through courses, e-books, or memberships further multiplies return on creative effort.

Each strategy demands initial setup but rewards patience with compounding returns. The key insight: sustainable money generation isn’t about overnight success, but about selecting models aligned with personal strengths, available time, and risk tolerance—while maintaining rigorous authenticity.

Building a Hybrid Earnings Ecosystem

The most resilient income frameworks integrate multiple strategies in synergy. For example, a freelance developer might combine contract work with automated micro-investments, while promoting a niche SaaS product through a blog—each stream reinforcing the others.This diversified approach buffers against market volatility and creates multiple pathways to liquidity. According to financial experts, “The future of earning isn’t monolithic—it’s networked, dynamic, and rooted in trust.”

To operationalize this vision, auditing income sources quarterly, tracking proof of payment systematically, and reinvesting returns promptly form essential habits. Digital tools now simplify this: accounting software like QuickBooks or FreshBooks automate receipt categorization and payment validation, reducing manual effort and boosting accuracy.

Meanwhile, analytics dashboards help identify high-performing income streams early, enabling agile shifts when needed.

In practice, whether securing proof of payment through encrypted ledgers or launching a hybrid income model, the underlying principle remains clear: money becomes easier when processes are transparent,

Related Post

The Untold Story: Decoding the Nuances of Dan Feuerriegel Married Status and Public Life

Unlocking Chemical Potency: What Is Q in Chemistry?

<strong>Air Busan Stuns the Aviation World with World’s First Ban on Power Banks</strong>

Hanna Oberg Fitness Bio Wiki Age Husband Ownu and Net Worth