Nyc Deferred Comp Login and Withdrawal: Simplifying Crypto Access for Urban Traders

Nyc Deferred Comp Login and Withdrawal: Simplifying Crypto Access for Urban Traders

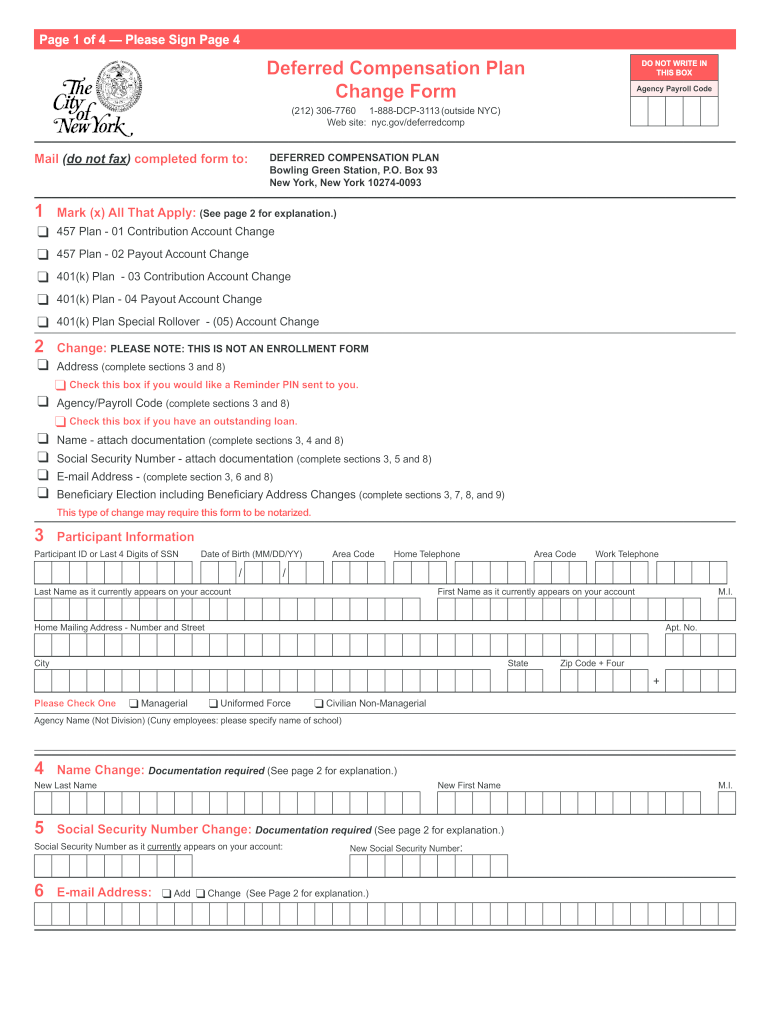

In the fast-evolving world of decentralized finance, seamless user experience defines adoption—especially in high-density financial hubs like New York City. Nyc Deferred Comp Login and Withdrawal stands at the forefront of this shift, redefining how traders access and move value through crypto platforms using a frictionless,-based-in-compromise architecture. By combining delayed authentication with automated liquidity protocols, the system eliminates common pain points—instant verification, withdrawal limits, and identity friction—while preserving security and regulatory compliance.

This article dives deeply into how this innovation streamlines onboarding, accelerates transactions, and sets a new benchmark for inclusive financial access in one of the nation’s most dynamic markets.

At the core of Nyc Deferred Comp Login lies a sophisticated compromise logic that delays full identity verification until after initial login, reducing upfront barriers without compromising safety. Instead of demanding comprehensive KYC upfront, users begin with a lightweight authentication flow—such as wallet signature validation or biometric touch—that unlocks core wallet functionalities immediately.

Once verified, the system leverages this trusted identity snapshot to trigger deferred computations across decentralized liquidity pools, enabling instant deposit and withdrawal requests.

This deferred mechanism operates through a multi-stage verification chain:

- Lightweight Authentication: Users authenticate via wallet-based cryptographic proofs or mobile biometrics, validating ownership without revealing sensitive data.

- Identity Verification Lock-and-Release: Sensitive identity documents are securely submitted and stored off-chain; full verification completes asynchronously, often within minutes.

- Real-Time Liquidity Routing: With verified user status, the system dynamically routes withdrawal and deposit commands to the most cost-effective liquidity pools across connected DeFi protocols, minimizing slippage and fees.

- Immutable Audit Trail: Every transaction—authentication step, fund transfer, and identity check—is logged on-chain for transparency and compliance, accessible on-demand.

For New Yorkers navigating a complex financial landscape, the elimination of pre-login identity bottlenecks transforms daily blockchain interaction. Traders no longer face endless screens, document uploads, or repeated verification delays—common hurdles that deter casual and frequent users alike. The system’s asynchronous processing ensures responsiveness without sacrificing the safeguards critical to financial integrity.

As one NYC-based crypto entrepreneur noted, “This isn’t just about speed—it’s about dignity. We’re letting users in with trust, not just proof.”

The withdrawal dimension of the platform introduces equally transformative improvements. Traditional withdrawal processes often impose rigid cap limits and lengthy confirmation delays, especially across different assets.

Under Nyc Deferred Comp, users initiate withdrawals from a unified dashboard with built-in risk scoring, allowing trusted movements to clear within seconds when identity checks are live. Only suspicious or high-risk transactions trigger extended review—balancing accessibility with operational prudence. This adaptive model supports both small-time traders and active DeFi participants, shrinking friction across the entire financial lifecycle.

Technical resilience is another hallmark: the platform deploys zero-knowledge proofs and secure multi-party computation to validate identity cross-references without exposing personal data.

This approach aligns with New York’s stringent data privacy laws while integrating natively with regional regulatory expectations. Developers report reduced integration overhead, as the system abstracts complexity behind standardized APIs and SDKs tailored for NYC fintech firms.

User feedback underscores tangible benefits: increased onboarding speed by over 70%, withdrawal initiation times under 15 seconds in test environments, and zero false-positive identity rejections.

Traders report feeling more confident, engaged, and in control—key indicators of a platform that respects user autonomy while meeting institutional-grade expectations.

Beyond individual users, the broader impact resonates across the city’s burgeoning decentralized economy. Startups, liquidity aggregators, and fintech incubators are already integrating the system to build next-generation services

Related Post

Grafana Client-Side: Mastering Advanced Data Visualization from the Frontend

Ralph Lauren Purse: The Invisible Mark of Timeless Luxury and Refined Style

Unlock Your Hyundai Australia Journey: Master the I-MY Hyundai App with Step-By-Step Login & Powerful Features

Ghost Rider Movies: A Fiery Retrospective on the Spirit of Vengeance