Unlocking Market Dominance: The Role of Commercial Real Estate Analysis and Strategic Investments in PDF Insights

Unlocking Market Dominance: The Role of Commercial Real Estate Analysis and Strategic Investments in PDF Insights

In an era defined by rapid economic shifts, evolving workplace dynamics, and fluctuating interest rates, commercial real estate remains a cornerstone of diversified investment portfolios. At the heart of informed decision-making lies Commercial Real Estate Analysis and Investments Type: PDF — a structured, data-driven assessment tool that empowers investors, developers, and financial strategists with actionable intelligence. PDF reports combine quantitative metrics, market trends, and dynamic forecasting models into a single, portable format, transforming complex real estate data into strategic clarity.

Whether evaluating urban office spaces, industrial logistics hubs, or retail complexes, these analytical documents serve as both diagnostic tools and blueprints for long-term value creation.

The power of a well-constructed PDF analysis lies in its ability to distill vast datasets into digestible, credible insights. According to Michael Chen, Director of Market Intelligence at Navio Real Estate Advisors, “Investors today no longer rely on fragmented reports.

A comprehensive commercial real estate analysis in PDF format integrates cap rate trends, occupancy rates, demographic shifts, and macroeconomic indicators into one authoritative resource — enabling faster, more confident decisions.” This convergence of data formats ensures that stakeholders across sectors — institutional investors, private equity firms, and corporate occupiers alike — can benchmark performance, identify undervalued assets, and anticipate market turning points.

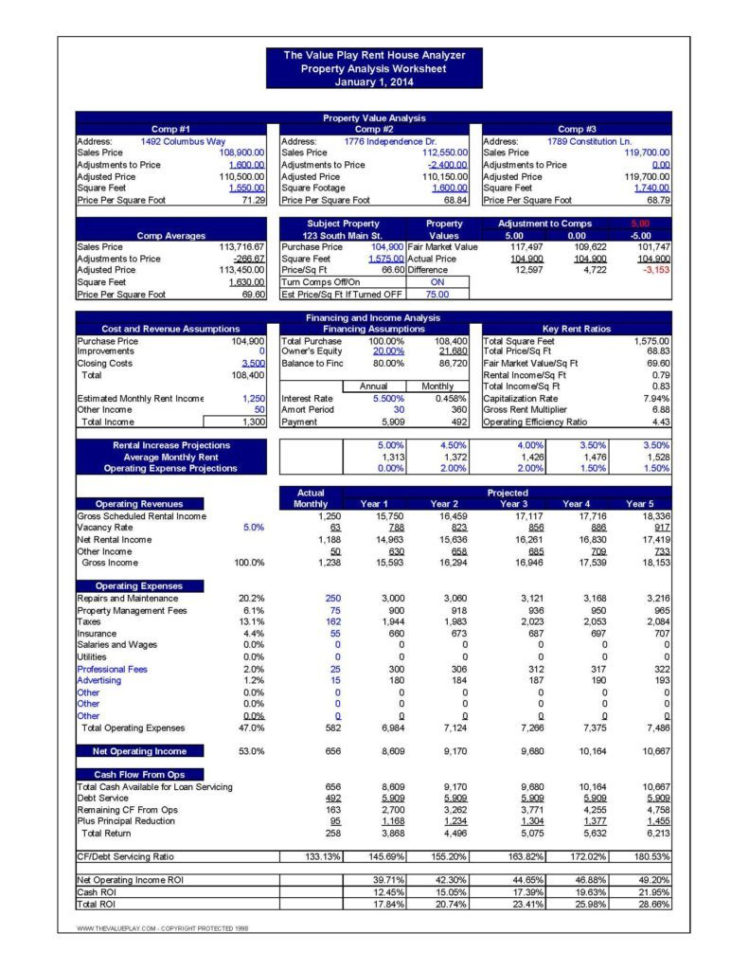

Core Components of a High-Impact Commercial Real Estate Analysis PDF: - Market Positioning & Sector Allocation: Detailed breakdowns of regional and sector-specific supply-demand imbalances, including submarket-level heat maps. - Financial Modeling & Valuation: Comprehensive projections using discounted cash flows (DCF), net asset values (NAV), and idealized cap rate analyses. - Risk Assessment: Evaluation of macroeconomic sensitivities, regulatory changes, and environmental, social, and governance (ESG) compliance.- Investment Thesis Development: Hedge funds and REITs leverage PDFs to align asset selection with long-term objectives, such as yield optimization or growth exposure. - Timeline Forecasting: Scenario modeling projecting rent growth, vacancy cycles, and exit timelines over 5–10 year horizons. Each element is grounded in verified data sources—from official census statistics and local zoning changes to lease schedules and tenant creditworthiness reports.

“The integrity of the analysis hinges on timeliness and accuracy,” notes Sofia Ramirez, Senior Analyst at Altura Capital. “Our PDF reports update monthly to reflect real-time lease renewals, capital expenditures, and revised income projections—ensuring investors act on current ground, not historical proxies.”

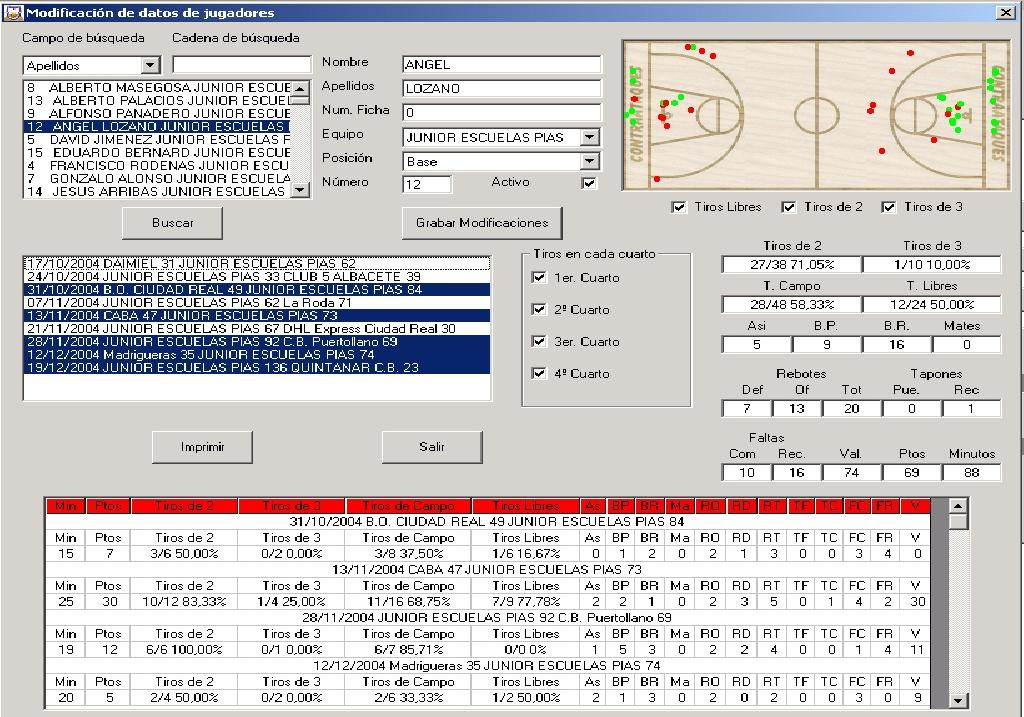

The strategic value extends beyond mere appraisal; modern PDFs integrate technological enhancements such as interactive dashboards and embedded GIS layers. These features allow users to toggle variables, compare asset performance across geographic clusters, and simulate various exit strategies.

Institutional investors increasingly demand flexibility: ability to import PDF data into portfolio management systems, overlay trauma risk indices, or annotate underwriting notes. This interactivity transforms static documents into dynamic decision engines.

Decoding Market Trends: From Office Reimagined to E-Commerce Frontiers Recent PDF analyses highlight a seismic shift in asset classes. The office sector, once under siege, reveals pockets of resilience in tech-anchored urban cores—driven by hybrid work reconfigurations and tenant demands for flexible layouts.Meanwhile, industrial real estate continues its ascent, fueled by e-commerce expansion and supply chain localization. Last year’s top-tier reports projected double-digit cap rate declines in logistics hubs near major population centers, citing a shortage of Class A facilities as a structural driver. Retail, too, has evolved.

PDFs now emphasize experiential and mixed-use developments where physical storefronts blend with last-mile delivery nodes. “Tenants no longer seek square footage alone—they demand flexible, tech-integrated spaces that support both showrooming and fulfillment,” explains Chen. Advanced PDF analyses parse foot traffic data, lease renewal rates, and same-store sales performance to identify retailers poised for growth.

Investment Strategies Informed by PDF Insights: - Core-Hold Portfolios: Focus on stabilized assets in high-barrier markets with predictable cash flows. PDFs here emphasize occupancy tenure, lease roll schedules, and tenant concentration risk. - Value-Add Renovations: Identify underperforming properties with redevelopment potential.

Analysis includes renovation cost modeling, ROI timelines, and permission roadmaps. - Opportunistic Bets: Target distressed or spontaneous vacancies in emerging neighborhoods. PDFs quantify recovery costs, speed-to-market risks, and jurisdictional incentive landscapes.

- Development Financing: Leverage PDF-generated projections for debt and equity plays, with lease-back analyses showing capital efficiency. Notably, environmental regulatory trends now shape PDF content significantly. Investors must assess energy compliance requirements, carbon transition costs, and green certification premiums.

A recent Deloitte report, accessible via downloadable PDF, found that LEED-certified assets command 7–10% higher occupancy and rent premiums—a clear financial incentive embedded in modern analysis.

Accessing and interpreting PDF commercial real estate analyses requires both technical fluency and strategic foresight. Leading platforms now offer edge: cloud-based PDF repositories synced with broker networks, allowing subscribers to download periodic reports directly into workflow tools.

“The best PDFs don’t just report—they educate,” says Ramirez. “Annotations guide readers through sensitivity analysis, highlighting thresholds where market inflection risks emerge.” Moreover, as AI begins reshaping real estate analytics, PDF formats adapt—incorporating machine learning-driven forecasts and natural language summaries that distill multi-page documents into instant insights. This hybrid evolution ensures that seasoned professionals retain control while younger investors tap into democratized intelligence at scale.

In essence, Commercial Real Estate Analysis and

Related Post

Benjamin Hollingsworth Actor Bio Wiki Age Height Wife Suits Heartland and Net Worth

Charly Jordan Fapello: Redefining Excellence in Basketball Analytics and Coaching Innovation

Philippine Agriculture on a Rapid Trajectory: Cultivating Growth by 2025

Bayley Says Austin Theory Is Her New Best Friend