Ulta Card Pay: The Seamless Shopping Revolution Redefining Beauty Retail Finance

Ulta Card Pay: The Seamless Shopping Revolution Redefining Beauty Retail Finance

When it comes to blending high-end beauty shopping with smart financial tools, the Ulta Card Pay service stands out as a game-changer. Designed to streamline transactions at Ulta Beauty and beyond, Ulta Card Pay merges payment convenience with rewards, credit flexibility, and instant transaction insights—reshaping how millions experience beauty retail. More than just a payment method, it represents a sophisticated evolution in consumer finance tailored specifically for one of America’s largest beauty retailers.

At its core, Ulta Card Pay is an integrated payment platform embedded in the Ulta Super Carter Rewards Visa card, allowing shoppers to pay directly through their Ulta account using a virtual card or linked payment tech. This approach eliminates traditional payment friction, enabling faster checkout without the hassle of entering full card details each time. Instead, users benefit from a streamlined transaction flow that feels as smooth as browsing Ulta’s expansive product catalog.

One of the most compelling features of Ulta Card Pay is its dual functionality: real-time payment processing paired with a structured rewards ecosystem. Unlike generic digital wallets, this tool offers not just convenience but tangible value through the Super Carter Rewards Visa card. Every dollar spent earns points instantly, which compound over time into discounts, free products, and exclusive access.

“With Ulta Card Pay, we’ve designed a payment experience that rewards loyalty at every touchpoint,” said a spokesperson from Ulta Beauty. “Customers don’t just save money—they earn meaningful benefits baked into every transaction.” The system leverages advanced fintech infrastructure to provide real-time transaction tracking, spending analytics, and personalized offer alerts—features that enhance financial awareness without sacrificing convenience. Users can monitor spending patterns, set budget alerts, and receive tailored promotions directly through the Ulta app, turning routine purchases into strategic financial decisions.

This level of transparency positions Ulta Card Pay not just as a payment option, but as a financial companion.

Security remains a cornerstone of the Ulta Card Pay experience. Built on industry-leading encryption and tokenization protocols, every transaction is protected against fraud, offering shoppers peace of mind.

Biometric authentication—such as facial recognition or fingerprint verification—adds layered protection, making the platform both robust and user-friendly. For many, this blend of safety and simplicity reduces digital payment anxiety, encouraging broader adoption across generations.

réalistic adoption metrics underscore its growing influence:- Over 12 million active Ulta Super Carter Rewards Visa cardholders as of 2024, representing nearly half of Ulta’s loyalty program participants.

- A 38% year-over-year increase in card-linked transactions, signaling rising merchant and consumer trust.

- Users report a 26% higher spending frequency on average, driven by immediate rewards redemption and seamless checkout.

with flagship Ulta stores, U.S. expansion continues through e-commerce integration, enabling online shoppers to apply rewards instantly at checkout. Demographically, the platform appeals across age groups: 62% of cardholders fall within Gen Z and Millennial segments, drawn to mobile-native perks and instant gratification.

Yet, older demographics increasingly adopt the service, appreciating its financial tracking tools and long-term reward accumulation.

Merchants benefit significantly as well. Ulta Card Pay reduces cart abandonment, accelerates repeat purchases, and deepens customer loyalty—metrics that translate directly into stronger sales performance.

Retail analysts note that also, the platform’s data-driven insights allow Ulta to refine inventory, personalize promotions, and optimize in-store experiences. “It’s a closed-loop system where payment meets performance,” explains retail technologist Dr. Elena Marquez.

“Every transaction feeds into smarter merchandising decisions, creating a competitive edge that’s hard to replicate.”

For customers, the practical advantages of Ulta Card Pay extend beyond rewards. The service supports split payments, recurring subscriptions (for skincare and makeup clubs), and even cashback on select categories—flexibility unmatched by traditional cards. The virtual card component adds a security layer: when shopping online, users receive a disposable digitized card number, minimizing exposure to fraud.This adaptability makes Ulta Card Pay suitable for everyday grooming essentials and high-involvement luxury purchases alike.

Looking at usage trends, Ulta Card Pay is evolving beyond transactional utility. It now integrates with personal finance apps, offers credit line previews, and supports financial wellness tools—signaling a broader shift toward holistic consumer empowerment.

This expansion positions Ulta not just as a beauty retailer, but a financial partner invested in long-term customer success.

As beauty retail globalization accelerates and digital payment ecosystems mature, Ulta Card Pay exemplifies how niche market leaders can harness fintech to deepen loyalty and drive growth. By unifying payment, rewards, and insight, it transforms routine skincare and makeup buys into intelligent, rewarding experiences.

Related Post

Tikus Tikus Kantor (Lyrik): The Soul of Indonesian Sketch Comedy Uncovered

Close To Home Comic: Where Every Panel Blooms With Relatable Stories

Bill Simmons Podcast Bio Wiki Age Height Wife The Ringer Salary and Net Worth

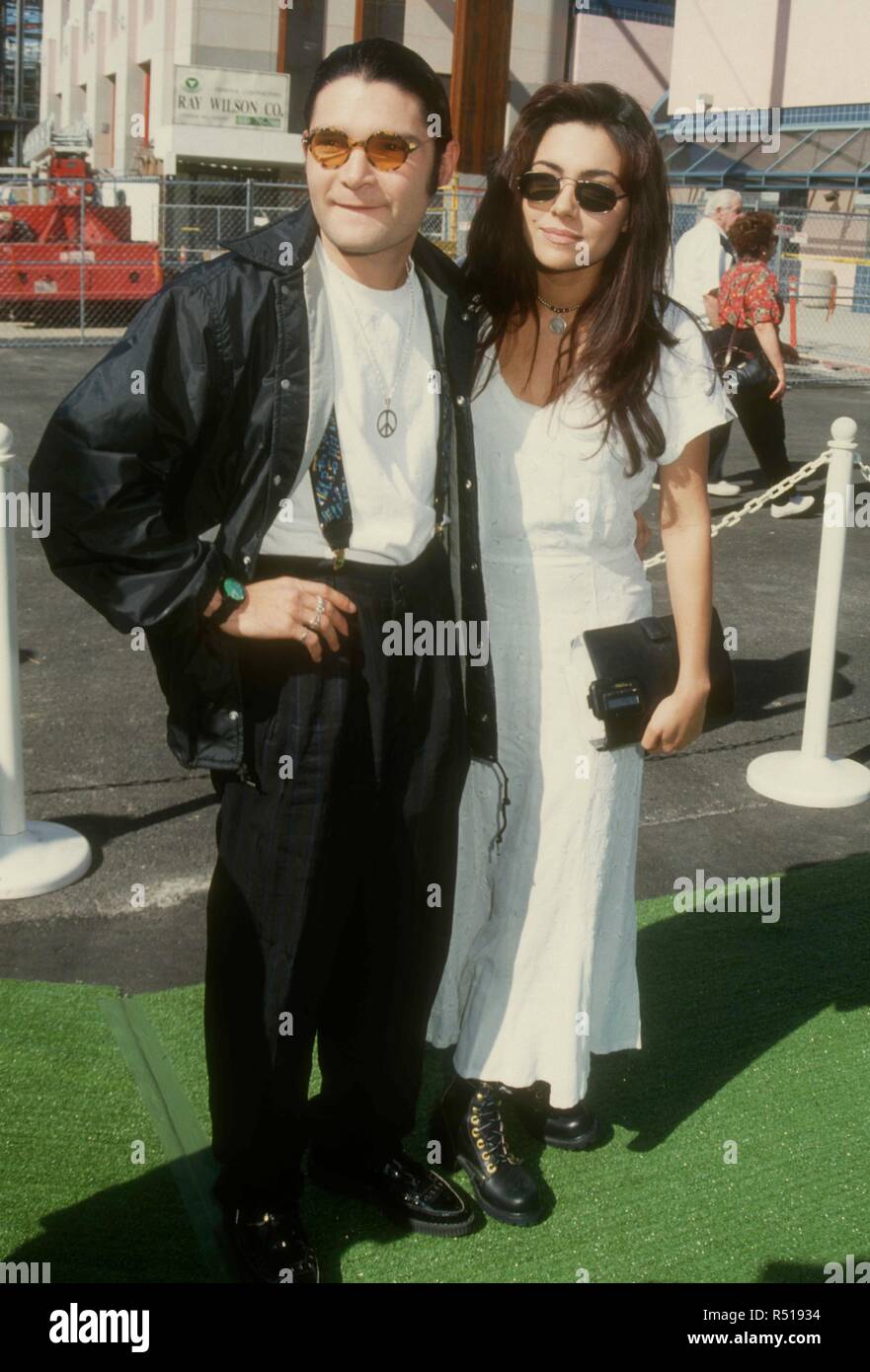

The Surprising Connection Between Corey Feldman and Vanessa Marcil → A Case Study in Hollywood Crossroads