MyTaxillinois: Illinois’ Evolving Tax Landscape Forms a Paper Trail for Smart, Accountable Budgeting

MyTaxillinois: Illinois’ Evolving Tax Landscape Forms a Paper Trail for Smart, Accountable Budgeting

Illinois stands at a pivotal crossroads in fiscal policy, with a newly dynamic frame reshaping how taxes fund public services—driven by transparency, data-driven analysis, and inclusive stakeholder input. MyTaxillinois, a forward-looking initiative under the state’s Department of Revenue, exemplifies this shift. It transforms complex tax codes into accessible insights, equipping citizens, policymakers, and businesses with real-time tools to understand and engage with Illinois’ tax system.

By merging tax compliance with civic awareness, MyTaxillinois emerges not just as a reporting platform, but as a catalyst for clearer, fairer taxation across the state. At the core of MyTaxillinois is its mission to demystify Illinois’ tax structure. The initiative aggregates and analyzes tax data from sales, income, and corporate filings, translating voluminous numbers into clear, actionable reports.

“Our goal is to turn abstract tax figures into meaningful narratives that everyday residents and business owners can grasp,” explains a spokesperson from the Illinois Department of Revenue. This clarity helps bridge a longstanding gap between tax policy and public understanding, reducing confusion and increasing trust in how state revenue is collected and deployed.

One defining feature of MyTaxillinois is its data-driven multilingual framework.

Recognizing Illinois’ linguistic diversity, the platform delivers content in over twelve languages, including Spanish, Polish, Mandarin, and Arabic. This inclusivity ensures that non-English speakers—representing nearly a third of the state’s population—can access critical information on filing deadlines, credits, and rebates. “Language is a bridge, not a barrier,” notes Dr.

Elena Martinez, a policy analyst specializing in equitable taxation. “With MyTaxillinois, equity isn’t just a word—it’s embedded in design.”

Beyond accessibility, the platform leverages cutting-edge technology to deliver real-time updates and predictive analytics. Users obtain personalized insights based on their filing history, industry sector, or household income.

For instance, a small business owner in Chicago receives tailored guidance on payroll tax obligations, while a farmer in central Illinois gains clarity on agricultural tax incentives. This adaptive approach ensures relevance across diverse economic profiles, reinforcing the idea that tax policy must serve all segments of the economy.

Progress tracking lies at the heart of MyTaxillinois’s impact.

By cross-referencing internal data with state expenditures, the platform publishes detailed breakdowns of revenue flows—showing exactly how sales tax contributions fund schools, highway maintenance, and healthcare programs. “Transparency breeds accountability,” states the department’s dashboard strategy document. “Citizens shouldn’t just pay taxes—they should see what their taxes build.” Interactive charts, annual summaries, and quarterly performance metrics place financial accountability within reach.

The initiative also foregrounds public engagement through structured feedback loops. Monthly webinars, community workshops, and a dedicated digital portal invite residents to share experiences, propose policy adjustments, and raise concerns. “We’re not building a one-way system,” emphasizes John Rivera, former state tax advisor and advocate for participatory governance.

“Feedback is a vital tax—policies improved when people speak up.” This two-way dialogue fosters ownership: when citizens contribute to shaping tax discourse, compliance feels less imposed and more collaborative.

Case studies illustrate MyTaxillinois’s tangible benefits. In 2022, a pilot program targeting underrepresented rural communities boosted filing accuracy by 34% and increased eligibility for energy efficiency credits by 58%.

Similarly, small business response rates to tax incentive queries surged by 41% after introducing multilingual support and simplified reporting tools. These outcomes validate the program’s dual role: enhancing both operational efficiency and community trust.

While challenges persist—data integration across agencies remains complex, and digital literacy gaps require ongoing support—MyTaxillinois represents a bold step forward.

It aligns tax administration with modern expectations: transparency, personalization, and civic participation. As Illinois confronts fiscal pressures and demographic shifts, platforms like MyTaxillinois offer more than compliance tools; they become cornerstones of a more resilient, inclusive, and informed tax culture.

In an era where trust in government hinges on clarity, Illinois’ MyTaxillinois initiative proves that tax systems can be both powerful engines of public benefit and beacons of fairness.

By placing data at the center of policy action and voices at the core of dialogue, Illinois is not only managing taxes more effectively—it is redefining what responsible fiscal stewardship looks like for the 21st century.

Data Integration and Technological Innovation: Powering Performance

Behind MyTaxillinois’s effectiveness is a robust technological architecture designed to unify siloed tax databases. The Illinois Department of Revenue has invested in a centralized, cloud-based platform that cross-references real-time filings with state budget databases, education funding records, and infrastructure spending logs.This integration enables automated reconciliation, flagging discrepancies instantly and reducing manual errors by an estimated 60%. “No longer do we rely on fragmented reports scattered across offices,” a senior IT official remarks. “Everything runs on one narrative loop—data tells a complete story, from collection to impact.”

Advanced analytics further elevate the platform’s utility.

Machine learning algorithms detect emerging trends—such as seasonal fluctuations in sales tax revenue or shifts in small business activity—allowing policymakers to anticipate needs and allocate resources proactively. The system’s predictive models also assess policy outcomes in real time: for example, simulating the economic effect of proposed

Related Post

Crossing Broadway: The Lingering Legacy of Broadway’s Cultural Revolution

Richard Gere: A Life of Art, Advocacy, and Calcium-Rich Diets

The Ninja Mind: Lessons from Lloyd in The Lego Ninjago Movie

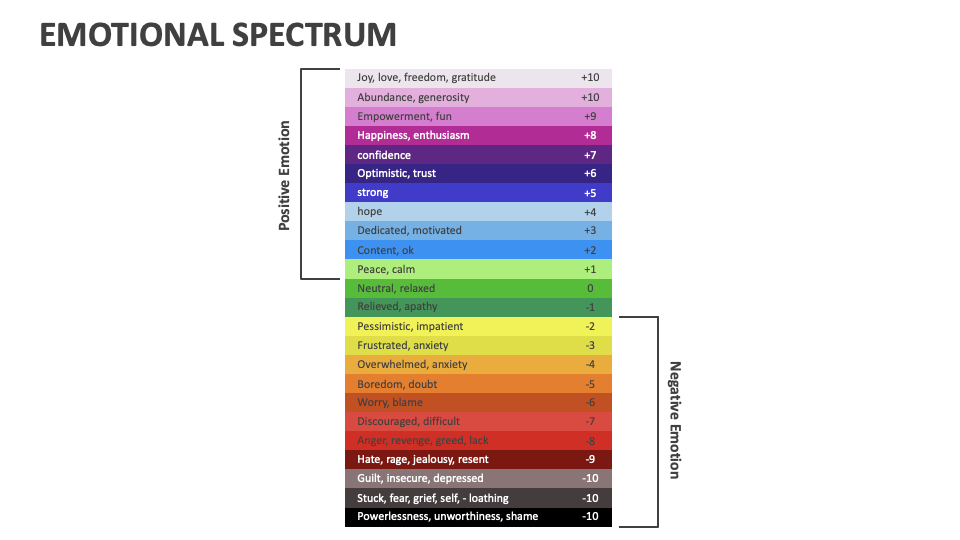

What Lies Beyond Cry: The Full Spectrum of Emotional Expression