The 25 Money Secrets Every Investor Should Know

The 25 Money Secrets Every Investor Should Know

Mastering personal wealth isn’t just about income—it’s about strategy, discipline, and hidden truths that separate the financially successful from the average. Drawing from 25 critical money secrets, this guide reveals the strategies that unlock financial freedom, from foundational wealth habits to advanced investment tactics. These insights, grounded in proven principles and real-world application, transform how money works for you—doubling assets, minimizing risk, and accelerating growth.

Understanding these less-discussed truths isn’t optional; it’s essential for anyone serious about building lasting prosperity.

1. Spend Like a CEO—But Track Every Penny

Treating money with the seriousness of a company’s balance sheet creates clarity.A CEO reviews spreadsheets daily; so should you. Track every expense, categorize spending, and compare it to income. As financial strategist Robert Kiyosaki advises, “You don’t manage what you don’t measure.” The discipline of meticulous tracking prevents aimless spending and exposes leaks in your budget—small leaks that drain collections over time.

2. Pay Yourself Before Paychecks End

The first secret to wealth accumulation is treating savings and investments as non-negotiable expenses. “Pay yourself first” means automating contributions to retirement accounts or emergency funds—before debt, bills, or discretionary spending.Financial activist David Bach calls this “paying your future self first.” Doing so ensures consistent growth, leverages compound interest, and builds unshakable resilience against financial shocks.

3. Compound Interest Works Better When Started Early

Compound interest remains one of finance’s most powerful forces—and the sooner you harness it, the greater the payoff.A $10,000 investment at 7% annual growth doubles in about 10 years; starting at 30 extends that to 40 years. As Albert Einstein reportedly called it, “It’s the greatest invention in history.” The secret lies in starting small and staying consistent—time turns modest sums into monumental wealth.

4.

High-Interest Debt Crushes Wealth—Avoid It at All Costs Credit card debt with double-digit percentages erodes income and savings faster than inflation. These interest payments act as a silent tax on your finances. Opinion leaders urge consumers to eliminate high-cost debt within 12–18 months.

Federal Reserve data confirms: households drowning in interest breathe 15–20% less net income than those prioritizing solvency. Debt savings directly fuels investment capacity.

5.

Your Net Worth Grows in Defined Intervals Measuring financial progress isn’t a yearly check—it’s a defined milestone. Monthly or quarterly assessments spot patterns, validate progress, and correct course. Research shows consistent reviewing accelerates goal achievement by 30% or more.

“Failure to track leads to failure to adjust,” observes certified financial planner Lisa Mendova. These checkpoints transform vague aspirations into demonstrable wealth.

6.

Real Estate Isn’t Just a Home—it’s Wealth Storage Residential real estate holds sentimental value, but investment-grade real estate compounds value when chosen strategically. Rental properties generate cash flow and appreciate over time; commercial assets offer steady income. As real estate investor Joel Manby notes, “The best wealth builder often sits under your feet or in the vicinity of your neighborhood—common-sense location strategy matters less than understanding market cycles.”

7.

Stocks Outperform Savings Accounts—By Decades While bank savings protect capital, annual returns rarely exceed 2–3% in modern economies, eroded by inflation. Over three decades, stock market investments average 7–10% returns, turning $5,000 into over $170,000—proof of compounding power. Financial fiduciary William Bernstein emphasizes: “For real wealth growth, most individuals would benefit from stock exposure over true savings.”

8.

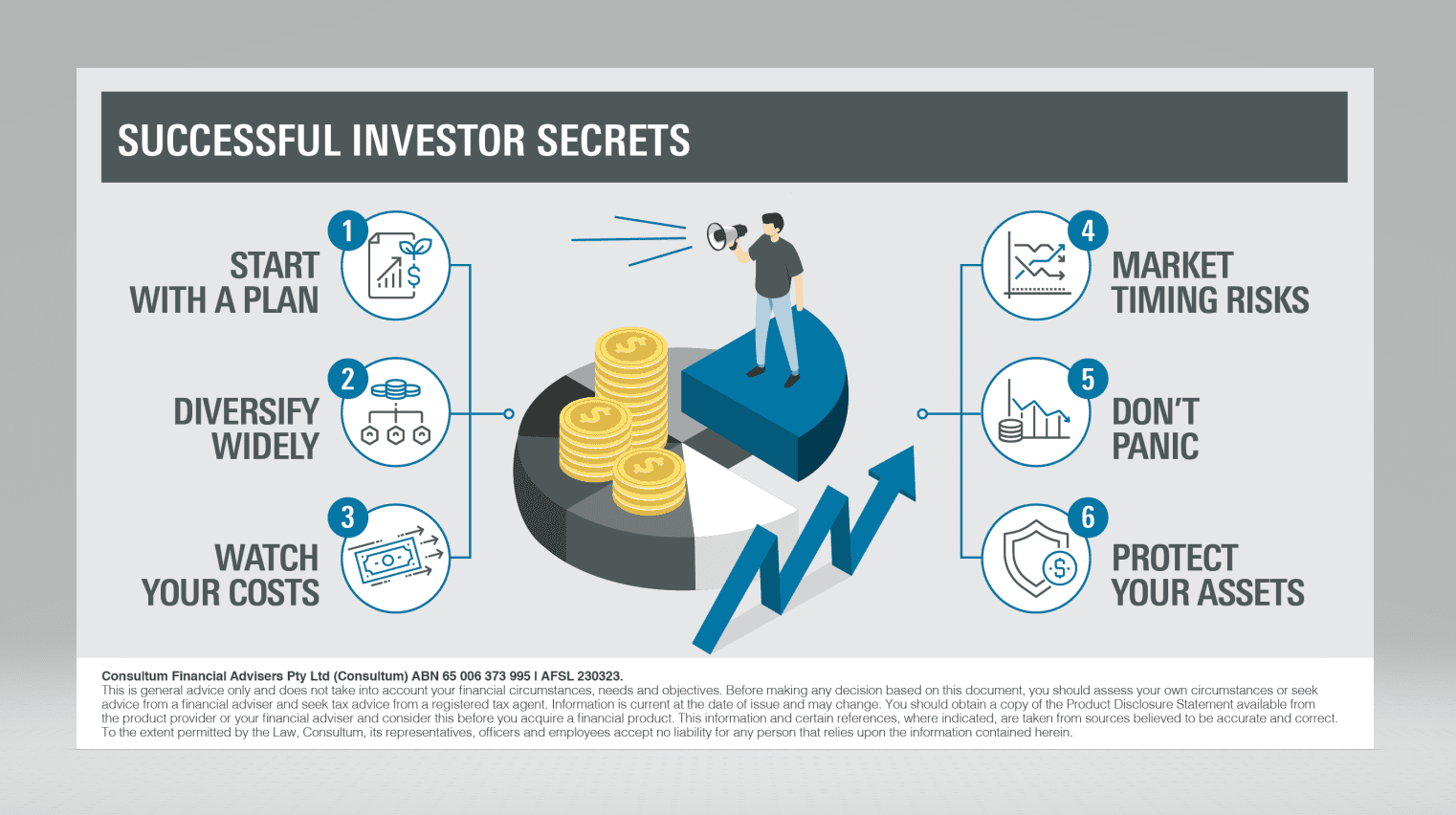

Diversification Isn’t Just a Buzzword—It’s Survival Concentrating wealth in one stock, sector, or asset class invites collapse. Diversification spreads risk across uncorrelated investments: stocks, bonds, real estate, commodities. Modern portfolio theory confirms: a balanced mix reduces volatility by up to 50% without sacrificing returns.

As Merrill Lynch declared, “Don’t put all eggs in one basket—it’s how you protect your nest egg.”

9. Tax Smarter—Not Just Legally, But Strategically

Tax efficiency directly increases net returns. Utilizing tax-advantaged accounts (IRAs, 401(k)s), studios like 1031 exchanges for real estate, and timing capital gains strategically uncapture up to 35% in autorités.Tax advisor Aaron Scott stresses: “Good planning isn’t about avoiding taxes—it’s about minimizing them intelligently.” These maneuvers compound savings at scale.

10. Emergency Funds Prevent Financial Ruin—Period

A well-funded emergency reserve—3 to 6 months of living expenses—turns crises into minor setbacks.Without it, job loss or medical bills often trigger debt cycles that take years to reverse. The Federal Reserve reports 40% of Americans couldn’t cover a $400 emergency. Because preparation protects opportunities, securing liquid capital isn’t a luxury—it’s essential risk management.

11. minimalist Living Unlocks Wealth Growth

Reduced consumption accelerates wealth. Minimalism cuts recurring expenses—subscriptions, impulsive purchases, overconsumption—freeing tens of thousands over years.As mutual fund expert Carolyn Krueger observes, “Living below your means isn’t sacrifice; it’s wealth multiplication in disguise.” Every saved dollar becomes a compounding asset.

12. Emotional Detachment Separates Wealth Accumulators

Fear, greed, and FOMO distort decisions.Successful investors base moves on data, not shock tactics. Warren Buffett famously advised, “Be fearful when others are greedy, and greedy when others are fearful.” Staying calm allows consistent values-based investing and avoids costly panic selling or speculative bubbles. Control emotion—weigh outcomes, not impulses.

13. Real Investments Vs. Cash—Inflation Erodes Power

Cash loses purchasing power in inflationary environments; assets like stocks, real estate, and commodities preserve value over time.A $100,000 savings account yielding 1% becomes worth $95,000 in real terms after 20 years with 2% inflation. Investing preserves wealth’s dignity—making time and diversification your greatest allies.

14.

Knowledge Outpaces Capital—The Most Undervalued Asset Financial success flows from understanding markets better than others. Reading housing trends, reading economic cycles, studying financial statements—these habits compound wisdom faster than passive income. As author Charlie Munger insists, “Smart people borrow money to invest in things they deeply understand.” Never underestimate what you learn.

15. Start Small—Consistency Trumps Multi-Million Dollar Bets

Perfect timing and large initial investments aren’t prerequisites. Compounding thrives on consistency: $100 saved monthly at 7% grows to over $130,000 in 30 years.Early adopters of small, regular contributions reap rewards far greater than sporadic windfalls. Begin now—size matters less than persistence.

16.

The Right Financial Advisor Bridges Strategy and Execution A trusted advisor tailors plans to your goals, simplifying complexity. Misaligned advice breeds frustration and wasted capital. Certification (CFP, CFA) signals expertise; alignment with personal values ensures trust.

“Look for someone who sees you—not just your numbers,” advises wealth coach Meldy Toups. A smart partner amplifies your control.

Related Post

25 Unfiltered Money Secrets From Donald Trump That Could Transform Your Wealth Strategy

From Small Town Roots to Growing Hub: Inside Barnesville, Georgia’s Revitalization Moment

Standard Motor Products UF62 Ignition Coil: The Workhorse Behind Reliable Engine Performance

Hannibal Buress Comedian Bio Wiki Age Height Wife Meme Shows Podcast and Net Worth