Rocket Lab Stock Price in Five Years: What Can Investors Anticipate?

Rocket Lab Stock Price in Five Years: What Can Investors Anticipate?

Over the past five years, Rocket Lab has transformed from a promising New Zealand-based space innovator into a key player in commercial satellite launches and next-generation space infrastructure. As the company prepares to chart its trajectory in the rapidly evolving NewSpace economy, one critical question looms large: what should investors expect from Rocket Lab’s stock performance in the next half-decade? With its unique blend of reusable launch technology, dedicated smallsat deployments, and expanding government and commercial partnerships, Rocket Lab stands at a pivotal junction—where bold ambitions intersect with market realities and financial expectations.

## The Foundation: Rocket Lab’s Strategic Evolution Since its founding in 2006 and the successful launch of its Electron rocket in 2018, Rocket Lab has redefined access to low Earth orbit for small payloads. The company’s pitch hinges on three core pillars: - **Reusable launch systems**: The development of the Neutron rocket and orbital refueling capabilities aims to drastically reduce launch costs and increase flight rates. - **Diverse customer base**: From major satellite operators to the U.S.

Space Force and academic institutions, Rocket Lab serves a growing and geographically broad clientele. - **Technology innovation**: Advances in avionics, composite structures, and racing-stripe thermal protection systems reinforce its competitive edge. These milestones have not only strengthened its operational profile but also reshaped investor sentiment ahead of long-term projections.

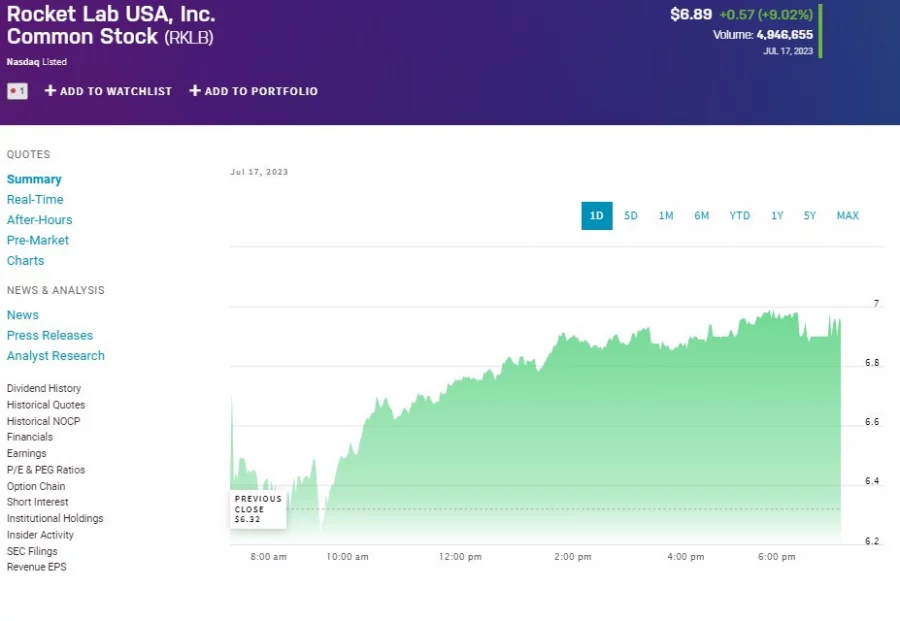

## Historical Performance: Rocket Lab’s Stock Journey Since its IPO on NASDAQ in November 2021, Rocket Lab’s stock has exhibited pronounced volatility, reflective of both market appreciation for its growth and the inherent risks of early-stage aerospace ventures. At launch, the shares entered trading at $20.10 per share; by year-end, they had risen over 40%, signaling strong initial confidence. However, 2022 and 2023 brought headwinds: rising interest rates, compressed valuations across tech sectors, and persistent challenges in scaling revenue relative to expenditures led to a sustained downward correction, with the stock declining nearly 70% from its 2021 peak by late 2023.

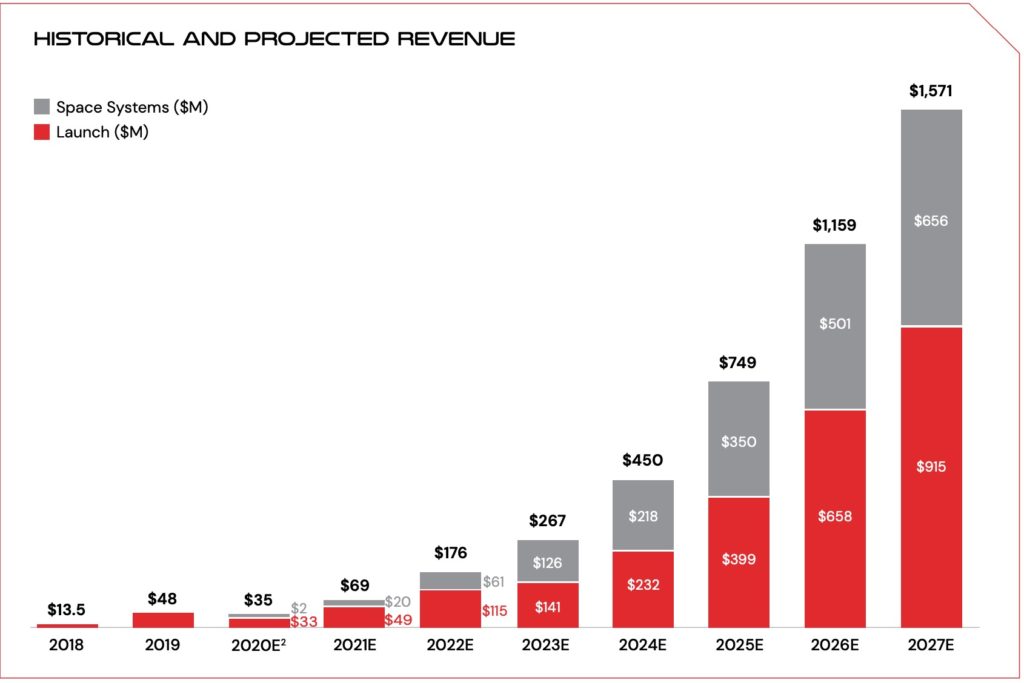

This turbulence underscored investor caution, particularly around commercialization timelines and capital efficiency. Yet, the underlying structural demand—driven by the global smallsat market, which is projected to exceed $30 billion by 2027—continues to underpin long-term optimism. ## Five-Year Expectations: What Data Suggests Despite headwinds, Rocket Lab’s fundamentals project a compelling upward trajectory over the next five years.

Key indicators shaping expectations include: - **launch rate scaling**: With Electron achieving over 100 launches by 2025 and Neutron expected to enter service by 2026, the company is poised to elevate launch frequency by more than 200% compared to current levels. This increase directly supports revenue stability and margin improvement. - **Revenue diversification**: The introduction of the Photon satellite platform and on-orbit servicing capabilities expands recurring service contracts, reducing reliance on one-off launch sales.

- **Market tailwinds**: Global demand for rideshare launches—especially from defense and data communications firms—is surging. The Pentagon’s push for resilient space architectures and commercial mega-constellations provide a multi-year growth tailwind. - **Capital strategy**: Rocket Lab’s shift toward tighter cost discipline, assetutilization, and projected cash positivity by 2026 aims to restore investor confidence and improve valuation metrics.

Market analysts project Rocket Lab’s earnings per share (EPS) to nearly double within five years, with enterprise value potentially expanding 2.5 to 3 times current levels under moderate launch cadence assumptions. ## Risk Factors and Balance to Consider Investors must weigh these positive projections against persistent challenges. The small launch market remains competitive, with legacy providers and emerging players vying for share.

Regulatory hurdles—ranging from spectrum allocation to orbital debris mitigation—could delay mission timelines. Moreover, scaling Neutron’s production and achieving orbital refueling milestones are critical yet uncertain path dependencies. “While the long-term potential is undeniable, near-term execution will determine whether Rocket Lab delivers on its ambitious valuation multiple,” noted a 2024 analysis by Rushworth Capital.

“The company’s ability to navigate launch cadence targets and revenue diversification will be the true litmus test.” ## Strategic Milestones to Watch Several pivotal events will shape the stock’s trajectory over the next five years: - **Neutron launch debut and early reliability metrics**: Sustaining high launch success rates after maiden flights is essential to customer retention. - **Order book strength**: Strongly backed launch commitments (e.g., NASA’s CubeSat deployments, private constellation support) validate long-term pipeline resilience. - **Policy shifts in space traffic management and export controls**: Favorable international regulations could accelerate global launch demand.

- **IPO readiness of SpinCo ventures (e.g., satellite component suppliers or propulsion specialists)**: Strategic corporate actions may unlock additional shareholder value. ## Sythetic Outlook: A Nascent Recovery in Space In five years, Rocket Lab’s stock is realistically positioned to evolve from a niche player into a mid-cap space sector plasmatic growth story—contingent on operational milestones, market expansion, and disciplined financial management. While headwinds persist, the company’s unique technological edge, expanding addressable market, and disciplined capital approach position it to outperform broader space equipment indices and key peers.

For forward-looking investors, Rocket Lab represents a strategic bet on the democratization of space—where accessible launch capacity and innovative service models converge to unlock exponential growth. Though volatility remains, the company’s trajectory suggests a compelling opportunity: not just a bet on rockets, but on the future of global connectivity and exploration. The question is no longer if Rocket Lab will rise, but how quickly and decisively it will capitalize on its defining decade.

Related Post

<strong>Dua Lupe: Redefining Authentic Catholic Devotion in a Digital Age</strong>

How Much Is Chris Tucker Worth? Unraveling the Financial Legacy of a Comedy Icon

Ryan Callaghan Bio Wiki Age Wife Podcast Meat Eater and Net Worth

Rita Ora works out after reports she is set to get ENGAGED to boyfriend Taika Waititi over Christmas