The Ultimate Guide to Bir Books of Accounts: Mastering Financial Record-Keeping for Modern Enterprises

The Ultimate Guide to Bir Books of Accounts: Mastering Financial Record-Keeping for Modern Enterprises

In the evolving landscape of business finance, precise and compliant accounting records are non-negotiable—yet few enterprise leaders fully understand the foundational role of Bir Books of Accounts. Bir Books represent more than just ledger entries; they are the cornerstone of transparent, auditable, and legally defensible financial tracking. These structured journals serve as the primary repository for daily transactions, enabling systematic documentation essential for reporting, taxation, and strategic decision-making.

For modern organizations, mastering Bir Books is not merely about compliance—it’s about operational clarity, risk mitigation, and long-term sustainability.

At the heart of effective financial management lies the Bir Books of Accounts—a formalized accounting record that captures all business transactions in chronological and categorical order. Unlike digital accounting software alone, Bir Books provide a physical or legally recognized auditable trail, ensuring every entry meets regulatory standards.

As accounting specialist Dr. Amara Lin stresses, “Bir Books are the backbone of financial truth—without them, financial statements are speculation, not insight.” These books follow strict accounting principles, often aligned with international standards like IFRS or local GAAP, depending on jurisdiction, ensuring consistency across financial reporting periods.

Structure and Components of Bir Books of Accounts

A Bir Book of Accounts is organized into distinct but interconnected sections, each serving a vital function in the accounting workflow: - **Particulars Columns:** These track the nature of each transaction—such as customer names, supplier codes, account numbers, or expense categories.Precise coding here prevents misclassification, a common source of financial errors. - **Date Field:** Recording the exact date of each transaction ensures accurate period matching, crucial for accrual accounting and tax compliance. - **Description Field:** A narrative or reference line explaining the source or purpose of the entry, such as “Sale of Product A to Client X.” - **Debit and Credit Totals:** Every entry displays parallel debit and credit values, maintaining the fundamental accounting equation: Assets = Liabilities + Equity.

- **Grand Total:** The net balance derived from debits and credits, displayed at the end of each page or section. importance of proper formatting cannot be overstated—errors in even a single page can cascade into misleading financial reports, audit failures, or regulatory penalties. Bir Books thus demand disciplined entry habits and clear classification.

The structure supports seamless integration with other financial systems. Many firms use Bir Books in tandem with double-entry accounting principles, ensuring every profit or loss is represented twice—once as income and once as expense. This dual recording enhances accuracy and forms the basis for generating reliable profit-and-loss statements.

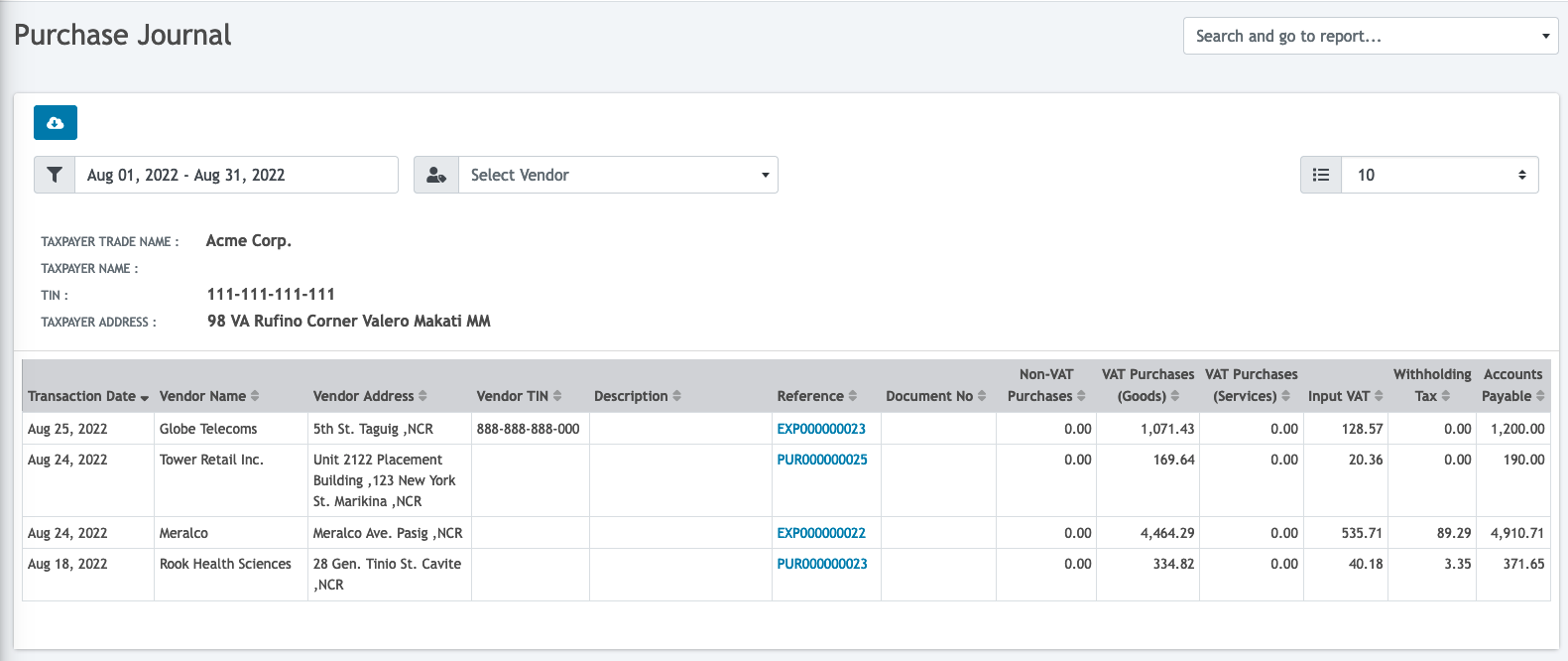

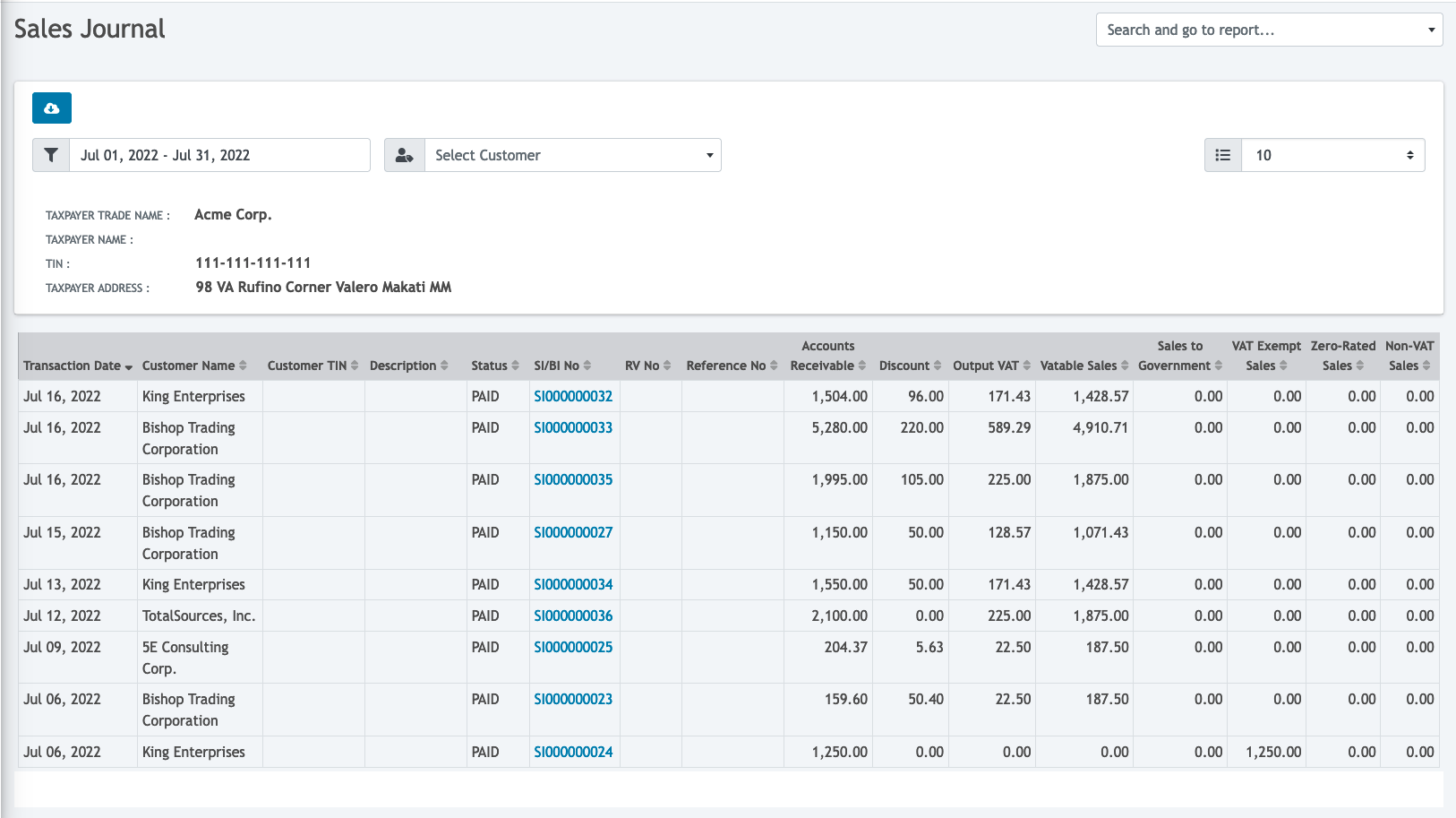

Types and Functional Roles of Bir Books in Business Operations

Bir Books are not a one-size-fits-all tool; they serve specialized functions across the accounting cycle: - **Sales Book (Debit Book):** Captures all credit sales, tracking receivables and revenue recognition. It underpins cash flow forecasting and sales performance analysis. - **Purchase Book (Debit Book):** Records vendor payments, enabling effective payables management and supplier payment scheduling.- **Journal Book:** The primary record where all transactions are first entered before posting to ledgers. It retains the original chronological narrative. - **Cash Book:** A hybrid ledger tracking cash inflows and outflows, critical for liquidity monitoring.

Each Bir Book supports a unique aspect of financial visibility. For example, reconciling the purchases and sales books daily prevents discrepancies that could distort inventory valuations or profit margins. As financial consultant James Rutledge notes, “A well-maintained set of Bir Books acts like a financial pulse monitor—revealing real-time health indicators of business operations.”

Best Practices for Managing Bir Books of Accounts

Effective Bir Books demand rigorous methodology.Key best practices include: - **Chronological Order:** All transactions must be recorded in the sequence they occurred to preserve audit integrity. Delayed entries break accountability chains and invite disputes. - **Categorical Precision:** Use standardized coding systems—such as a 10-digit TAN or ERP-compatible IDs—to classify entries accurately.

This simplifies reconciliation and automated reporting. - **Immediate Posting:** Entries should be posted to the general ledger promptly after recording. Delays increase the risk of data loss or misplacement.

- **Regular Reconciliation:** Monthly reviews against bank statements, vendor invoices, and subsidiary ledgers ensure timeliness and prevent accrual errors. - **Secure Storage:** Whether physical or digital, Bir Books must be preserved under legal retention schedules. Firms should implement access controls and backup protocols.

Failing to follow these practices risks audit failures, tax scrutiny, or distorted financial analysis—costs that extend far beyond simple arithmetic mistakes.

Related Post

Mastering Makaut Ec601: Decoding the Instrumentation Control System Question Paper with Precision

Billy And Mandy Cast Revealed: The Wild Personalities Behind the Animated Schemer

The Tomodachi Effect: How Team Tomodachi Indonesia Shaped Community, Culture, and Gaming in the Heart of Jakarta