Victoria’s Secret Credit Card Hacks and Must-Knows: Unlock Savings With Insider Secrets

Victoria’s Secret Credit Card Hacks and Must-Knows: Unlock Savings With Insider Secrets

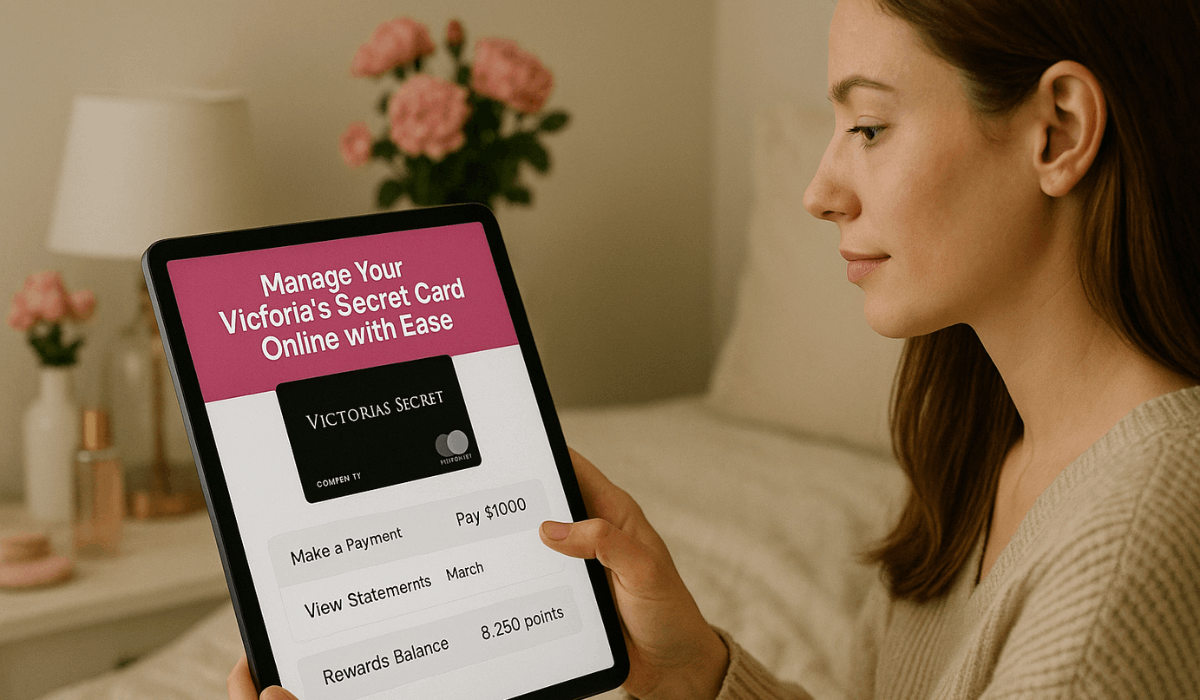

Victoria’s Secret doesn’t just sell lingerie—it commands attention with provocative fashion, compelling brand narratives, and, increasingly, savvy credit card strategies. For millennials and luxury shoppers alike, the secret lies not only in the iconic buccaneer branding but also in strategic financial tools that maximize rewards, minimize debt, and unlock exclusive perks. Navigating Victoria’s Secret credit card offers requires awareness of key hacks—from leave-behind discounts and cashback structures to expert-approved spending practices—all designed to turn everyday shopping into a financially smart move.

One of the most potent Victoria’s Secret credit card advantages is the Lavish Rewards Program, accessible through select co-branded cards, including the Platinum and Diamond Card options. These programs reward users with double points on beauty and lingerie purchases—categories that dominate the store’s inventory. “Shoppers who chip into Victoria’s Secret’s curated product lines can earn up to 10% bonus points every quarter,” notes financial analyst Marlena Cruz.

“This isn’t just marketing—it’s a structured way to build significant rewards around what you already buy.” Unlike generic reward cards, Victoria’s Secret supports consumers through exclusive offer cards, early access to Black Friday deals, and bonus point weekends tied directly to fashion collections.

Another underleveraged hack is timing your credit card usage to optimize bonus periods. The Platinum Card, for instance, delivers peak reward spikes during Victoria’s Secret’s seasonal sales—September’s Spring collection drop and December’s holiday fashion rush consistently trigger 3x or 5x point multipliers on apparel and accessories.

“Cardholders who plan pivotal purchases around these high-reward windows can significantly reduce equivalent spending costs,” says credit strategist James Roch. “It’s less about hoarding cash and more about aligning big buys with reward pulses.” The key is tracking event schedules closely—Victoria’s Secret frequently publicizes bonus opportunity calendars on its official website and app.

To truly maximize benefits, users must understand the nuanced structure of reward accumulation.

Most co-branded cards award points based on purchase volume and category, but Victoria’s Secret enhances value through tiered bonuses. For example, hitting $500 in monthly lingerie and beauty spending unlocks an extra 2% cashback bonus that compounds weekly. Similarly, referring friends or making qualifying in-store purchases can yield instant bonus points—up to 500 points per referral, redeemable instantly through the app.

“The modeling-driven aesthetics translate into financial aesthetics, too,” Roch adds. “Every strategic purchase isn’t just a fashion statement—it’s a reward accumulator.”

Equally crucial is the credit limit and payment discipline. While Victoria’s Secret doesn’t publicly disclose individual credit limits, financial insiders confirm that card issuers assess income, credit history, and spending habits before approval.

A common breakthrough for savvy shoppers: applying 30–60 days in advance of major fashion launches boosts approval odds and ensures access to pre-sale rewards. As credit counselor Elena Vaughn advises: “Don’t chase higher limits blindly—focus on responsible spending that aligns with your budget and rewards goals.” Overutilization undermines the entire advantage, turning rewards into debt traps.

Beyond point systems, Victoria’s Secret credit cards deliver tangible real-world perks.

Exclusive access to VIP previews, members-only shopping events, and free alterations since 2023 elevate the ownership experience. These benefits compound savings: saving 10% on a $150 dress through rewards and pre-sale access often costs as little as $10 post-points—a stark contrast to standard retail pricing. Additionally, payment flexibility includes no foreign transaction fees for international shopping and grace periods that accommodate busy lifestyles, particularly around holiday shopping seasons.

Security and fraud protection round out the must-know elements. Victoria’s Secret partners with major credit networks to offer real-time transaction alerts, two-factor authentication, and advanced AI monitoring—tools indispensable in today’s digital landscape. Users are encouraged to enable push notifications and review statements weekly to detect irregularities quickly.

In reality, the magic of Victoria’s Secret credit card strategy lies not in complexity but in consistency—aligning shopping habits with reward cycles, maximizing category bonuses, and maintaining disciplined credit use. These hacks transform luxury retail from a discretionary expense into a calculated financial advantage. For consumers willing to engage smartly, every purchase becomes an opportunity to earn, save, and feel empowered by smarter credit use.

The true secret of Victoria’s Secret credit cards is their fusion of style and substance—where fashion-forward shoppers unlock invisible rewards embedded in every transaction, turning fashion indulgence into a precisely tuned financial edge.

Related Post

The Regal Rarity: Unpacking the Charm, Care, and Commercial Viability of the Lavender Orpington Chicken

What Time Is It in Michigan Right Now? The Precision Behind Every Clock in the Great Lakes State

The Rising Voice of Briar Rose Christensen: From Indie Aspirant to Inspirational Trailblazer

Is Ben Shapiro’s Wife Okay? A Deep Look Into Their Life Together