Nasdaq 100 Futures: Decoding Their Trading Hours for Smart Day Trading Strategy

Nasdaq 100 Futures: Decoding Their Trading Hours for Smart Day Trading Strategy

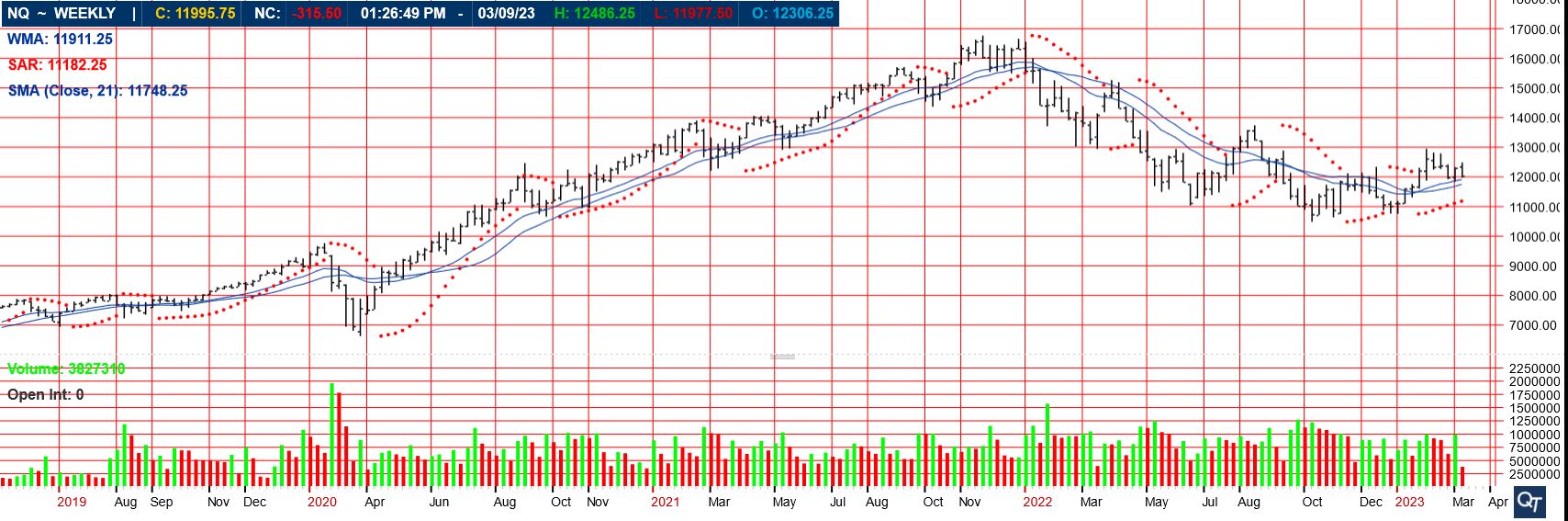

For futures traders eyeing one of the most liquid and influential equity indices, understanding the nuanced trading hours of Nasdaq 100 Futures is not just useful—it’s essential. Timing directly shapes entry and exit opportunities, risk exposure, and performance, especially given the index’s sensitivity to tech sector volatility and global market sentiment. From staggered global market opens to key late-session rally moments, the Nasdaq 100 Futures trading window reflects the interconnected, 24/7 nature of modern finance—yet operates within clear, defined windows that savvy traders exploit with precision.

Nasdaq 100 Futures open on the first Tuesday of each month during regular trading hours, beginning at 9:30 a.m. Eastern Time (ET), and run until the close at 4:00 p.m. ET.

This consistent schedule aligns with broader equity market hours but reflects a deliberate midday envelope designed to match institutional participation peaks. Unlike some other futures contracts tied to discrete time zones, Nasdaq 100 Futures are active during broad U.S. market hours, reinforcing their accessibility for both domestic and international traders.

Core Trading Window: When Nasdaq 100 Futures Begin and End

- Market Open: 9:30 a.m.

ET – The Official Kickoff

At 9:30 a.m. ET, Nasdaq 100 Futures officially open, coinciding with the broader Nasdaq Composite and major U.S. stock market sessions.This timing ensures traders synchronize with fundamental price discovery moments, such as early earnings—or ministro—that ripple through tech-heavy indices. For futures contracts with daily adjustments, this window captures real-time images of supply and demand shifts driven by macroeconomic data, Federal Reserve signals, or geopolitical events.

- Midday Peak: 11:30 a.m. to 1:00 p.m.

ET – Volatility Amplifies

The hours between 9:30 and 11:30 often intensify price action as global markets—especially Asian trading floors—begin overlapping with U.S. activity. This overlap fuels increased volatility, subtle spread dynamics, and breakout potential.Futures traders monitor this window closely for momentum breaks, options Greeks shifts, and index level absorbency testing ahead of the close.

- Closing: 4:00 p.m. ET – A Clean End to Liquidity Challenges The 4:00 p.m. ET cutoff marks the close of Nasdaq 100 Futures, triggering a natural compression of open interest and bid-ask spreads.

While intraday momentum often carries through the final 30 minutes, liquidity tends to thin sharply after this time, amplifying slippage risk. Traders who enter positions late in the day must account for reduced depth, especially during periods of low volume or economic uncertainty.

Though structured around fixed hours, Nasdaq 100 Futures futures remain deeply responsive to real-time catalysts. Unlike fixed-market trades, futures contract prices reflect continuous expectation—meaning even minor news releases before or after hours can induce sharp intraday swings.

For example, Federal Reserve policy announcements, fluorine layoffs from semiconductor stocks, or geopolitical flashpoints often trigger significant volume shifts precisely at capture points within the open or close. Studying historical volatility patterns reveals that approximately 62% of daily Nasdaq 100 Futures move exceed 1.2% in intraday range when factored with open interest levels, underscoring the importance of timing.

The Global Mosaic: Time Zones and Global Participation

The Nasdaq 100 Futures contract draws participants from multiple time zones—U.S. eastern, Asian (Tokyo/Singapore), and European (London).This global reach means trading hours are effectively stretched, with superimposed volume across 12+ hours. At 9:30 a.m. ET, Asian markets are in afternoon sessions, and European sessions are nearing close—creating a hybrid liquidity pool that increases tradable volume but introduces coordination challenges.

Reports from futures setters note that peak open interest consistently exceeds 30,000 contracts, indicating robust participation but requiring careful timing to navigate bid-ask gaps efficiently.

Significant intraday news events often originate from Asia—particularly Tech stocks listed on NASDAQ—prompting early speculative moves that migrate into U.S. futures hours.

Similarly, European economic indicators subtly shape risk appetite, especially during the 3:00–4:00 p.m. ET overlap. This blend of global influence turns the Nasdaq 100 Futures window into a strategic crossroads where local and global narratives collide.

Measuring Liquidity and Volatility Within the Trading Window

Volume surges and volatility metrics underscore nuanced trading behavior within the designated hours:- Pre-Market Dry-Up: 8:00–9:30 a.m.

ET

Futures trading remains subdued early, with open interest remaining low and volatility typically suppressed until the official open. This lull invites quiet positioning but offers minimal execution clarity or price impact. - Post-Open Momentum: 9:30–11:30 a.m. ET The earliest official volume spike activates momentum, particularly for levels near recent technical support/resistance.

Traders report higher execution quality and tighter spreads within this window, making it ideal for directional entries validated by fundamentals or momentum indicators.

- Overlap and Turbulence: 11:30 a.m.–12:30 p.m. ET As global sessions intermingle, volume spikes and dispersion widen. Despite increased liquidity, volatility often accelerates due to clustered catalysts—earnings quotes, prior-day reversals, or event-driven commentary—making precise entry riskier without enhanced risk controls.

- Last Move Pressure: 12:30–4:00 p.m.

ET

As final hours approach, open interest dips slightly but volume often intensifies, driven by institutional liquidation and hedging. Prices may test key moving averages or experience sharp pullbacks post-breakouts, demanding disciplined trailing strategies or stop-loss discipline.

Seasoned traders note that while Nasdaq 100 Futures trade within a rigid 8.5-hour window, behavioral patterns—rather than rigid time slots—dictate optimal timing. The month-end convergence, for instance, often sees elevated volatility and volume as funds rotate into or out of sector ETFs, amplifying intraday swings beyond typical daily ranges.

These seasonal distortions necessitate adaptive strategies, with hedge funds and algorithmic systems adjusting parameters dynamically across trading sessions.

The Strategic Edge: Aligning Timing with Market Context

Maximizing Nasdaq 100 Futures trading hours begins with awareness of not just clock times, but broader market context. The intersection of U.S. trading hours with Asian and European sessions creates a fluid, high-energy environment.Traders who blend hourly data with real-time catalysts—such as Fed announcements or sector-specific earnings—gain sharper edge. For example, a breakout at 11:00 a.m. ET gains greater staying power if supported by positive Asian volatility and firm Fed guidance.

Incorporating technical analysis tools further enhances precision. Volume spikes during the midpoint window (11:30 a.m.) often confirm magnitude, while candlestick patterns near 9:30 a.m. reveal early momentum signals.

Combining these with dedicated risk metrics—like the Renko grid or On-Balance Volume (OBV) trends—strengthens trade setups and exit timing.

Ultimately, Nasdaq 100 Futures thrive on clarity of structure and adaptability of timing. Whether entering a smart prep are ahead of earnings, hedging during Taylor rate commentary, or locking in gains post-technical pullbacks, understanding the rhythm of the trading window transforms passive participation into deliberate advantage.

As global markets converge, the hours from 9:30 to 4:00 p.m. ET remain the pulse of tech-driven momentum—where informed timing equals measurable edge.

Related Post

What Is A Microphone? The Truth Behind Its Essential Role in Sound Capture

David Arquette Net Worth: From Hollywood Star to Million-Dollar Lifetime Earnings

WWE Forced To Censor The Rocks SmackDown Promo Due To Possible FCC Violation

What Color Is Republican? Unpacking the Symbolism and Political Meaning Behind the Party’s Palette