Pay Samsung Financing: Easy Guide to Buying Smart Without the Stock Price

Pay Samsung Financing: Easy Guide to Buying Smart Without the Stock Price

In today’s fast-paced consumer landscape, accessing credit has never been more critical—and Samsung’s financing options stand out as a powerful, accessible pathway to owning the latest devices without derailing your finances. Pay Samsung Financing: Easy Guide steps through the key components of Samsung’s installment plans, clearly demystifying how to obtain flexible payment terms, avoid high interest traps, and secure top-tier electronics with greater financial control. This guide reveals not just the mechanics but the strategic advantages of using Samsung’s in-house financing, empowering consumers to make informed, manageable purchases.

Understanding the core mechanics of Pay Samsung Financing begins with clarity on how installment payments work. Unlike traditional loans, Samsung offers flexible repayment schedules tailored for smart devices, from smartphones and tablets to wearables. These plans typically allow buyers to split total costs into manageable monthly installments—often as low as 40 corners (approximately $40 USD)—spread over terms of 6 to 24 months.

Many configurations feature zero down payments, enabling immediate activation of a device without upfront costs.

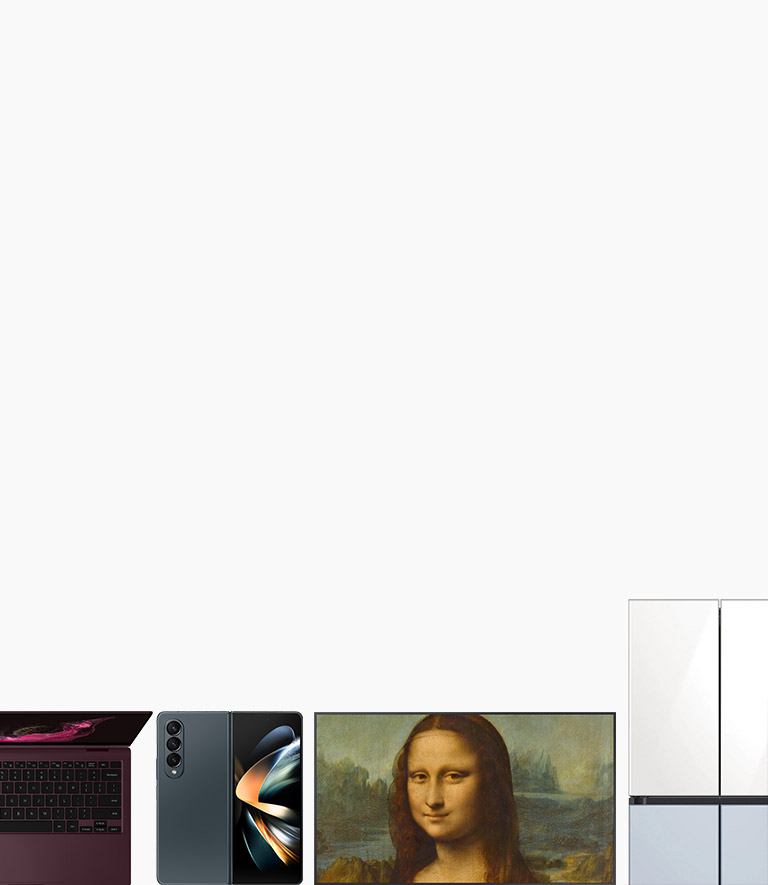

The flexibility doesn’t stop at installment amounts and duration. Samsung’s system supports various device categories, including Samsung Galaxy smartphones, smartwatches, and smart home gadgets, with financing referrals automatically displayed during online checkout.

This seamless integration reduces friction and decision fatigue, letting consumers compare plans side-by-side with transparent terms. “Our goal is to help customers access innovation on their terms,” states a Samsung consumer finance spokesperson. “We believe smart devices shouldn’t be out of reach—financing is the bridge.”

Selecting the right financing plan hinges on understanding key product-specific terms.

Samsung’s installment options frequently vary by model tier—premium phones may offer longer repayment periods but with slightly higher effective interest rates, while entry-level models often include faster, interest-free payment plans. Importantly, all official financing stays within legal interest rate caps, ensuring affordability and compliance. Consumers should review two main factors: total repayment amount and monthly payment capacity.

For example, a $800 Galaxy device financed over 12 months carries a lower monthly burden than a phased payment of $80 over 24 months—but only when factoring actual financing interest. Advanced consumers appreciate the ability to lock in favorable terms before final approval, avoiding last-minute surprises.

Defaulting carries tangible consequences, making financial discipline central. Samsung enforces punctual payments—late fees typically begin at 5% of remaining balance for minor delays, escalating to account suspension if unpaid beyond 30 days.

In extreme cases, Samsung may report payment history to credit bureaus, affecting scoring and future borrowing. Yet, the benefits of structured payments outweigh these risks: disciplined installment plan users often build or maintain strong credit, while avoiding the high-pressure cycle of payday loans or unregulated financing. “Consumers who choose Samsung financing report significantly lower stress,” notes a recent survey by the Personal Finance Institute.

“It’s not just about paying now—it’s about paying smart, deliberately.”

Integrating Pay Samsung Financing into broader financial planning promises long-term benefits. Pairing device purchases with installment plans preserves emergency savings and credit health, essential for financial resilience. For budget-conscious buyers, building a basic emergency fund before financing can buffer against unexpected expenses.

Many users strategically delay large non-essential purchases to align with seasonal financing promotions—or interest-free grace periods—maximizing affordable access without compromising stability. Samsung’s transparent disclosures, including total cost breakdowns upfront, support informed budget alignment. This transparency helps consumers avoid hidden charges, ensuring they truly understand the full scope of their commitment.

To optimize the financing experience, follow these actionable steps: - Begin with device selection and review financing options at point of sale - Use Samsung’s official online portal to calculate total cost and monthly payments - Pre-approve payment terms to lock favorable rates - Set automatic reminders or calendar alerts for upcoming due dates - Maintain open communication in case of temporary financial strain—Samsung offers limited payment pause options within acceptable terms - Always compare financing with existing credit to avoid over-leverage The digital transformation of financial access has made Pay Samsung Financing a cornerstone of modern purchasing.

Its blend of flexibility, legal compliance, and consumer-centric design reshapes how people upgrade technology, shifting from high-pressure sales to sustainable ownership. By embracing structured installment plans, Samsung doesn’t just sell devices—it promotes responsible investment. This guide reveals why Pay Samsung Financing is not merely a payment method but a strategic financial tool that empowers users to thrive in today’s tech-driven economy without sacrificing stability.

Related Post

Erome Register 12 Is Changing Everything Faster Than Expected

Simone Biles and Charlie Kirk: A Partnership Redefining Resilience in the Face of Olympic Pressure

Master Challenge: Slope Run Hooda Math Defies Limits with Precision and Strategy