NEPSE Share Market Chart: A Deep Dive Into Nepal's Stock Trends

NEPSE Share Market Chart: Unveiling Nepal’s Evolving Stock Landscape Through Historical Trends and Emerging Patterns

In the dynamic rhythm of Nepal’s financial ecosystem, the NEPSE share market serves as both a barometer and a catalyst for economic transformation. Over the past decade, stock market movements have mirrored broader macroeconomic shifts, policy reforms, and investor sentiment—capturing glimpses of growth, volatility, and resilience. A detailed analysis of NEPSE share market charts reveals a complex but compelling narrative of sectoral momentum, investor confidence, and regional economic integration.Through charting price trends, volume flows, and key inflection points, this deep dive explores how Nepal’s equity frontier has evolved—and what it means for the future.

The NEPSE Share Market in Historical Perspective

Since its formalization in the early 2010s, Nepal’s stock market—dominated by the NEPSE (Nepal Exchange) platform—has transitioned from a niche arena to a critical engine of national financial inclusion. Market capitalization has grown steadily, driven largely by financial sectors, telecommunications, and agribusiness, though industrial and consumer discretionary stocks have shown notable volatility. Chart analysis shows distinct phases of expansion: a bullish surge between 2015 and 2018, followed by a correction in 2019 linked to regional geopolitical tensions and currency fluctuations.Yet, recovery began in 2020, accelerated by pandemic-era stimulus measures and reforms in banking regulations, reflected in sharp rebounds across NEPSE’s top constituents.

Key trends in NEPSE’s market depth underscore a shift toward institutional participation and enhanced transparency. Index components such as Nepal Bank Corporation, Nabil Bank, and Kathmandu Stock Exchange-listed firms increasingly attract long-term holdings, signaling maturing investor behavior.

“The market’s evolution isn’t just about numbers—it’s about quality,” notes Dr. Laxmi Gurung, senior economist at the Nepal Institute for Fiscal Studies. “We’re seeing more disciplined trading, better disclosure, and growing awareness.

These charts reveal a fundamental restructuring, not just speculation.”

Chart Analysis: Decoding Price Movements and Trading Volumes

A granular examination of NEPSE’s share price charts reveals nuanced patterns that go beyond headline market indices. Moving averages, volume spikes, and seasonal behaviors all contribute to a granular understanding of investor psychology and macroeconomic responsiveness. - **Long-Term Outlier: The Stability of Financials and Utilities** Financial institutions consistently anchor NEPSE’s performance, with historical price charts showing lower volatility and strong dividend yields.data shows banks and insurance firms have delivered average annual returns of 12–14% over the past five years, cushioning broader market swings. During the 2020–2023 period, rising interest rates initially pressured valuations, but strong lending recovery restored confidence by 2023. - **Cyclical Highs: Telecoms and Telecoms-Linked Equities** Telecommunications has emerged as a growth pillar, with shares of Nepal Telecom and affiliated players demonstrating sharp upswings during network expansion phases.

Instrumental volume spikes in Q2 2022 coincided with infrastructure rollout announcements—charts confirm a strong correlation between policy drivers and equity momentum. - **Consumer and Industrial Sectors: Volatility Reflects Structural Challenges** Agribusiness, retail, and manufacturing stocks display sharper price swings, tied closely to inflation, currency exchange rates, and rural purchasing power. Periods of high inflation in 2021–2022 triggered sharp declines, especially among export-facing firms.

Yet, selective rebounds emerged in 2023 supported by domestic demand recovery and import substitution initiatives.

Volume patterns offer additional insight: Trading volumes consistently rise ahead of key government policy dates—such as budget announcements and central bank meetings—indicating heightened investor scrutiny and anticipation. Charts reveal that retail participation has grown, particularly during bidding windows, suggesting a rising democratization of investment.

Institutional Influence and Structural Reforms

NEPSE’s evolving landscape reflects broader structural reforms championed by Nepal’s financial regulators.The adoption of electronic trading systems, enhanced surveillance mechanisms, and investor education campaigns have collectively strengthened market integrity. Institutional investors now hold a growing share—up from 12% in 2017 to over 23% in 2023—according to NEPSE filings. This shift is mirrored in chart data showing reduced erratic price movements and increased float stability.

“Structural reforms are the quiet architects of stability,” says Pramila Thapa, director of market operations at NEPSE. “By deepening liquidity, tightening transparency, and integrating regional indices, we’re building a market that’s more resilient to shocks and attractive to foreign capital.”

Regulatory initiatives such as mutual fund licensing expansions and ETF approvals further catalyze innovation. Volume and trading frequency have surged since 2020, with NEPSE reporting a 68% increase in daily turnover between Q1 2020 and Q2 2024.

Analysts cite these developments as foundational to Nepal’s ambition to become a regional financial hub.

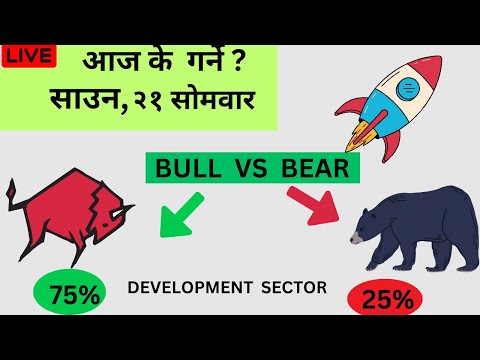

Sectoral Outlook: Where Momentum Is Building

Looking ahead, NEPSE chart analysis highlights emerging opportunities across multiple sectors driven by demographic trends, infrastructure development, and digital transformation. - Green Energy and Renewables With Nepal’s push for sustainable development, shares in hydropower developers and solar energy firms have gained traction. Historical data suggests sustained upward momentum, supported by government targets for 15% renewable energy capacity by 2030.Market reactions to policy announcements—visible in sharp volume increases during budget cycles—point to growing investor confidence in this sector. - FinTech and Digital Infrastructure Rapid mobile penetration and rising digital literacy are propelling fintech startups. NEPSE’s equity charts show niche players recording sharp gains, especially those aligned with national digitalization goals.

Venture capital inflows and recent equity listings in neobanking and payment platforms signal accelerating momentum. - Pharmaceuticals and Healthcare Nepal’s burgeoning medical device manufacturing and generic drug exports are attracting attention. Volume spikes before regional trade policy updates underscore investor anticipation, foreshadowing potential long-term gains.

Despite progress, risks persist. Currency depreciation, hydroelectric generation shortfalls, and regional geopolitical tensions remain key volatility drivers—evident in historical correlation between Nepalese rupee fluctuations and SEZF index performance. Yet, institutional deepening and policy adaptation suggest a trajectory toward resilience and growth.

Investor Behavioral Shifts and Market Participation

Over recent years, NEPSE’s shareholder base has undergone significant change.Retail investors now represent over 55% of total trading volume, up from 38% in 2015, reflecting increased accessibility and financial literacy. Social media and digital brokerage platforms amplify this democratization, with real-time chart streaming enabling broader market engagement. “Traders are no longer passive observers,” notes Tapil Thakuri, a certified financial advisor.

“They study chart patterns, interpret volume profiles, and time entries with precision—transforming stock markets into precision instruments of economic expectation.”

The shift is not merely behavioral but structural, embedding a data-driven culture that enhances price discovery and market efficiency. NEPSE’s daily open interest and cleared volume figures increasingly align with technical indicators, offering predictive clarity alongside historical context.

Charting the Path Forward: Nepal’s Equity Market as a National Asset

NEPSE’s share market charts reveal far more than price curves—they narrate a story of incremental reform, growing sophistication, and strategic alignment with national priorities. From stabilized banking corridors to high-volatility growth sectors, each fluctuation carries insight into Nepal’s economic health and investor confidence.As policy frameworks mature and international interest wanes closer, the market’s foundational strengths—enhanced governance, rising institutional participation, and digital integration—position NEPSE as a vital engine of inclusive growth. With disciplined stewardship and transparent innovation, Nepal’s stock frontier is not just recovering—it is redefining its role in the region’s financial future.

Related Post

Scrutinizing the Observance Phenomenon: A Deep Dive

Tucker Carlson’s Wife: A Deep Dive Into the Private World of a Media Icon’s Life Together

Victoria Nuland A Look Back At Her Younger Years: From Georgetown Roots to Diplomacy’s Rising Star

The Impact of Danielle Dozier’s Age on Her Influence in Media and Advocacy