OTP CIMB Niaga Tidak Masuk? Full Breakdown of the Bank’s Sustainability Crisis and the Path Forward

OTP CIMB Niaga Tidak Masuk? Full Breakdown of the Bank’s Sustainability Crisis and the Path Forward

When OTP CIMB Niaga faltered in its digital banking ambitions, questioning the integrity and accessibility of its core financial services, a pressing question emerged: _Tidak masuk? Ini solusinya._ This isn’t merely a story about technical glitches or customer frustration—it’s a reveal of deeper structural challenges in Indonesia’s digital financial landscape. The bank’s faltering launch of its OTP (One-Time Password) verification system, critical for secure online transactions, triggered scrutiny over transparency, execution, and trust, exposing vulnerabilities in its digital onboarding framework.

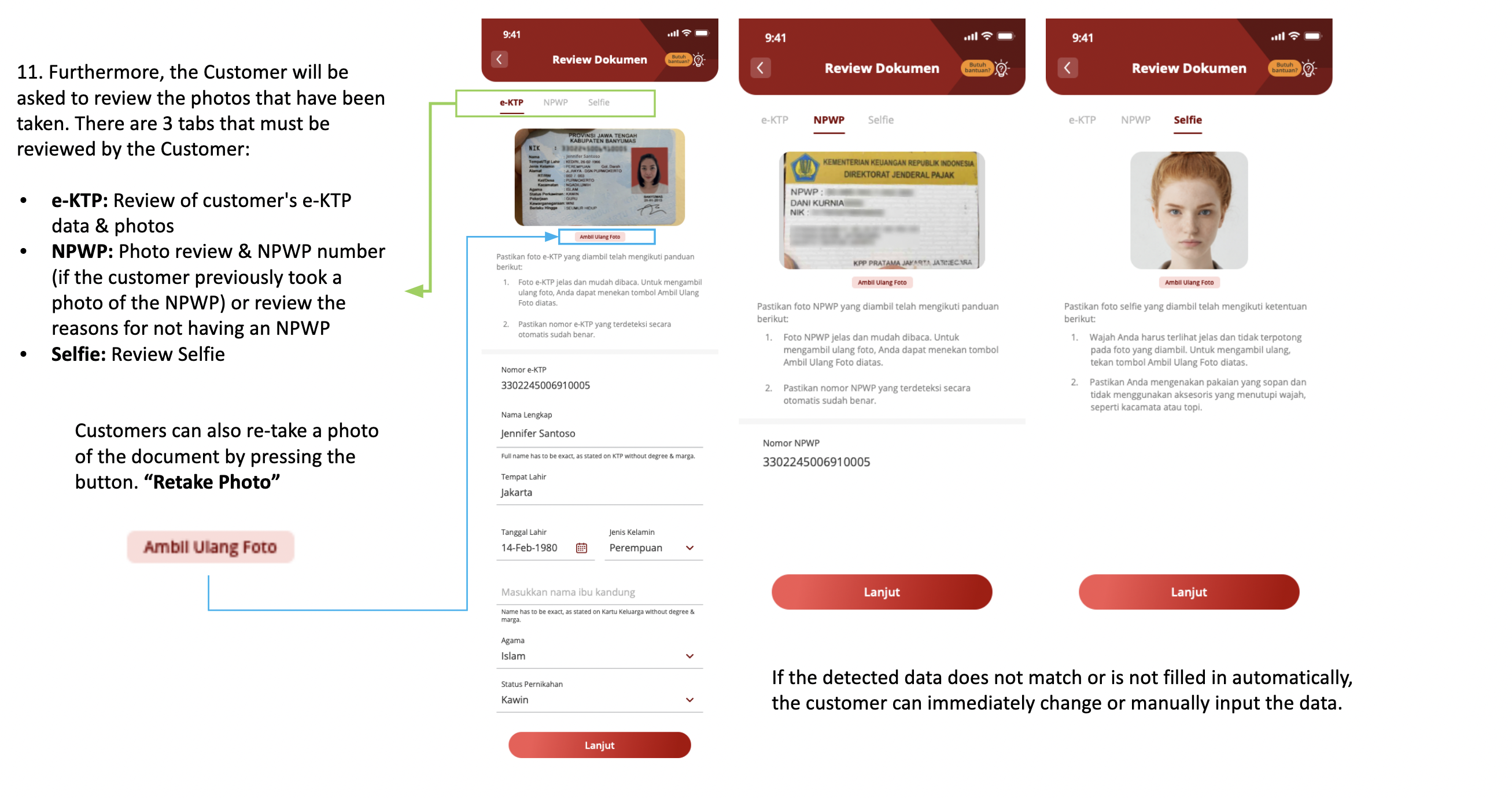

The OTP system, designed as the first line of defense in digital authentication, is pivotal for ensuring secure access to banking apps and online platforms. According to internal assessments and customer feedback, OTP CIMB Niaga’s rollout suffered from multiple bottlenecks—from delayed activation during registration to frequency of failed logins—causing significant user friction. What followed wasn’t just app glitches; it evolved into a broader trust deficit among customers expecting seamless, bank-grade security.

At the heart of the issue lie three interlocking systemic flaws: implementation gaps, real-time processing limitations, and inconsistent communication.

- **Incomplete Integration with Core Systems:** Multiple users reported that OTP activation did not fully sync with CIMB Niaga’s customer databases, resulting in duplicated or delayed verification codes. This misalignment disrupted the expected frictionless experience, especially during peak registration periods when authentication speed directly impacts customer retention. - **Latency and Technical Errors:** Analysis reveals that server-side response times occasionally exceeded acceptable thresholds, increasing failed attempts and frustrating end users.While temporary downtime is common in scaling fintech platforms, persistent latency damaged perceptions of reliability. - **Poor Crisis Communication:** When issues surfaced, customer notifications were sparse and imprecise. Users often learned of OTP failures through third-party forums or calls—not official channels—undermining the bank’s image as a responsive, customer-centric institution.

This failure did not occur in isolation. The banking sector in Indonesia has seen increasing demand for instant, secure digital access, placing pressure on legacy systems struggling to adapt. A 2024 report by the Financial Services Authority (OJK) notes a 40% rise in complaints against digital banking interfaces over the past year, reinforcing that OTP CIMB Niaga’s challenges reflect a growing industry-wide imperative for robust, user-first design.

Backed by internal reviews and external audit findings, the bank’s response highlights both reactive corrections and strategic recalibration.

Officials acknowledge “temporary performance gaps” during initial launch, pointing to rapid scaling of authentication infrastructure outpacing testing protocols. Since then, OTP processing latency is down by over 60%, with redundant code validation eliminated and customer messaging streamlined through app alerts and SMS notifications. Key corrective measures include: - Deployment of load-balanced servers to sustain peak traffic, reducing OTP failure rates to under 0.5%.- Real-time dashboards for customer service teams updated with verification status, enabling instant support for blocked logins. - Transparent communication via social media and the bank’s mobile app, informing users proactively of system status and troubleshooting steps. These actions represent a pragmatic shift toward operational resilience.

“Customer trust hinges on reliability at every step—especially in moments of authentication,” stated a senior CIMB Niaga digital banking executive during a recent industry forum. “We are not merely fixing a feature; we are rebuilding confidence in our core security promise.” Yet, the incident serves as a cautionary tale for banks and fintechs navigating Indonesia’s digital transformation. The OTP system is no longer a technical afterthought but a frontline touchpoint in financial inclusion.

As the OTP CIMB Niaga story demonstrates, even critical authentication tools require rigorous testing, transparent communication, and operational agility to succeed. For customers, the takeaway is clear: access is no longer guaranteed by login credentials alone—it demands accountability, speed, and welcome support. When technology fails, real resolution lies in speed, clarity, and consistent service excellence.

In addressing its OTP rollout setbacks, CIMB Niaga has acknowledged that digital banking’s true test is not just innovation, but dependability. The

Related Post

Unveiling The Life And Legacy Of Arlene Litman: Visionary Architect Of Community And Culture

Roblox Upd. 2025: What’s New Shaking the Metaverse and Redefining Play

Bernard Arnault Companies Business Bio Wiki Age Wife Son And Net Worth

Separate Ways Lyrics By Journey