Texas Mineral Deed Transfer Form: Your Essential Guide to Smooth Land and Resource Ownership Transfer

Texas Mineral Deed Transfer Form: Your Essential Guide to Smooth Land and Resource Ownership Transfer

Navigating the transfer of mineral rights in Texas demands clarity, precision, and a firm grasp of legal mechanics—elements perfectly embodied in the Texas Mineral Deed Transfer Form. Whether selling, gifting, or transferring ownership of subsurface resources, understanding how this deed functions is critical to protecting your interests and ensuring compliance with state law. The Texas mineral deed is far more than a legal document; it’s a foundational tool that establishes clear title, removes ambiguity, and facilitates seamless transactions across one of the nation’s most resource-rich states.

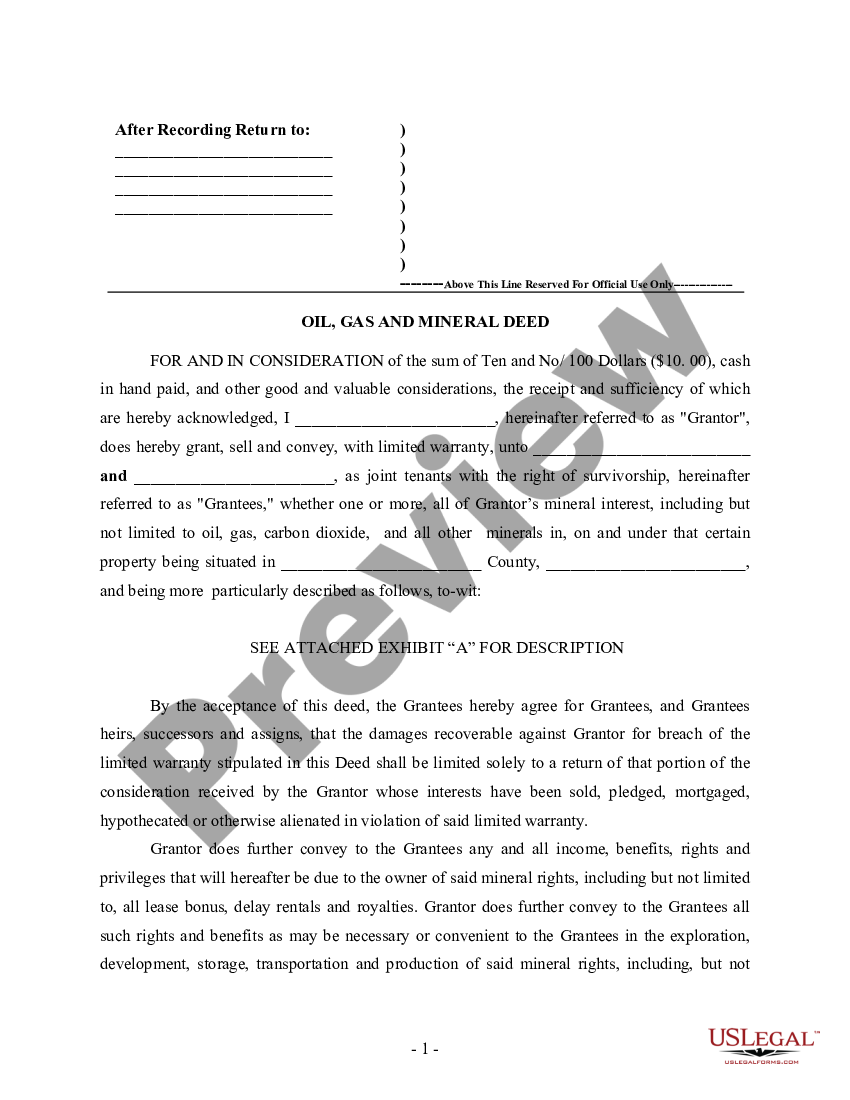

The Texas mineral deed serves a pivotal role in real estate and energy law, formalizing the legal transfer of subsurface mineral rights separate from surface ownership—a common arrangement in Texas given the vast oil, gas, and mineral deposits beneath much of the state. Unlike straightforward property deeds that bundle land with subsurface assets, the mineral deed isolates ownership of beneath-the-land resources, enabling precise documentation of rights, liabilities, and conditions governing transfer.

For buyers and sellers, the Texas Mineral Deed Transfer Form streamlines what could otherwise be a complex, time-consuming process.

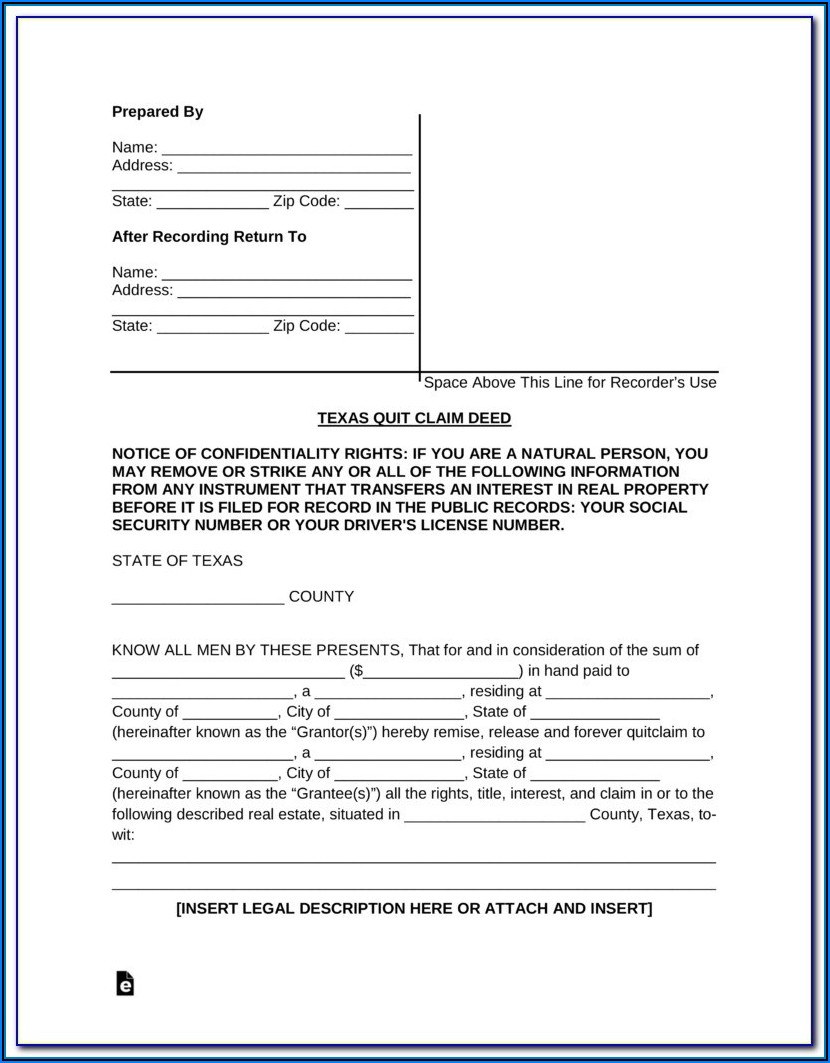

At its core, this document confirms that the person or entity named recipient holds lawful title to the mineral rights, transferring full control over extraction, development, and economic use. This form must accurately reflect all relevant details: owners’ full legal names, explicit description of the mineral tract, and any specific conditions related to royalties, environmental obligations, or existing leases.

What sets the Texas version apart is its strict adherence to state-specific statutory requirements. As defined by the Texas Property Code, including provisions under Chapter 44 of the Texas Deeds and Estates Code, the mineral deed must clearly describe the tract using survey details, legal descriptions, and often metes and bounds or lot and block references.

This level of specificity prevents future disputes over abstract boundaries or ambiguous descriptions. The form also serves as public record when appropriately notarized and filed, enhancing enforceability and transparency.

Key Components Every Texas Mineral Deed Must Include

- **Identification of Donor and Grantee:** Full legal names and addresses of both parties, ensuring there is no room for error or misidentification during transfer. - **Clear Mineral Tract Description:** Integration of official land surveys, legal descriptions per Texas Parks and Wildlife or county records, and parcel maps, reducing confusion over resource boundaries.- **Grant of Mineral Rights:** Explicit statement transferring full ownership, exploration, development, and production rights—critical given the economic value tied to Texas’ vast energy reserves. - **Royalties and Payment Terms:** Definition of how emerging revenues from extraction will be shared, including percentages, accounting methods, and timing of payments. - **Existing Leases or Agreements:** Disclosure of any pre-existing mineral leases, rights-of-way, or servitude agreements that continue in force post-transfer.

- **Representations and Warranties:** Affirmations by the grantor regarding ownership clarity and absence of liens, encumbrances, or disputes that could affect title. - **Execution Documentation:** Requirement for both parties to sign in the presence of a notary public, validating identity and willingness to transfer.

Without these elements, the deed remains incomplete and vulnerable to legal challenges—risks particularly high given the high-value nature of Texas mineral assets and frequent legacy transfers.

Why Choosing the Right Form Matters in Texas’ Unique Legal Landscape

Texas operates under a dual system of landownership, where surface and mineral rights often belong to different parties.This separation, enshrined in decades of legal precedent and codified in statutes like the Texas Mineral Statutes, adds complexity to real estate transactions. The Mineral Deed Transfer Form ensures that this separation is legally recognized and properly recorded. Its proper execution safeguards buyers from inheriting hidden obligations—such as dormant leases, environmental liabilities, or undisclosed third-party interests.

For energy companies, ranchers, or investors, the significance is no less profound. Consider a ranch owner transferring oil rights to a developer: the deed must explicitly state that rights are non-encumbered, royalties are payable upon successful extraction, and no historical disputes exist. Conversely, a mineral owner seeking to sell a tract needs assurances that the grantee receives clear, marketable title—free of ambiguity.

The form acts as a legal shield, clarifying expectations and preventing costly litigation years later.

Recording the deed with the county title office is not optional but mandatory. Once filed, it becomes a public record, visible to future buyers and creditors alike.

This transparency aligns with Texas’ emphasis on clear property records—long valued by lawyers, titles companies, and landowners seeking security in ownership claims.

Best Practices for Completing and Executing a Texas Mineral Deed Transfer

To minimize risk and ensure enforceability, several best practices are strongly recommended:- Engage a Qualified Titles Attorney:** Legal counsel familiar with Texas mineral law helps draft accurate, defensible language, catching subtle pitfalls invisible to non-experts.

- Use Precise Descriptions:** Avoid vague terms—incorporate professional survey markings and official land codes to guarantee exact tract boundaries.

- Verify All Parties and Obligations:** Confirm donor eligibility, confirm grantee capacity, and detail all financial and operational terms with specificity.

- Include All Necessary Disclosures:** Full transparency on existing leases, environmental restrictions, and contingent rights protects all involved and supports future transactions.

- Ensure Proper Notarization:** Both signatories must appear before a notary, with proof of identity and acknowledgment, to validate authenticity.

- File Promptly with County Clerk:** Timely recording preserves priority, shields title, and satisfies statutory notice requirements.

- Use Precise Descriptions:** Avoid vague terms—incorporate professional survey markings and official land codes to guarantee exact tract boundaries.

Additionally, modern title companies often recommend digital annotation and blockchain verification as supplementary safeguards, though the Texas Mineral Deed Transfer Form remains the foundational document.

Together, these steps create a transfer process grounded in legal rigor and operational clarity.

In Texas, where vast landscapes conceal valuable beneath-the-earth mineral rights, the Mineral Deed Transfer Form transforms abstract assets into clear, transferable property. It bridges legal complexity with practical utility, enabling stakeholders—from energy firms to family ranchers—to engage confidently with real estate markets. Done right, it ensures value flow uninterrupted, rights held secure, and disputes avoided.

For anyone involved in mineral asset transactions, mastering this document is not just advisable—it is essential.

The Texas Mineral Deed Transfer Form excels as both a legal instrument and a practical tool, offering a blueprint for smooth, secure ownership transfer in one of America’s most dynamic resource regions. Whether enhancing investment confidence or safeguarding long-term resource control, understanding its structure, purpose, and execution remains indispensable.

![Texas Deed Forms & Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/11/Texas-Deed-of-Trust-Templates.Legal_.jpg)

Related Post

Movie Rules for Adults: Commanding the Screen with Clarity, Consent, and Context

🔥 Domine a Mesa: 5 Jogos de Sinuca Online para 2 Jogadores que Vão Viciar Você!

Navigating the Gulf Coast: Essential Insights on the Alabama Florida Map

Maritess Revilla Husband: The Quiet Force Behind a Growing Legacy