Pay Pay My Bill for Verizon: Your 4 Best Options to Manage Your Telecom Finances Like a Pro

Pay Pay My Bill for Verizon: Your 4 Best Options to Manage Your Telecom Finances Like a Pro

Verizon remains one of the most powerful telecommunications providers in the U.S., but managing monthly bills can feel overwhelming—especially with complex plans, data overages, and recurring charges. To simplify, Verizon offers four distinct, powerful methods to settle your account efficiently: direct payment, automated renewals, flexible plans with payment windows, and balance transfers via third-party services. Understanding these options empowers customers to control costs, avoid late fees, and stay on top of connectivity expenses without friction.

Each of the four primary payment strategies caters to different financial habits and tech preferences—from the convenience of instant bank transfers to the long-term benefits of payment scheduling. By unpacking the mechanics, risks, and perks of each, users gain the clarity needed to optimize their Verizon experience and maintain seamless service.

1. Direct Payment: Instant, Secure Bill Settlement Online

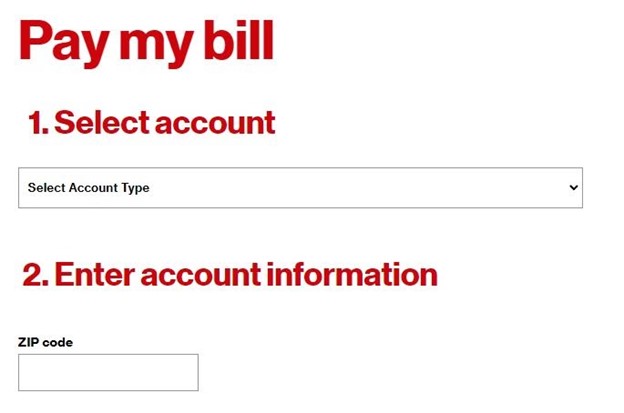

Paying Verizon’s bill instantly through the official Verizon app, website, or mobile banking portal is often the fastest and most reliable method.Using real-time linking, customers can authorize one-time payments or set up automatic withdrawals with minimal steps. Linking a checking or savings account takes under a minute, requiring only basic banking details and a few seconds of labor. Key advantages: - Instant confirmation and creation of paperless records - Direct control over payment timing and reduction of late fees - Enhanced security via encrypted financial channels - Immediate updates reflected in your account dashboard How it works: After entering payment information, a one-time amount is debited within minutes.

A confirmation email and in-app notifications ensure full transparency. Enabling automatic payments from your bank account eliminates manual input and reduces overspending risk. Verizon also supports multiple payment methods—credit/debit cards, ACH transfers, and even Venmo—giving users flexibility.

While direct payment demands no setup fees, users must maintain accurate financial records and review transaction history regularly to prevent overdrafts. For those prioritizing digital immediacy, this method delivers clean, accurate, and frictionless bill resolution.

2. Automated Renewals: Never Miss a Payment—Unless You Choose To

Automated renewals represent Verizon’s most user-friendly payment system, designed to keep service uninterrupted with minimal effort.By linking a bank account or prepaid card, bills are automatically deducted on renewal date—eliminating late payments and service interruptions. This feature is built into Verizon’s account settings and requires no additional subscription. Why customers love it: - Eliminates risk of missed deadlines or forgotten reminders - Reduces mental load by automating a monthly chore - Provides clear visibility through late payment alerts and usage alerts - Built-in flexibility—easily pause or adjust during low-usage periods

While this convenience is powerful, it demands vigilance.

Users receive advance notifications weeks before renewal, typically via email and app alerts, requiring proactive review. Errors in payment links or expired cards can trigger hold-ups, so verifying details quarterly is essential. Yet for disciplined users, automation delivers predictable costs and peace of mind, aligning service with real-time financial planning.

Best for: Steady-income households, budgeters, and those preferring hands-off banking

3.

Flexible Pay Plan Flexibility: Projects, Bills, and Custom Timing Verizon’s flexible payment plans allow customers to tailor billing around their lifestyle and financial rhythm. From prepaid flexibility to project-specific payment windows—ideal for gig workers, students, or seasonal earners—these options decouple payment cycles from rigid monthly schedules. Users can select plans aligned with pay cycles, event payments, or irregular inflows.

Key features: - Customizable billing intervals (weekly, bi-weekly, monthly) - Project billing with single or dunning-free payments - Grace periods or temporary suspensions during income gaps - No extra fees for plan adjustments

For those with fluctuating income, the ability to sync payments with earnings prevents missed bills during lean months. Students taking summer breaks or freelancers with variable monthly returns benefit from this adaptive model. Though slightly more complex than direct payments, the pay-as-you-go structure supports sustainable spending, especially when paired with budget-tracking apps that sync with Verizon’s platform.

While these plans require thoughtful setup—understanding due dates and payment windows is crucial—doing so unlocks true financial agility. In an era where stability matters, Flexible Pay Plans offer a pragmatic middle ground between rigidity and chaos.

Best for: Irregular income earners, freelancers, students, and adaptive spenders

4. Balance Transfer and Third-Party Solutions: Low-Interest Financing and Offset Platforms

For customers seeking debt optimization, Verizon’s bill payment process intersects with advanced financial tools: balance transfers and certified third-party balance transfer services.Though not explicitly built into Verizon’s platform, users can leverage external programs to restructure payments—lowering interest burdens and consolidating liabilities. Services like Chase Complete Pay, Experian, or certified debt consolidators automate full repayments through secured lines or lower-rate credit products. Advantages of third-party balance transfers: - Potential 0% APR periods (often 12–21 months) - Simplified monthly payment via a single provider - Credit counseling integration for better long-term health - Risk of balance transfer fees (3–5%), so weigh savings carefully

These solutions work best when paired with disciplined use—income must comfortably cover transferred balances to avoid new debt.

Verizon itself doesn’t process but facilitates access via partner networks. Users must verify background checks, creditworthiness, and program terms before proceeding. While more complex than direct payment, thoughtful repayment via balance transfer can transform missed bill stress into a structured financial recovery path.

For those already managing debt, aligning Verizon payments with a low-interest bridge offers a clear advantage—but transparency about fees and terms is nonnegotiable. This method suits responsible borrowers seeking to regain control of their financial trajectory.

Mapping the Path Forward: Choosing Your Payment Future

Selecting how to pay Verizon’s bill isn’t just about convenience—it’s about financial strategy. Direct payments and automated renewals deliver speed and security for reliable users.Flexible plans accommodate non-traditional work and unpredictable incomes. Balance transfers offer transformative debt relief, but demand careful planning. Each option reinforces Verizon’s shift toward consumer-centric fintech solutions, empowering customers to align billing with budget discipline, lifestyle, and long-term wellness.

Mastering these four approaches means no more missed payments, unexpected fees, or budget disruptions. Instead, telecom management becomes a seamless, predictable component of modern life—supported by tools designed for control, clarity, and confidence. For anyone navigating Verizon’s ecosystem, understanding these payment pathways isn’t optional—it’s essential.

Use the right method, stay informed, and keep your service uninterrupted, pain-free, and truly under your control.

Related Post

All My Life, K Ci: A Lyrical Journey Through Love, Longing, and Quiet Resilience

Anna Palmer Punchbowl News Bio Wiki Age Height Husband Salary and Net Worth

Find Your Lost OPPO Phone: A Simple Guide to Second Chance Recovery